Bitcoin continues its boring sideways movement. The cryptocurrency has not been able to leave the wide range of fluctuations of $18.2k–$25k for four months in a row. Buyers and sellers do not have the necessary volumes to achieve their targets.

Bitcoin and S&P 500

Bitcoin tried three times to go beyond the current fluctuation range, but all attempts failed. In addition to the liquidity crisis, the correlation with SPX has also affected Bitcoin's capabilities. The stock index continues to decline after trying to realize the bullish momentum.

At the same time, there is also good news for the cryptocurrency, because if the S&P 500 is approaching the update of the local low, then BTC is near $19k. This indicates the minimum level of volatility in the market, as well as the absence of trading volumes.

Is the bottom passed?

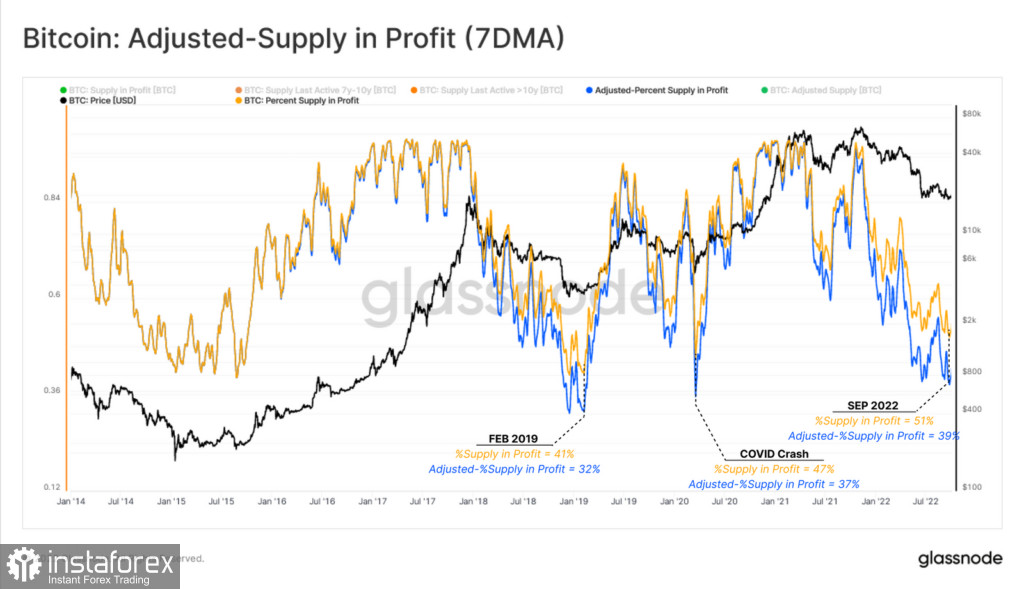

Glassnode analysts, in their next weekly report, indicate that Bitcoin has already formed a bottom and is at the final stage of a bear market. The decrease in the level of volatility and trading volumes correspond to the final segment of the formation of the local bottom. Despite this, Glassnode is confident that the flat may drag on for several more months.

However, there is reason to believe that at a distance of a week and a half, Bitcoin may go beyond the current range of $19k–$20.4k. On Thursday, the publication of quarterly reports starts, which is very likely to have a negative impact on the quotes of stock indices and cryptocurrencies.

Given this fact, we can expect volatility in the market and an impulse growth in trading volumes. The wedge pattern on the daily Bitcoin chart is still not broken, and the increase in trading volumes and volatility may accelerate this process.

Is Bitcoin preparing to rise?

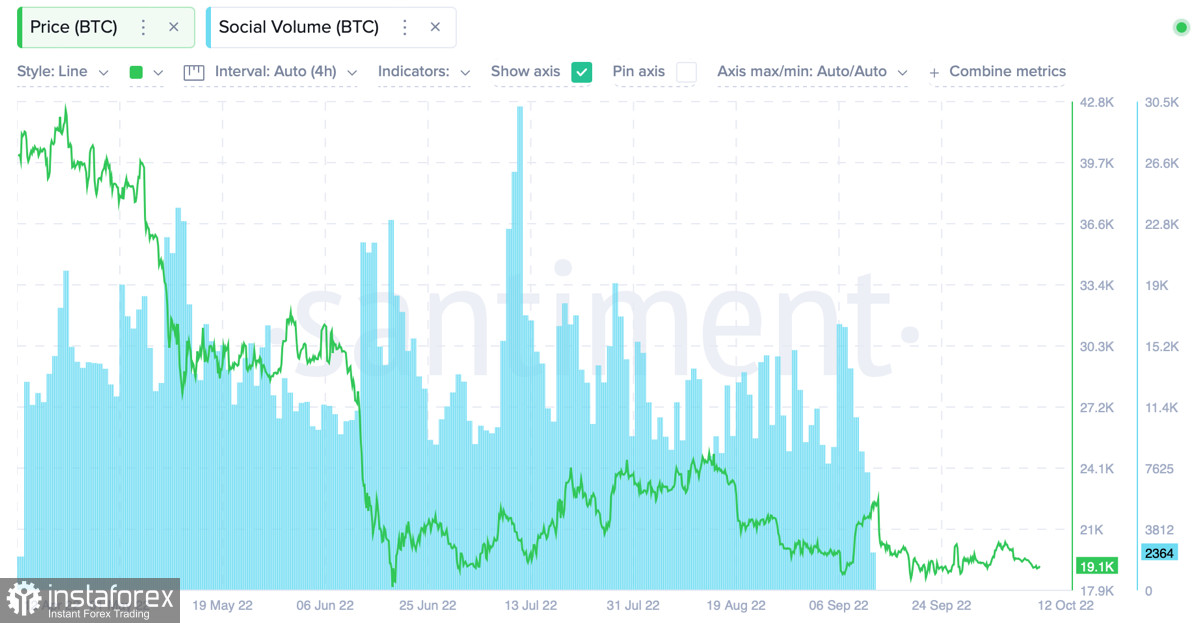

There is a high probability of an upward breakout of the pattern as Santiment captures bullish sentiment among crypto bloggers. About 80% of influencers believe that Bitcoin will rise soon. At the same time, the overall social activity in relation to cryptocurrencies and BTC remains low.

Michael van de Poppe, an expert at the Amsterdam Stock Exchange, believes that BTC volatility will start to rise from October 13th. The catalyst for the activation of market players will be the publication of reports on inflation, the labor market, and retail sales. Given the set of important events in the coming days, we should expect an impulsive price movement.

It is important to understand that after the bottom formed near $17.6k, investors had four months of consolidation. There is no doubt that large volumes of liquidity are concentrated under the local bottom level. It is unlikely that a bullish trend will start without a final drop to get huge amounts of fuel.

Meanwhile, the weekly BTC/USD chart is dominated by consolidating sentiment. The asset continues to move flat near the $19k level. At the same time, trading volumes remain approximately at the same level. The volatility of the asset is also at a local low.

Results

In the next few days, the market can expect increased volatility, provoked by various reports. Bitcoin has every chance to make a bullish exit beyond the current range of fluctuations. With a successful bullish breakout of the $20k level and consolidation above the downward trend line at $20.4k, BTC will continue to move towards $23k. However, we should not expect the emergence of a medium-term upward trend.