The US dollar index extended gains on Tuesday, following BoE Governor Bailey's comments. The Bank of England announced its bond-buying support would end on October 14th. US stock indices reacted to the news with a fall into the red zone. At the same time, demand for safe-haven assets, primarily the greenback, grew.

The International Monetary Fund downgraded its global growth forecast to 2.7% for 2022, citing high risks to the global economy.

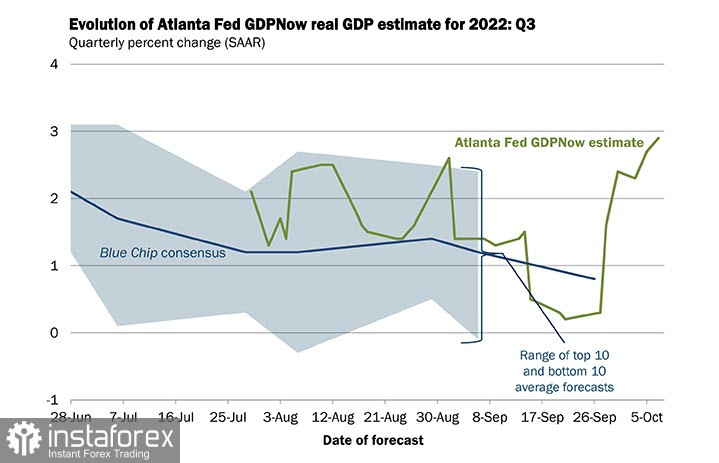

The Atlanta Fed's GDPNow model estimated that the US economy grew by 2.9% in the third quarter. The American economy is nowhere near a recession, which means the United States is in a better state than its European counterparts. Therefore, the Federal Reserve is likely to stay hawkish, which is seen as the driving force for the greenback.

Today, the market will focus on the release of the FOMC Minutes. Data on producer prices in the United States may trigger an increase in volatility as well. The publication of the US inflation report on Thursday will become the main event of the whole trading week.

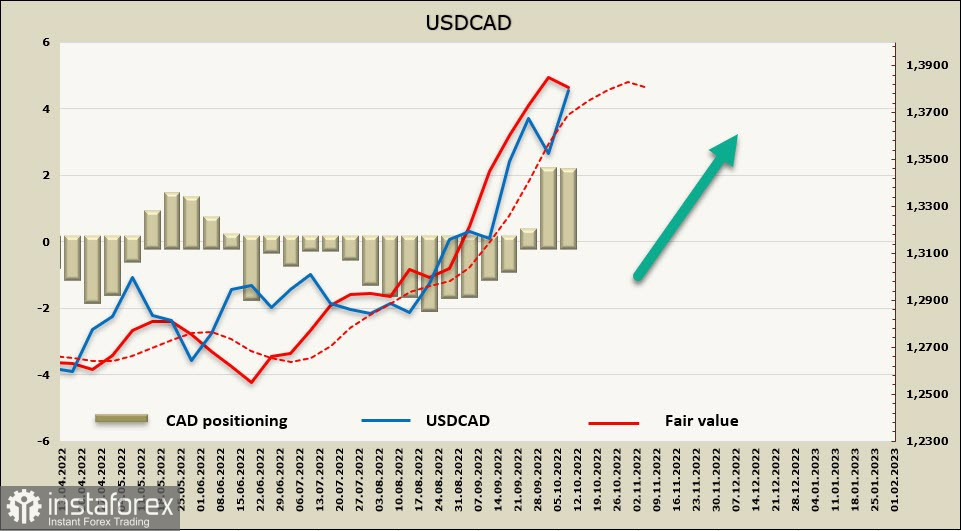

USD/CAD

Tiff Macklem, the governor of the Bank of Canada, send a hawkish message to the market last week. Inflationary risks in Canada are higher than in the United States because wages rise at a faster pace, he explained. Canada kept stimulating consumer demand during the summer season, while similar programs were halted in the United States. Although global supply chains are stabilizing, the pressure on global prices will unlikely ease, he underlined. This means that high inflation in Canada has both internal and external grounds. Therefore, the Bank of Canada can hardly change its stance on monetary policy.

