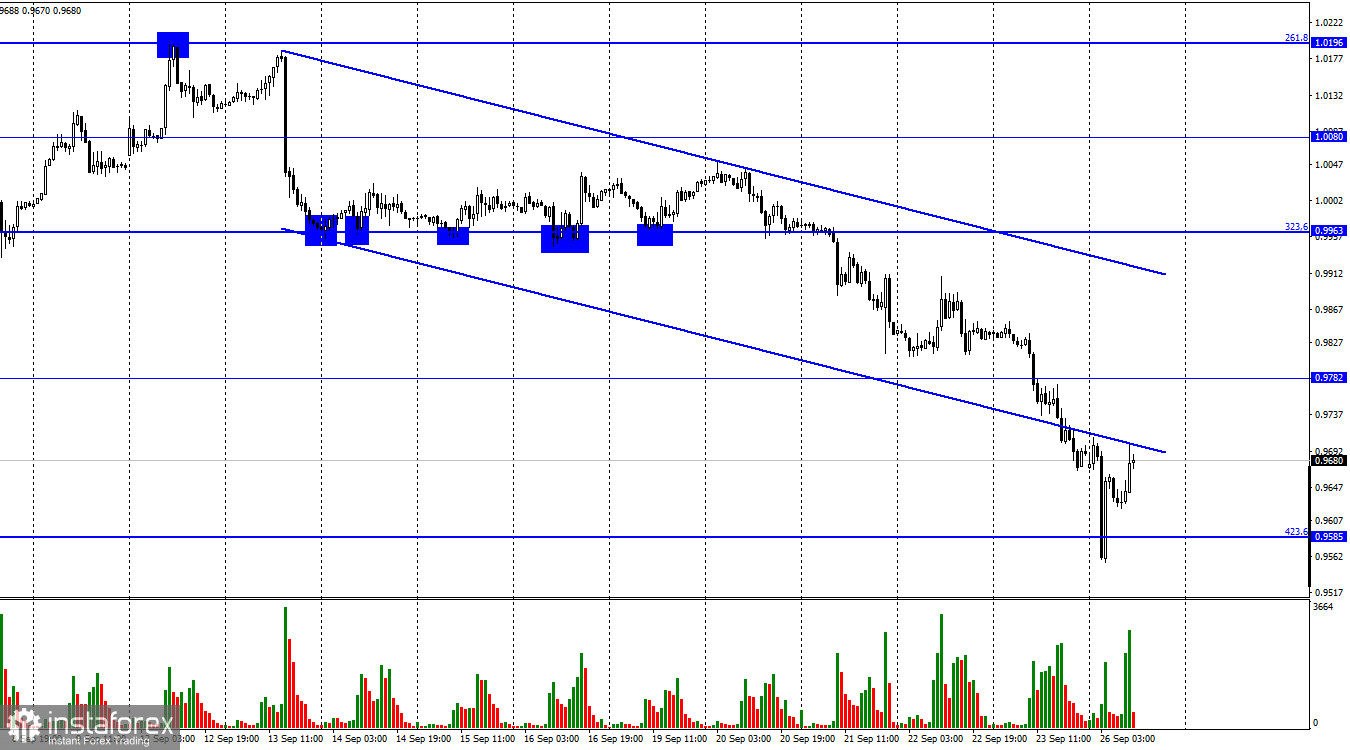

Good afternoon, dear traders! The EUR/USD pair maintained its downward movement, dipping below 0.9782. Today, it reached 0.9585, the Fibonacci correction level of 423.6%. If earlier we could talk about a more or less gradual fall of the euro, now we see a sharp decline. Moreover, this morning the UK government announced new economic measures to bolster UK's resilience. It is preparing a large-scale tax cut for legal entities and individuals in order to stabilize the economy. The Bank of England may hold an emergency meeting to raise the key rate. There is plenty of negative news in the euro area too. The results of the elections to the Italian parliament will be announced today. The exit polls show that the center-right coalition led by Giorgia Meloni is likely to win the majority in the Italian elections. If so, Italy may begin to move away from the bloc.

The discord in the EU is rather unfavorable for the EU states and the euro. Ursula von der Leyen has already stressed that the EU may impose sanctions on Italy and Hungary due to their pro-Russian rhetoric. This is a bearish factor for the European currency. Apart from economic woes, the EU may soon face political ones. The euro recovered quickly after an overnight drop. However, a sharp rebound will hardly last for long given the weakness of the euro. Apart from that, economic problems are also weighing on the euro. The downward corridor clearly indicates the bearish trend. The price has already tumbled below it. A further fall in the euro looks more possible.

