EUR/USD

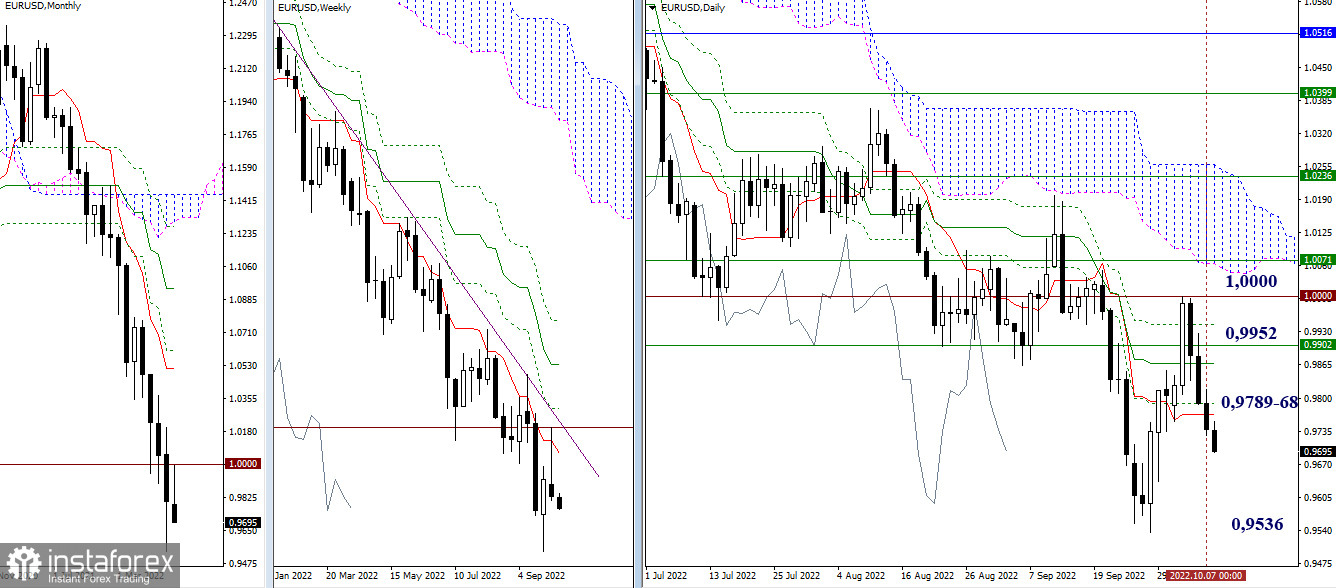

Higher timeframes

Last week, bears managed to slow down another corrective rise. As a result, a rebound from the meeting with the resistance zone of 1.0000 - 0.9952 (psychological level + weekly short-term trend) was formed. To date, the bears have passed the daily supports (0.9768 - 0.9789). The next important downward benchmark can be considered the low of the current correction of the higher timeframes at 0.9536.