The next monetary policy meeting is scheduled for October 25th. The Canadian regulator is expected to hike rates by 0.5%. By the end of the year, the interest rate would exceed 4%. The spread value between Canadian and US bonds is narrowing, with the prospect of stabilization in the loonie in the medium term.

The CAD net short position gained 297 billion during the reporting week, reaching -1.584 billion. We have the bearish positioning. The settlement price is above the long-term moving average, but the impulse is getting weaker. A bearish correction may occur in the short term.

When the OPEC+ group agreed to cut oil production and crude prices increased, the loonie strengthened and a modest bearish correction in USD/CAD followed. On Tuesday, however, the pair already approached the high. USD/CAD has strong growth potential with the target at the high of 1.4667, recorded in March 2020.

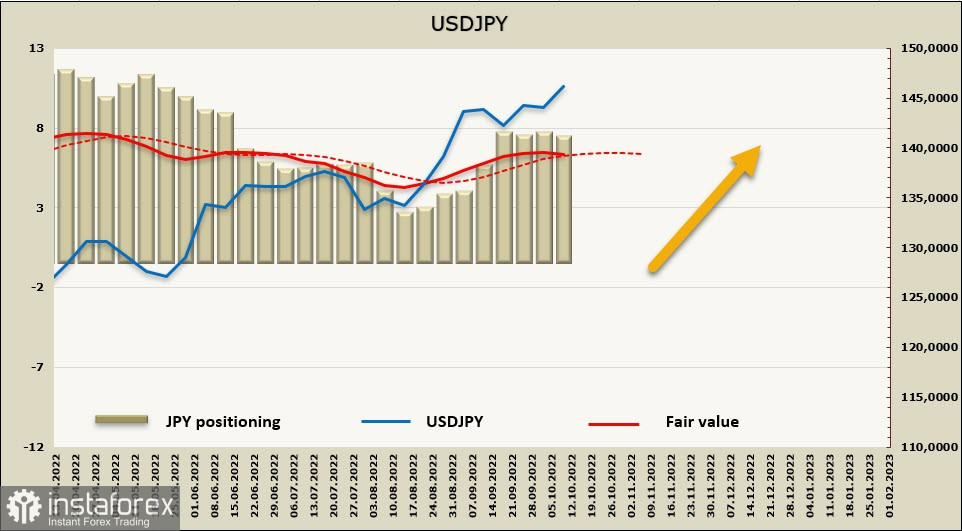

USD/JPY

Japan's Prime Minister Kishida told FT that he fully supports the Bank of Japan's ultra-loose monetary policy. Moreover, he stated that the policy should stay loose until wages see a steady rise.

Meanwhile, the latest macro results came disappointing. Japan's core machinery orders fell 5.8% in August from the previous month, missing economists' expectations. The forecast was based on the results of the Tankan survey, which showed that big firms expected to increase capital expenditure by 16.4%. This is seen as a sign of a steady economy and a lower-than-anticipated reduction in global demand. The current account balance saw a surplus in July and August, despite the fact that the trade balance moved deep into the red.

The Bank of Japan will extend its ultra-long bond purchases in October-December to support financial health. This would make the outlook for the yen even more gloomy. The yen is unlikely to strengthen for long as the Bank of Japan follows its current course.

The JPY net short position remained unchanged at -7.079 billion during the reporting week. The settlement price is below the spot price and has no momentum, which indicates that the yen is bearish largely due to the Bank of Japan's monetary stance. The regulator continues to buy back bonds at a fixed price, which results in liquidity growth.

Since the Bank of Japan has no intention to review its monetary policy stance, USDJPY is likely to stay bullish. The quote is nearing the target of 147.71.