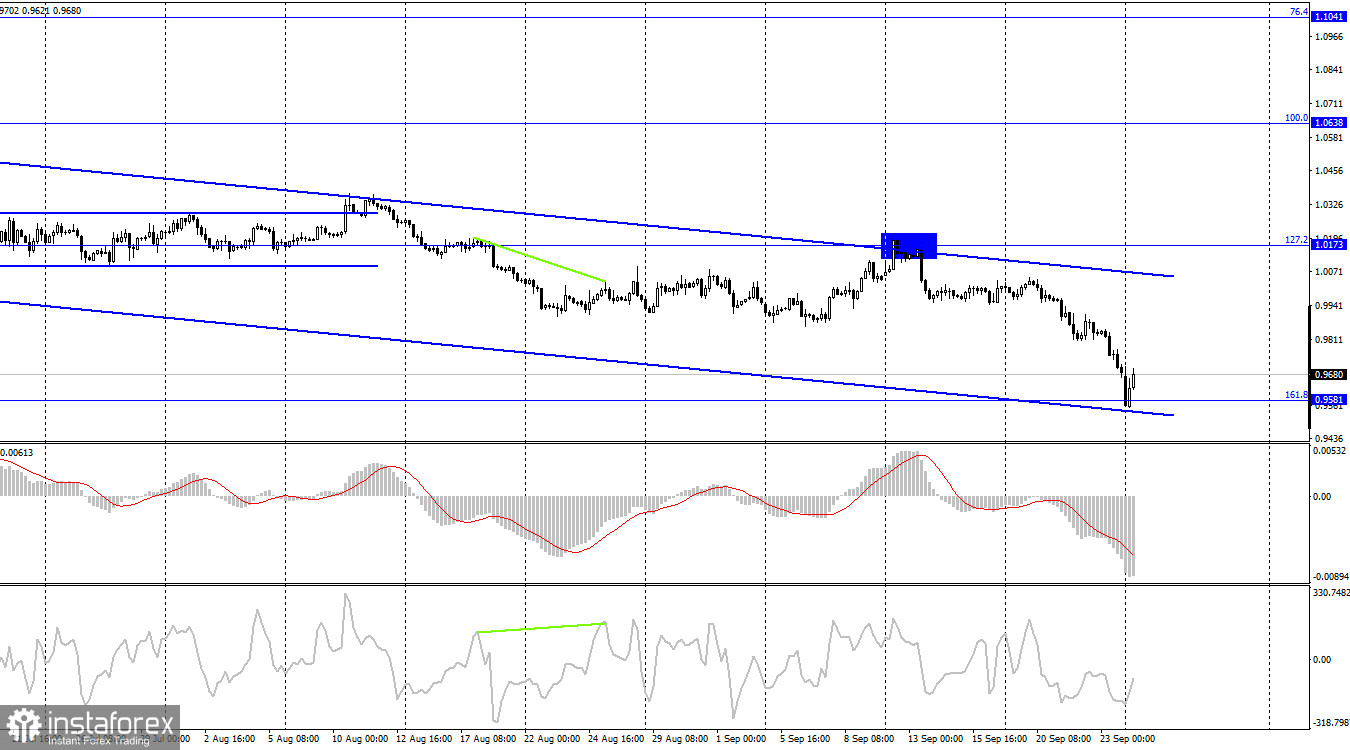

On the 4-hour chart, the EUR/USD pair slid down to 0.9581, the Fibonacci correction level of 161.8%. If the pair rebounds from this level, it may climb to the upper border of the downward corridor. However, it is hard to predict which levels the pair may reach given the strong bearish bias. If the pair moves below 0.9581, the euro is likely to drift lower.