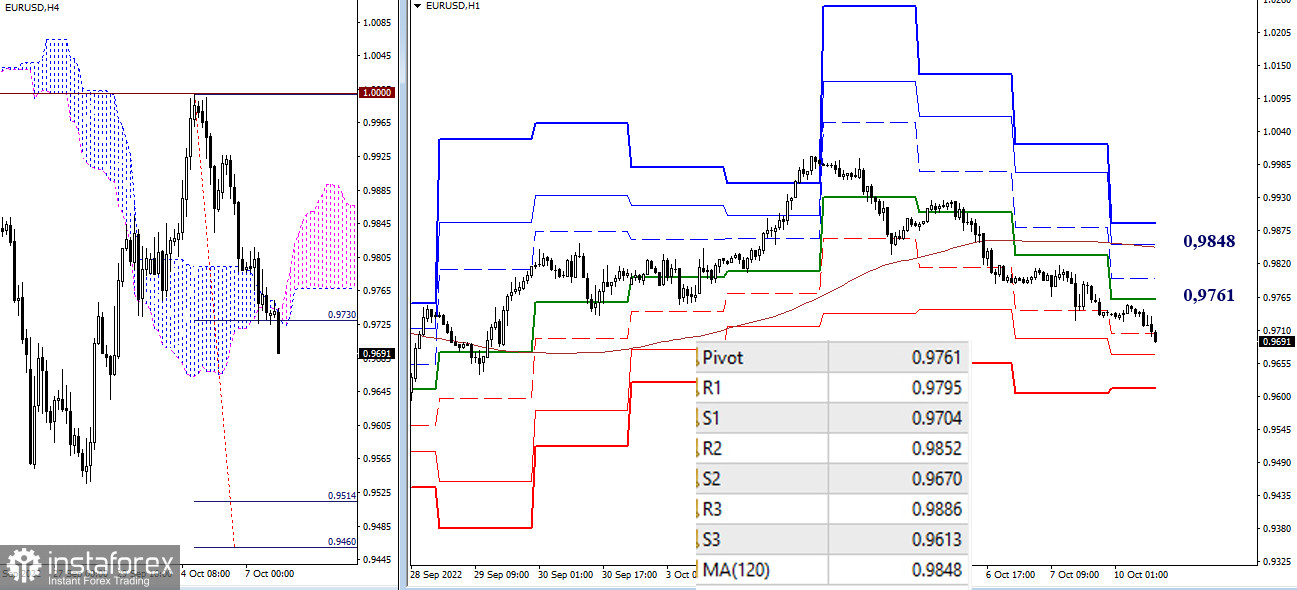

H4 – H1

As of writing, the advantage on the lower timeframes is on the side of the bears. The benchmarks for the decline are the support of the classic pivot points 0.9670 and 0.9613. In addition, a downward target is being formed for the breakdown of the H4 cloud, its possible reference points can now be 0.9514 - 0.9460. The key levels of the lower timeframes today act as resistance, they can be noted at 0.9761 (central pivot point) and 0.9848 (weekly long-term trend).

