Expectations of a so-called reversal of the Federal Reserve System are exaggerated, and investors risk suffering from the situation that was observed this summer: markets were rising on expectations of a reduction in aggressive Federal Reserve policy, which did not happen, and stock indices hit their new yearly lows. The situation is about the same again now but market participants now have a real hope that inflation in the US will actually start to slow down after 5 months of interest rate hikes. Although judging by what is going on in the energy market right now, that may not happen again.

Several Fed officials have already stated their focus on lower inflation and now all eyes will be on the ADP data and the US jobs data scheduled for Friday. The new earnings and spending season could be the next catalyst for a spike in volatility in the markets.

As I noted above, most American politicians support the most hawkish scenario. Yesterday, Fed Chairman Philip Jefferson said that price stability could take some time to recover and would likely entail a period of below-trend growth. He also expressed concern that high inflation could feed into household inflation expectations.

The European Stoxx 600 index halted its best three-day gain streak since November 2020. The index fell by 0.8%, offsetting some of its 5.3% gain seen since Thursday of last week. Real estate, auto parts, and retail stocks fell the most.

West Texas Intermediate crude futures showed gains and remain above $86 a barrel. The OPEC+ is considering cutting production by as much as 2 million barrels a day, delegates said ahead of the group's meeting in Vienna but it has not yet been officially announced. If that happens, oil prices will continue to recover, putting even more pressure on the energy market.

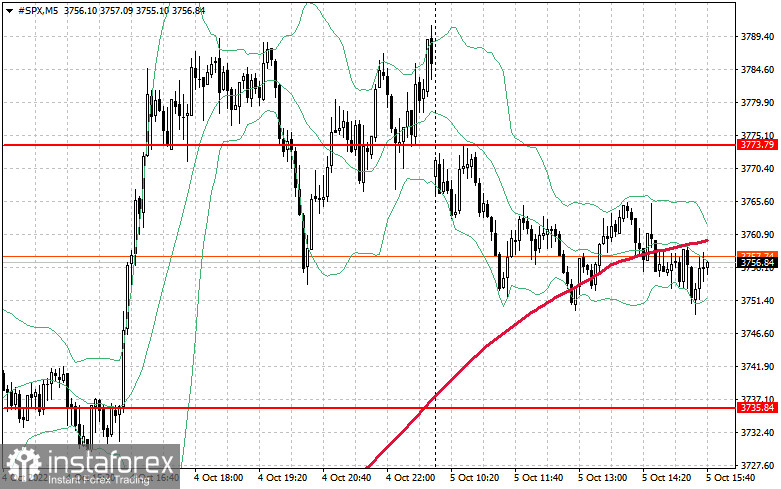

As for the technical picture of the S&P500, after yesterday's rise, demand has declined a bit, as has the index. The instrument is trading below $3,773, creating some difficulties for further bullish rally. Bulls will clearly expect a run to $3,773 after strong data on the US economy, which will leave hope for a further upward correction. A breakthrough of $3,773 may support a new upward momentum, aimed at the resistance of $3,801. The next target is the area of $3,835. If the price declines, bulls are likely to show their activity near $3,735. However, if this level is breaken through, it may quickly push the trading instrument down to $3,706 and $3,677, and also open an opportunity to reach a new support of $3,648. Below that level, you can bet on a larger sell-off of the index to the low of $3,608, where the pressure might ease a bit.