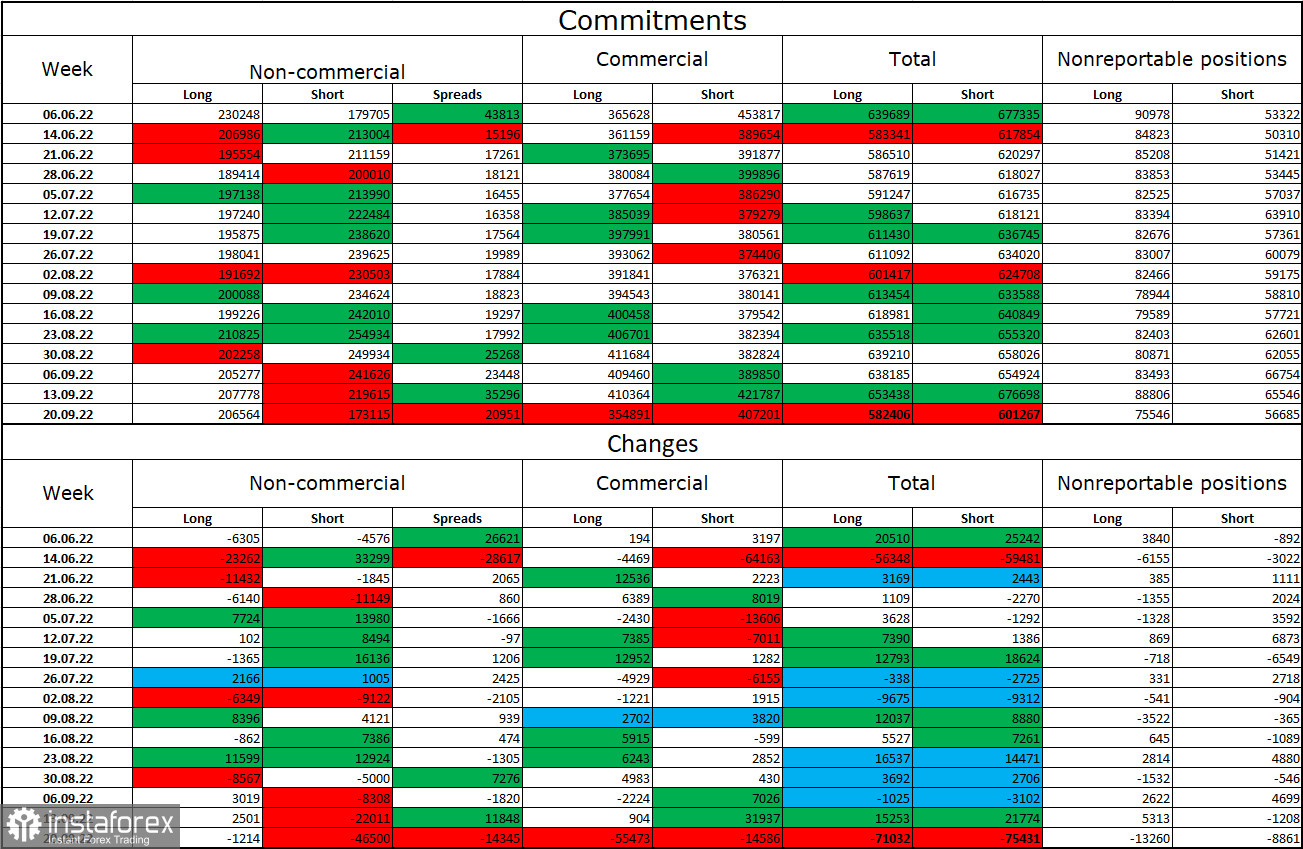

Commitments of Traders (COT):

Last week, speculators closed 1,214 Long positions and 46,500 Short ones. It means that the bearish bias has weakened significantly. The total number of Long positions amounts to 206,000 and the number of Short positions totals 173,000. Thus, now the mood of the major players is bullish, Yet, see the euro is still unable to recover. In the last few weeks, the likelihood of an upward movement has been gradually growing. However, traders are more prone to buy the US dollar, not the euro. The euro has failed to resume an upward movement in the last few months. Therefore, it is better to pay attention to the downward corridor on the 1H and 4H charts. The euro may jump if it consolidates above the downward corridor.

Economic calendar for US and EU:

EU – ECB President Lagarde is going to deliver a speech (13:00 UTC).

On September 26, the economic calendar for the European Union and the United States includes only one important event. Christine Lagarde is going to make a speech. traders are sure to take notice of it given the weak euro. Today, the impact of fundamental factors on market sentiment may be moderate.

Outlook for EUR/USD and trading recommendations:

It is better to open short positions if the pair rolls back from 1.0173 (1.0196) on the 4H chart with the target levels of 0.9900, 0.9782, and 0.9581. It is recommended to open long positions on the euro if it consolidates above 1.0173 on the 4H chart with the target level of 1.0638.