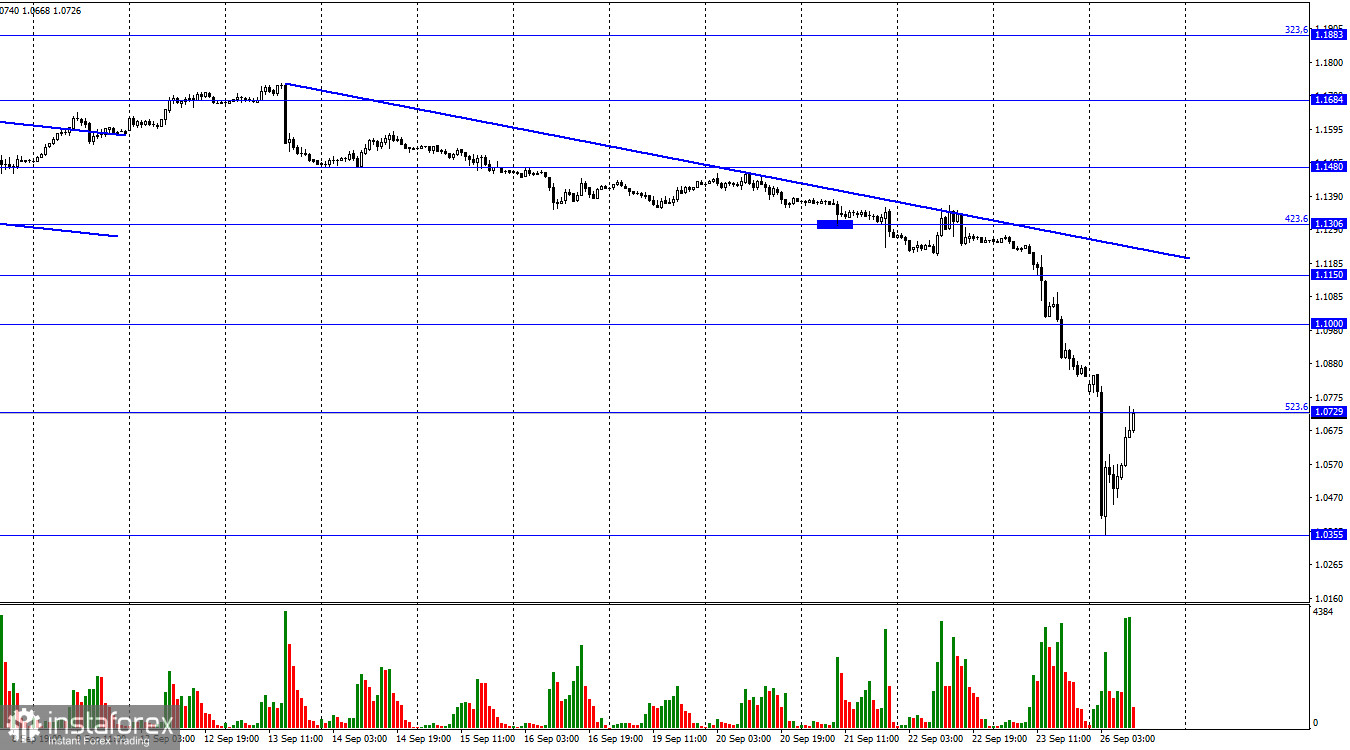

Hi, dear traders! According to the H1 chart, GBP/USD slid down by 400 points on Friday and another 400 points today. This is a massive drop for the pound sterling, even when considering its losses of the past few months. The main reason for the plunge is tax cuts for households and businesses in the UK, which are aimed to fight soaring energy prices. These plans by the UK government have triggered panic in the market. Market players are now actively discussing another possible interest rate hike by the Bank of England. The pound sterling has reached an all-time low against the US dollar. Amid constantly deteriorating geopolitical situation, new UK macroeconomic data has been released.

According to a batch of data released on Friday, services PMI declined to 49.2 from 50.9, manufacturing PMI increased to 48.5 from 47.5, and composite PMI decreased to 48.4 from 49.6. These data releases were not negative enough to trigger such a massive drop in the UK. In the US, services PMI advanced to 51.8 from 51.5, manufacturing PMI rose to 49.2 from 43.7, and composite PMI increased to 49.3 from 44.6. These indexes increased strongly, but the US dollar has already been moving up. At this point, global events such as tax cuts in the UK or mobilization in Russia are key factors for GBP/USD. The situation in the UK financial sector has remained dire since Brexit. Mobilization in Russia would lead to new Western sanctions against Moscow and would significantly worsen the already poor relations between Russia and the West.

