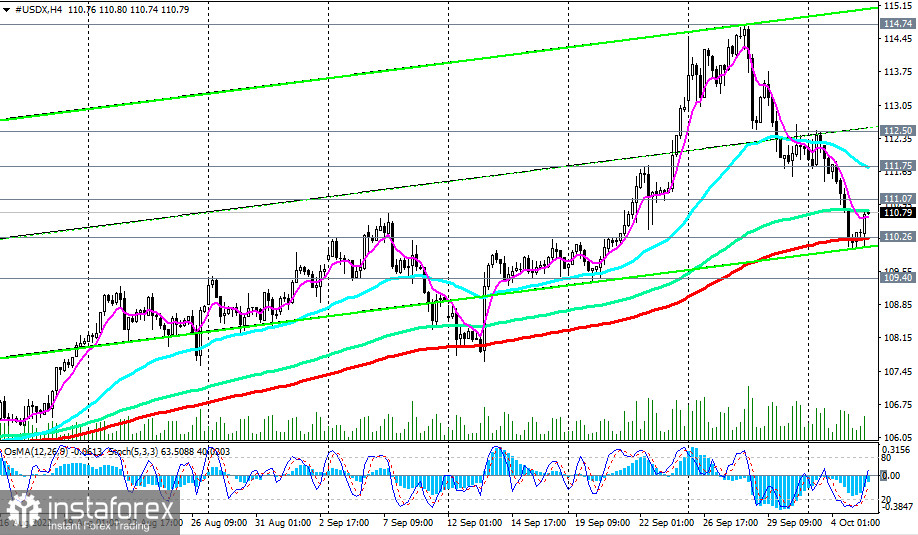

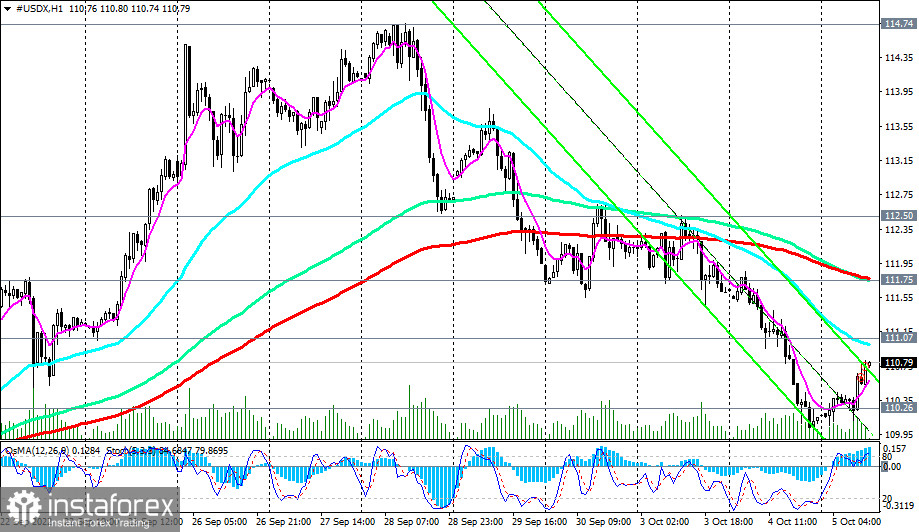

As of writing, the dollar index (CFD #USDX) is trading near 110.79, having rebounded today from the important support level of 110.26 (200 EMA on the 4-hour chart).

The breakdown of short-term resistance levels 111.07 (200 EMA on the 15-minute chart), 111.75 (200 EMA on the 1-hour chart) will be the first signal that the dollar and the DXY index will return to growth.

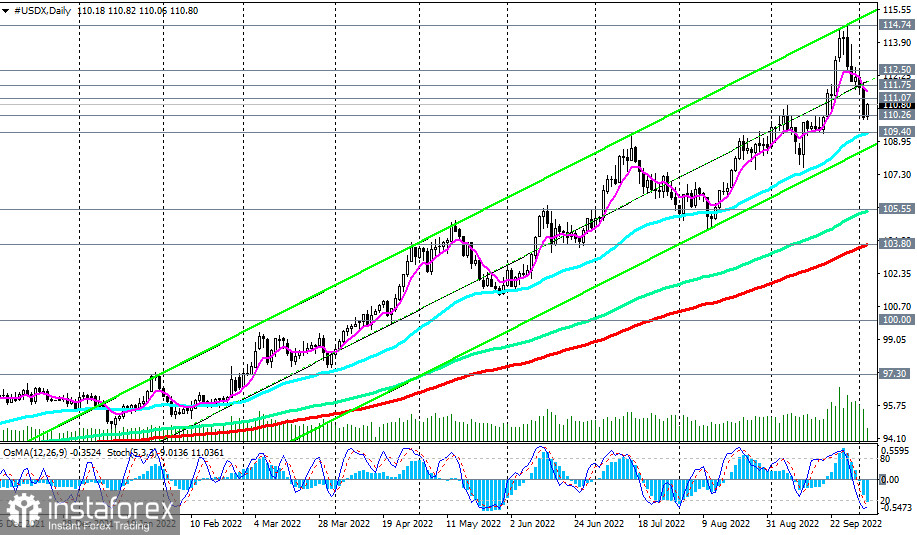

The dollar's upward trend continues, pushing the DXY towards more than 20-year highs near 120.00, 121.00.

In an alternative scenario, a confirmed breakdown of the support level of 110.26 (200 EMA on the 4-hour CFD #USDX chart) will become a sell signal.

The target is the important support level at 109.40 (50 EMA on the daily chart). Its breakdown, in turn, may provoke a deeper correction to the support levels of 105.55 (144 EMA on the daily chart), 103.80 (200 EMA on the daily chart).

Support levels: 110.26, 109.40, 105.55, 103.80

Resistance levels: 111.07, 111.75, 112.50, 114.00, 114.74, 115.00

Trading Tips

Sell Stop 109.90. Stop Loss 111.10. Take Profit 109.40, 105.55, 103.80

Buy Stop 111.10. Stop-Loss 109.90. Take-Profit 111.75, 112.50, 114.00, 114.74, 115.00