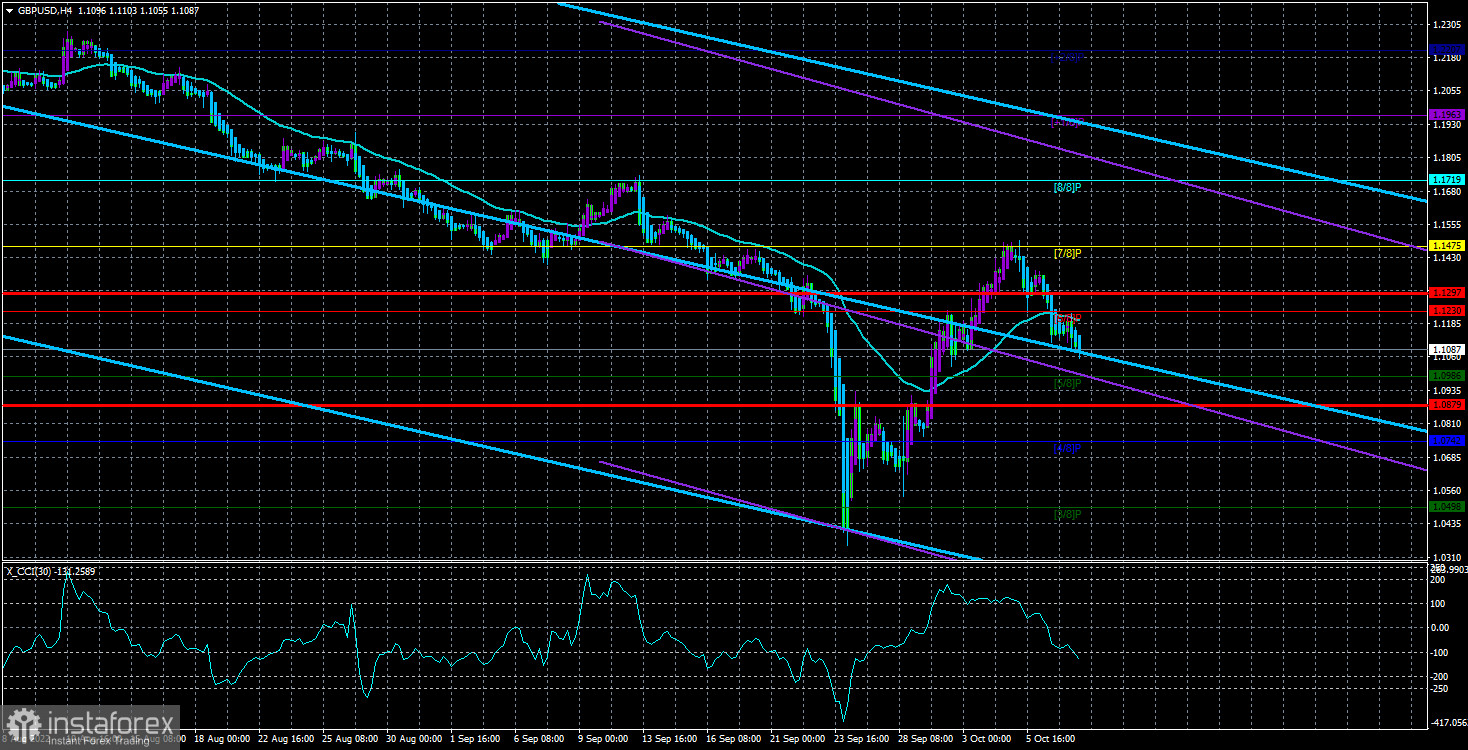

The GBP/USD currency pair also consolidated below the moving average on Friday, so the trend changed to a downward one. We have already said earlier that if we delete two weeks when the pair first collapsed by 1000 points and grew by 1000 points, everything is going according to the technical picture of the last two months for the pair. There is a clear downward trend, and the British currency is slowly "sliding" down. The "prick" of absolute lows that happened a few weeks ago may well be considered the end of a downward trend, but geopolitics may continue to have a devastating impact on all risky assets. Recall that the pound, like the euro, is falling against the background of the complicated geopolitical situation, not even in Ukraine but in the world. Recently, world leaders have been talking about nuclear war too often. In particular, US President Joe Biden said yesterday that the probability of such a war is the highest in the last 60 years. It is unclear who is behind undermining the "Northern Streams" and the Crimean Bridge. Still, these sabotage or terrorist attacks will not remain without consequences. The only question is, for whom will these consequences be and what? Thus, we would say that the probability of a new fall in the euro and the pound is still high.

Moreover, technical indicators are starting to turn down again. Only the critical line on the 24-hour TF, below which it has not yet been possible to gain a foothold, can save us from a new fall.

Meanwhile, Liz Truss's political ratings are falling like a boulder dropped from a high-rise building in the UK. In principle, it all started with the plan to reduce taxes, which, under the yoke of criticism from Parliament, had to be urgently finalized and processed. Nevertheless, many politicians, including a sufficient number of conservatives, believe Truss should declare a vote of no confidence. It is unlikely that she will be supported by most conservatives, who themselves chose Truss as their leader. Still, the very fact of a possible vote a month after taking office as prime minister is something out of the ordinary.