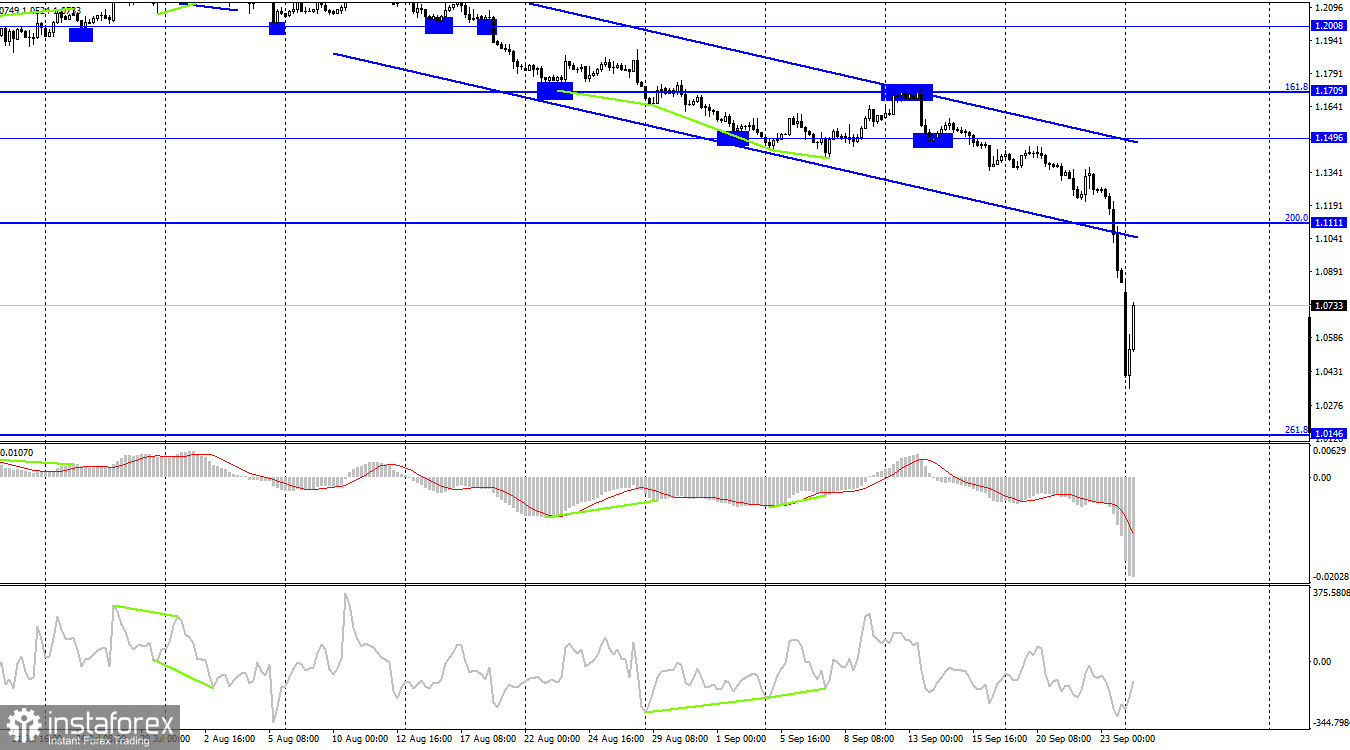

According to the H4 chart, the pair settled below the Fibo level of 200.0% (1.1111). It could then decline towards the retracement level of 261.8% (1.0146). GBP/USD has already covered most of the 1000 pips distance between these levels. The recent upward correction, which happened several hours ago, would likely not prevent the pound from sinking even deeper after the previous nosedive.