***

GBP/USD

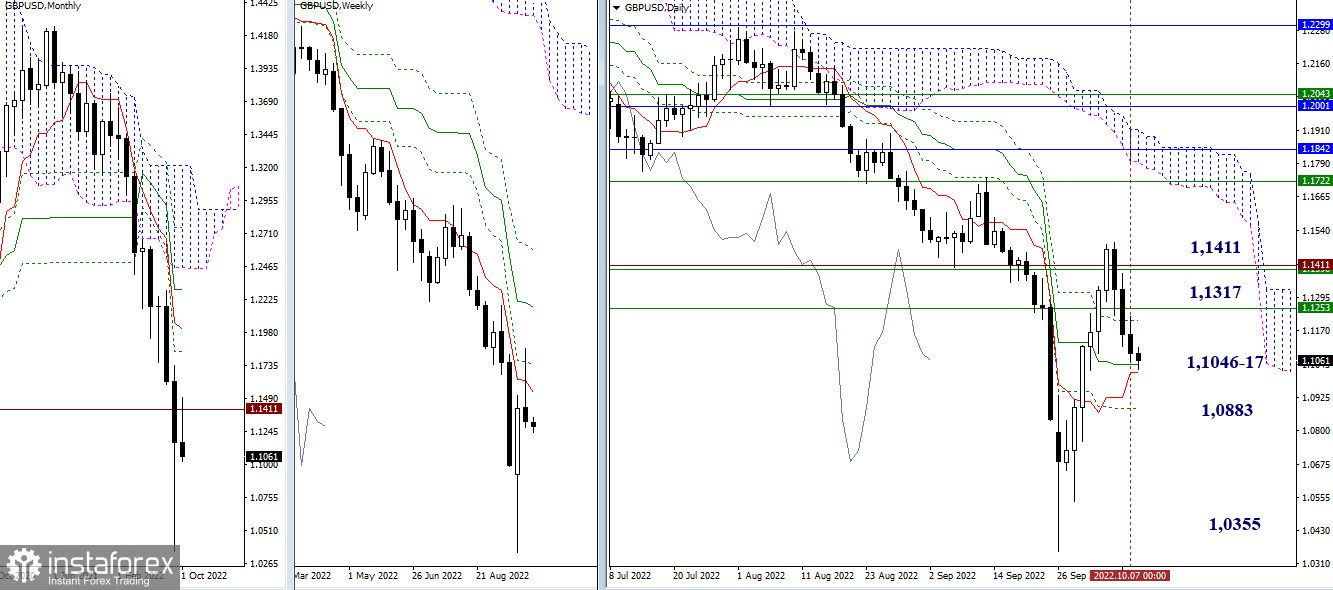

Higher timeframes

Last week, a rebound was formed from the resistances 1.1317 - 1.1400 - 1.1411 (weekly levels + historical level), as a result of which the pair returned to the support zone and the influence of the daily Ichimoku cross 1.1046-17 - 1.0883. The strength of the supports can now provoke deceleration and the development of a rebound. In case of a breakdown and continued decline, the main task of the bears will be to update the September low (1.0355).

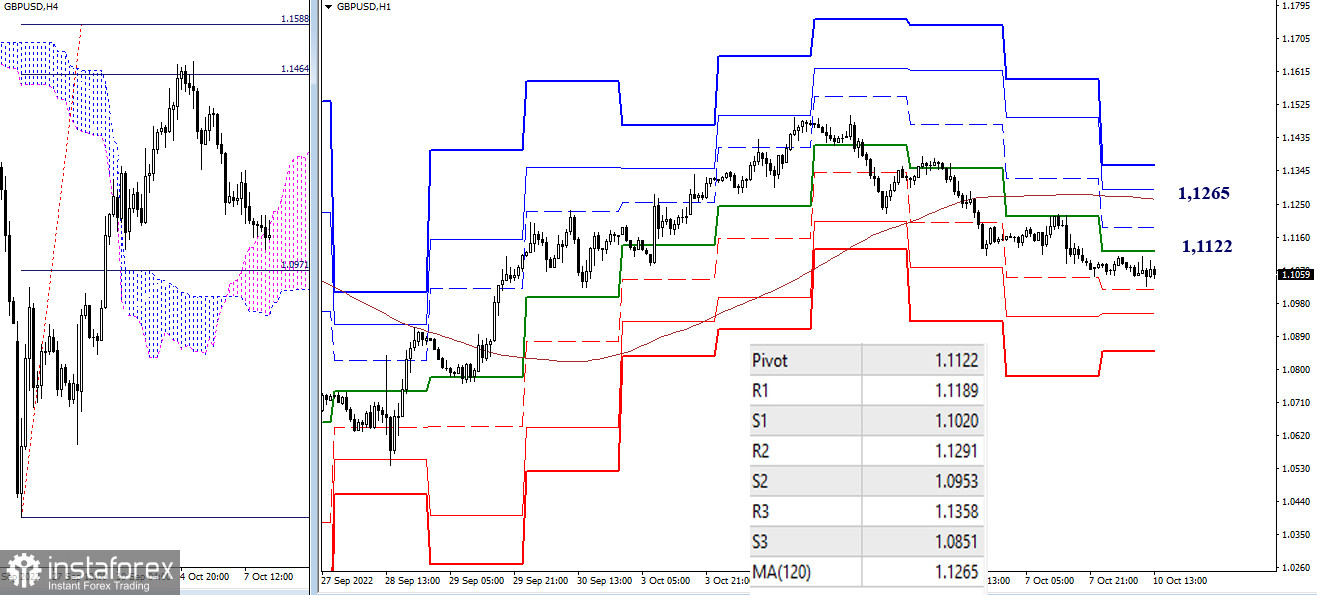

H4 – H1

The advantage is currently on the side of the bears. The downward benchmarks within the day are the support of the classic pivot points (1.1020 – 1.0953 – 1.0851). The key levels of the lower timeframes are now acting as resistance, located at 1.1122 (central pivot point of the day) and 1.1265 (weekly long-term trend). Testing and consolidation above these levels will allow players to make a difference in the distribution of the balance of power.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)