Will the British stats save the pound from a new fall?

There will be many important publications in Britain this week, but it should be noted that British statistics have less weight in the eyes of traders than American ones. And in the States, an inflation report will be published this week, which will most likely not affect the "hawkish" attitude of the Fed. On Tuesday, the unemployment rate and wages will be announced, as well as a speech by the Chairman of the Bank of England, Andrew Bailey. Bailey is now receiving increased attention amid rumors that the regulator may raise the rate by 0.75-1.00% in November. Also, everyone is interested in the new financial market stabilization program, which involves the daily purchase of long-term bonds until October 14. This program is the antipode of the previously announced program for the sale of bonds from the BA balance sheet, so there are a lot of questions about it. Industrial production and monthly GDP will be released on Wednesday. These are not the most important reports right now. Thus, it seems there will be enough events, but only Andrew Bailey can really impact the market mood.

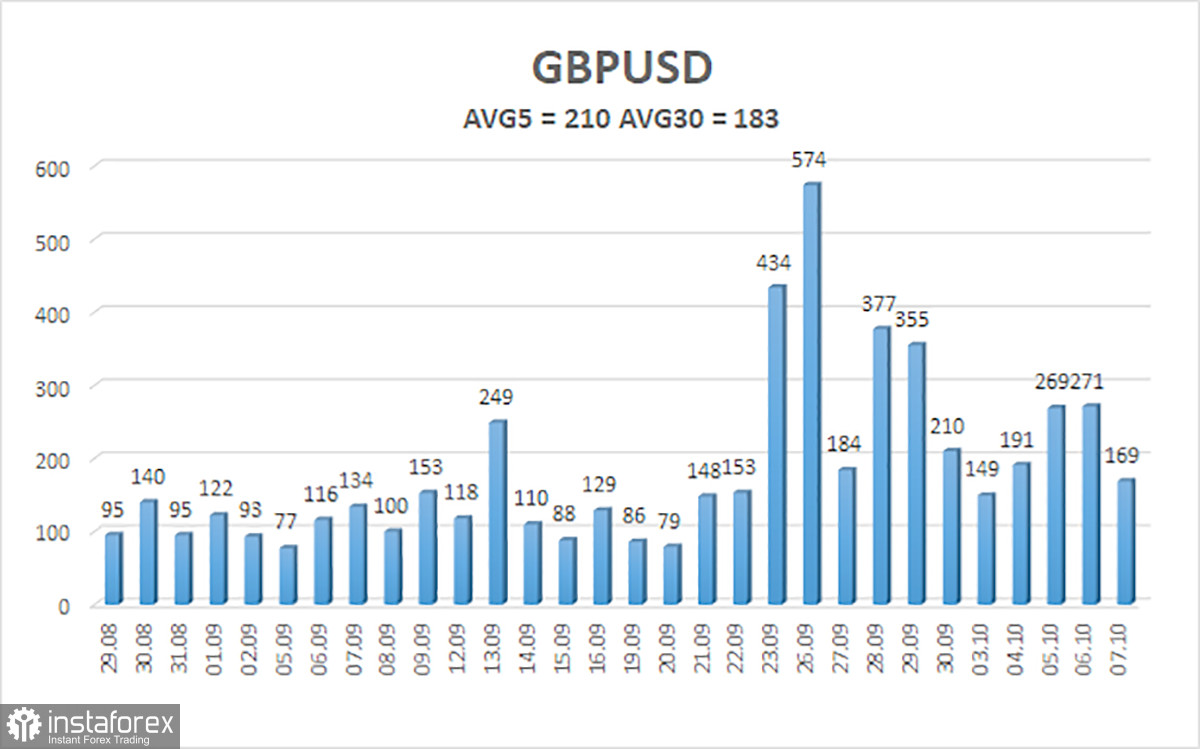

In America, in addition to the inflation report, applications for unemployment benefits, retail sales, and a consumer sentiment indicator from the University of Michigan will be published. Thus, we would say that it is worth paying attention this week to Bailey's speech, the inflation report, and geopolitics. More precisely, it is better to say this: the US inflation report and Bailey's speech on geopolitics. We believe that it is geopolitics that will "rule the ball" this week. Unfortunately, this does not mean anything good for the pound. Also note that volatility remains very high, which is clearly seen in the illustration below.

The average volatility of the GBP/USD pair over the last five trading days is 210 points. For the pound/dollar pair, this value is "very high." On Monday, October 10, thus, we expect movement inside the channel, limited by the levels of 1.0879 and 1.1297. A reversal of the Heiken Ashi indicator upwards will signal a round of upward correction.

Nearest support levels:

S1 – 1.0986

S2 – 1.0742

S3 – 1.0498

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1475

R3 – 1.1719

Trading Recommendations:

The GBP/USD pair in the 4-hour timeframe continues its downward movement, not a correction. Therefore, at the moment, you should stay in sell orders with targets of 1.0986 and 1.0879 until the Heiken Ashi indicator turns up. Buy orders should be opened when the price is fixed above the moving average line with targets of 1.1297 and 1.1475.

Explanations of the illustrations:

Linear regression channels help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.