According to the results of the last trading week, bulls on the EUR/USD pair failed to build on their initial success: in order to develop corrective growth, they needed not only to overcome the parity level, but also to gain a foothold above 1.0050. Despite a fairly strong upward momentum (the pair rose by more than 200 points in two days), the bears seized the initiative and regained their lost positions. The EUR/USD bulls failed to even test the 1.0000 target, which already acts as a key price barrier.

Therefore, the main intrigue of the upcoming week lies in a non-trivial question: will the bulls on the pair decide on another counterattack or will their opponents return EUR/USD to the price level of 0.9550-0.9650?

Over the last three days of the past week, the price has steadily declined. This was mainly due to the fact that hawkish expectations about the Federal Reserve's actions have risen again. If on Monday (after the release of the disappointing ISM index in the manufacturing sector) the probability of a 75-point rate increase at the November meeting decreased to 50%, then by the close of the five-day trading period this indicator increased to 80% (after the release of the ISM index in the service sector and Nonfarm - both release came out in the green zone).

Therefore, the events of the upcoming week will either strengthen or weaken the positions of the dollar bulls. That is, either the EUR/USD bulls will make another attempt at an upward breakthrough to the parity level, or the bears will try to gain a foothold within the 96th figure in order to subsequently claim a second assault on the 95th price level.

US trading floors will be closed on Monday - Columbus Day is celebrated in America. During the European session, two representatives of the European Central Bank will speak - Joachim Nagel (head of the Bundesbank) and Philip Lane (chief economist of the central bank). They have previously advocated in one form or another for "strong action" in response to a 10% increase in inflation in Germany and the eurozone. Nagel, of course, made the hawkish theses more specific, hinting at a 75-point rate hike at the next meeting. But in general, these representatives of the ECB are unlikely to be able to surprise the market with anything - they will not jump above a kind of "ceiling" in their statements.

On Tuesday, Fed representatives Patrick Harker and Loretta Mester will announce their position. If Harker does not have voting rights this year, then Mester, on the contrary, by rotation in 2022, has the right to vote in decision-making in the Committee. Previously, she voiced very hawkish theses. In particular, she assured journalists that inflation in the United States had not reached its peak, and also denied rumors that the Fed could pause the process of raising interest rates in the foreseeable future. In her speech on Tuesday, she can comment on the latest releases (in particular, the growth of the PCE index), supporting the US currency with her hawkish rhetoric.

Interesting events are expected on Wednesday, October 12th. First, the US will publish the producer price index. As you know, this indicator can be an early signal of changes in inflationary trends, or their confirmation. According to preliminary forecasts, on a monthly basis, the indicator will increase by 0.2% (after a decrease of 0.1% in August), in annual terms it will grow by 8.3%. Excluding food and energy prices, the index can also demonstrate positive dynamics, both in monthly and annual terms.

Another important Wednesday release is the minutes of the September Fed meeting. Let me remind you that following the results of the September meeting, the dollar received support from "point forecasts", which reflected the hawkish mood of the Fed. According to the released scatter plot, the median forecast for the federal funds rate at the end of next year rose to 4.6%. Whereas in June, the "FOMC points" (Dot Plot) showed the upper bar at the level of 3.8%. By the end of 2024, Fed officials see the rate at 3.9%, while the previous (June) estimate was at 3.4%. Considering this fact, as well as previous macroeconomic reports and the rhetoric of the majority of the Fed representatives, it can be assumed that the minutes of the September meeting will be hawkish.

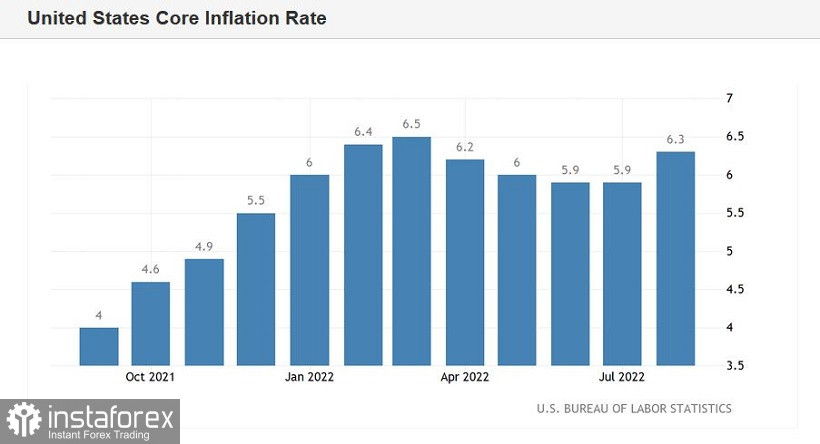

The central report of the week for dollar pairs will be published on Thursday. We will find out the key data on the growth of US inflation. According to most experts, the general consumer price index in annual terms will rise to 8.1%, in monthly terms it will grow by 0.2%. But the core index, excluding food and energy prices, may jump to 6.6%. In this case, the indicator will update the 40-year (!) high, strengthening the positions of the dollar bulls.

Well, finally, on Friday all the attention of EUR/USD traders will also be riveted to the American statistics. Among all the releases, we should highlight the report on the volume of retail sales (a minimal increase in the indicator is expected) and the consumer sentiment index from the University of Michigan (an increase of 58 to 60 points is expected). Also on the last trading day, Fed Board member Lisa Cook will speak. Her rhetoric may affect the dynamics of the EUR/USD pair.

In general, US inflationary releases will set the tone for trading next week. The hawkish theses of the Fed's minutes may strengthen the positions of the EUR/USD bears, but still the main attention will be focused on inflation reports. In addition, in my opinion, the market has not fully won back the Nonfarm published last Friday. Let me remind you that the unemployment rate in the United States fell to 3.5%, and the number of non-farm payrolls increased by 253,000. Salaries did not disappoint either.

Thus, many factors speak in favor of the fact that the US currency will only gain momentum in the near future. It is advisable to use corrective rollbacks for the EUR/USD pair to open short positions. The first bearish target is located at 0.9700 (lower line of the Bollinger Bands indicator on the 4-hour chart). The main target is 0.9610 (bottom line of Bollinger Bands on the D1 timeframe).