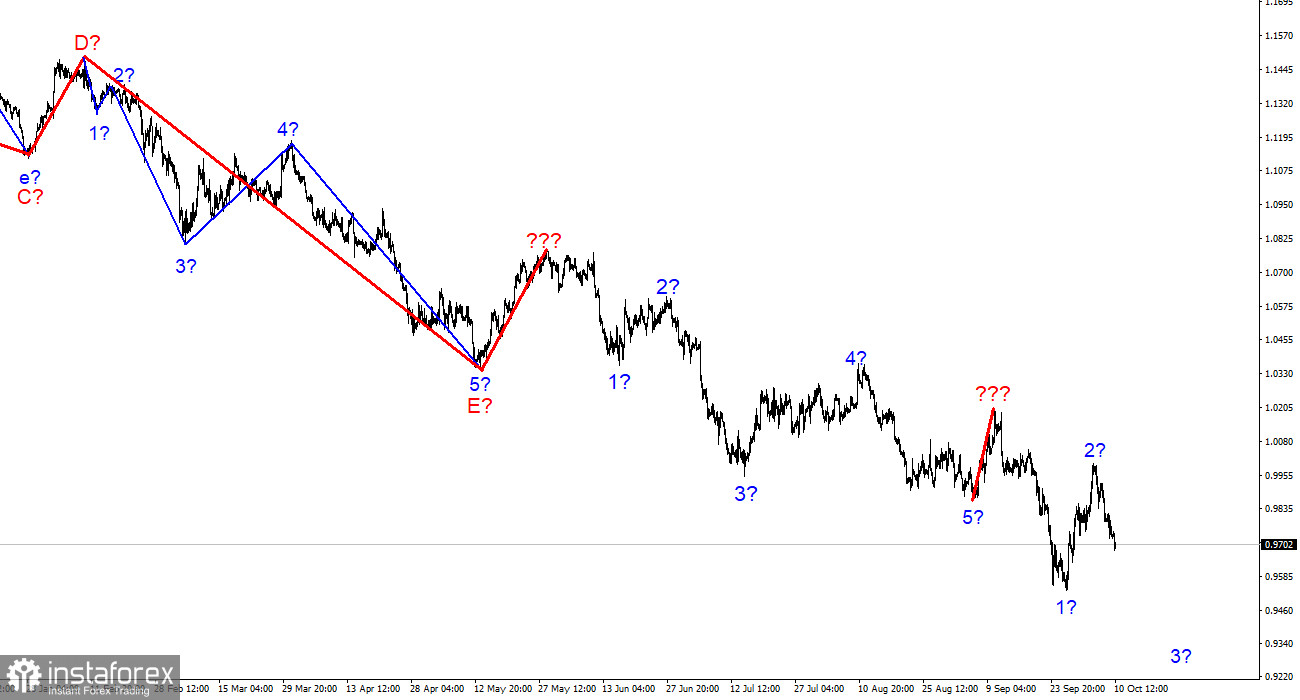

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than ever in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down-a weak corrective wave up." The goals of the downward trend segment, which has been complicated and lengthened many times, can be found up to 90 figures or even lower. At this point, the (presumably) wave 3 of the downward trend section can be built.

The dollar is growing, and a miracle can only save the euro currency.

The euro/dollar instrument declined by another 50 basis points on Monday. Remember that on Friday, when the unemployment and labor market reports were released, the index fell by the same amount. From my point of view, this market behavior suggests that it does not care now what economic data is published in the USA or the European Union. Geopolitics and factors of the Fed and ECB scale are first. Let's look into them in more detail.

Sometimes there are situations when ordinary statistics do not matter much. This means that factors of greater importance and priority have entered the work. It's no secret that the geopolitical situation in the world has always greatly influenced the market's mood. The more stable and safer it is, the higher the probability of a calm and smooth movement of instruments, and the dollar does not have a pronounced advantage at this time. And vice versa. Currently, the Ukrainian-Russian conflict does not allow the markets to breathe freely, and they respond with new purchases of the US dollar. If you ignore individual waves, we have seen the dollar rise for almost two years.