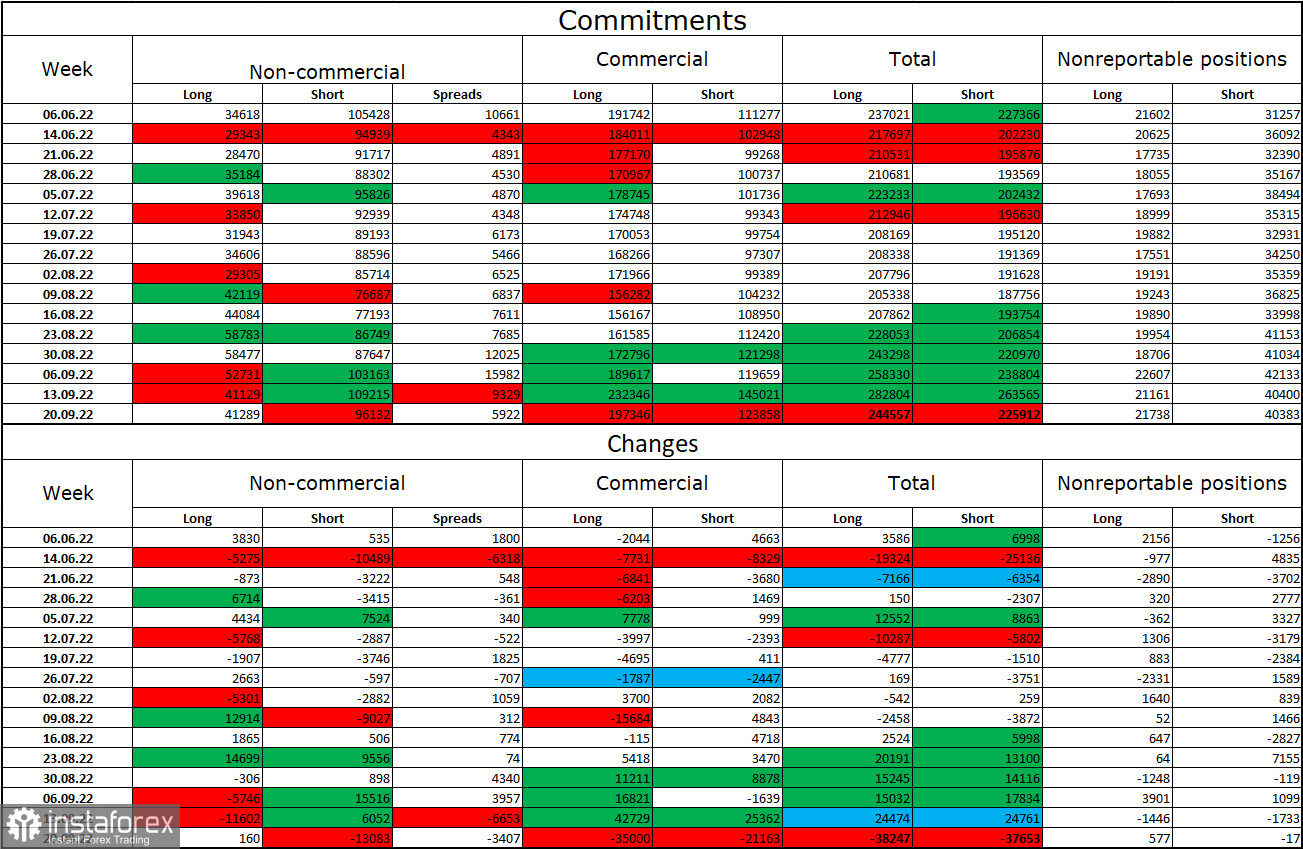

Commitments of Traders (COT) report:

Non-commercial traders became less bearish on GBP/USD over the past week. Traders opened 160 Long positions and closed 13,083 Short positions. However, most major players remain predominantly bearish, and open Short positions outnumbers Long positions greatly. The latest report and the events of the past few days make a GBP/USD uptrend unlikely. Major players have largely remained bearish on GBP, and slowly became more bullish, opening more long positions. However, the pound continues to sink, and it would take a long time for traders to become predominantly bearish. At this point, current events suggest that GBP could decline indefinitely.

US and UK economic calendar:

There are no events on the economic calendar in the US and the UK today. However, some news reports could affect the sentiment of traders, similar to how tax cuts in the UK triggered panic in the market earlier.

Outlook for GBP/USD:

Earlier, traders were recommended to open short positions if the pair closed below 1.1496 on the H4 chart with 1,1111, 1,1000, and 1,0729 being targets. GBP/USD has already hit all these targets. Opening new long and short positions is not recommended at the moment.