The second factor is no less important. At the beginning of this year, the Fed began to raise the rate, but it was not the first among the major central banks to do this, and all the "latecomers" joined the process a little later. The ECB and the Bank of England are raising the interest rate, but the demand for the US currency is not decreasing. Someone may say – because the Fed rate is higher, following this logic, the dollar can grow for a very long time, several months for sure. Nobody knows how much more geopolitics will stimulate demand for the dollar.

General conclusions.

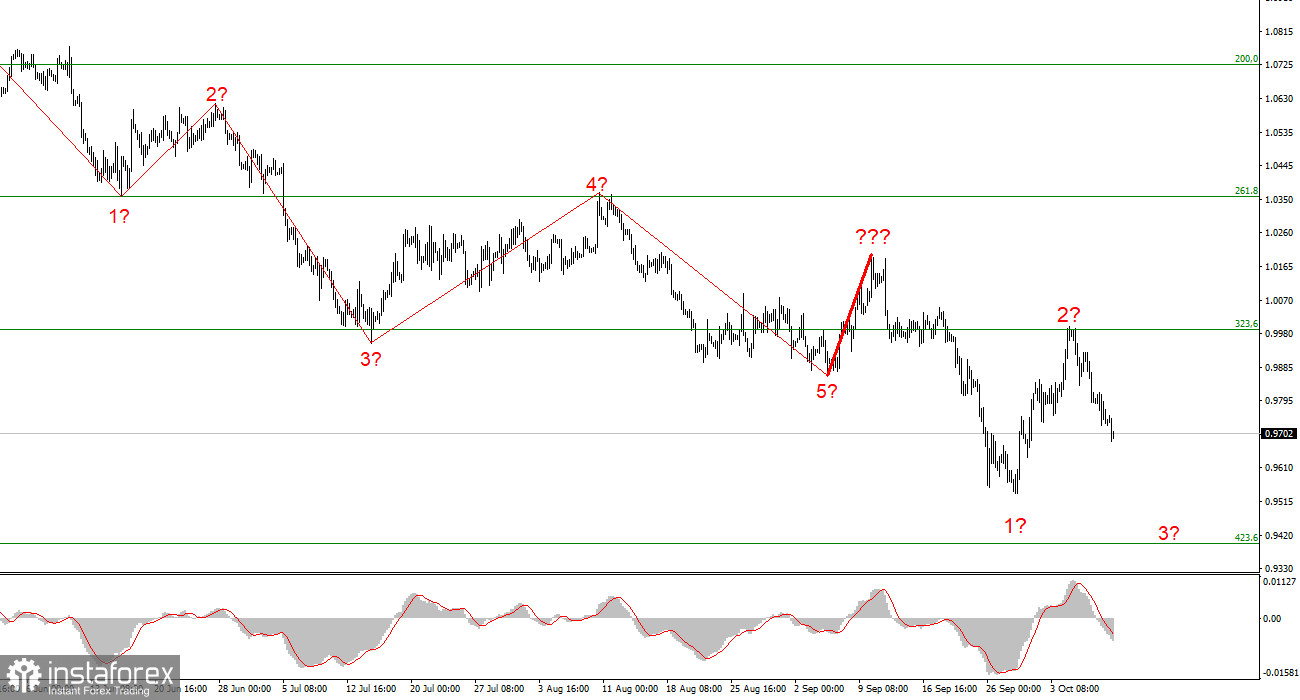

Based on the analysis, I conclude that the construction of a downward trend section continues but can end at any time. At this time, the instrument can build a new impulse wave, so I advise selling with targets near the calculated mark of 0.9397, which equates to 423.6% by Fibonacci, by the MACD reversals "down." I urge caution, as it is unclear how much longer the overall decline of the instrument will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be just completed, and a new one has begun its construction.