Everything flows, everything changes. If in ancient times, during periods of great upheaval, people hid money in gold, now they are running towards the US dollar. The higher the stress in the financial markets, the better for the dollar. Even local outbreaks unnerve investors. The shock in the British bond market due to the vulnerable positions of pension funds swept in waves in other global debt markets. There are fears that history will repeat itself in 2023 with some other country or group of countries. The 15% chance of global GDP growth below 1% in 2023 in IMF forecasts does not inspire optimism either. In this scenario, many people will feel pain, which worsens their mood and contributes to the continued rally in the USD index.

In order to understand where we will be, we must first figure out how we got here. I highlight three major developments that make the current situation in the markets extremely nervous. First, it is the highest inflation in decades. It turned out to be more stable and longer than expected. On paper, in such an environment, gold should feel like a fish in water, but in practice, the precious metal is sensitive to the monetary policy of the Fed. The intention of the central bank to raise the federal funds rate to 4.5–4.75% in 2023 hurts XAUUSD positions and threatens a global recession.

Secondly, the armed conflict in Ukraine influenced the approach of the recession. Its consequences were more devastating for the global economy than could be expected. The energy crisis, according to the IMF, will slow the eurozone's GDP to 0.5% in 2023. The region is threatened with a recession in the near future, if it hasn't happened yet. Gold was initially enthusiastic about the sharp escalation of geopolitical risks in Eastern Europe, but then ceded the initiative to the US dollar. The dollar proved to everyone who the main safe-haven asset now is.

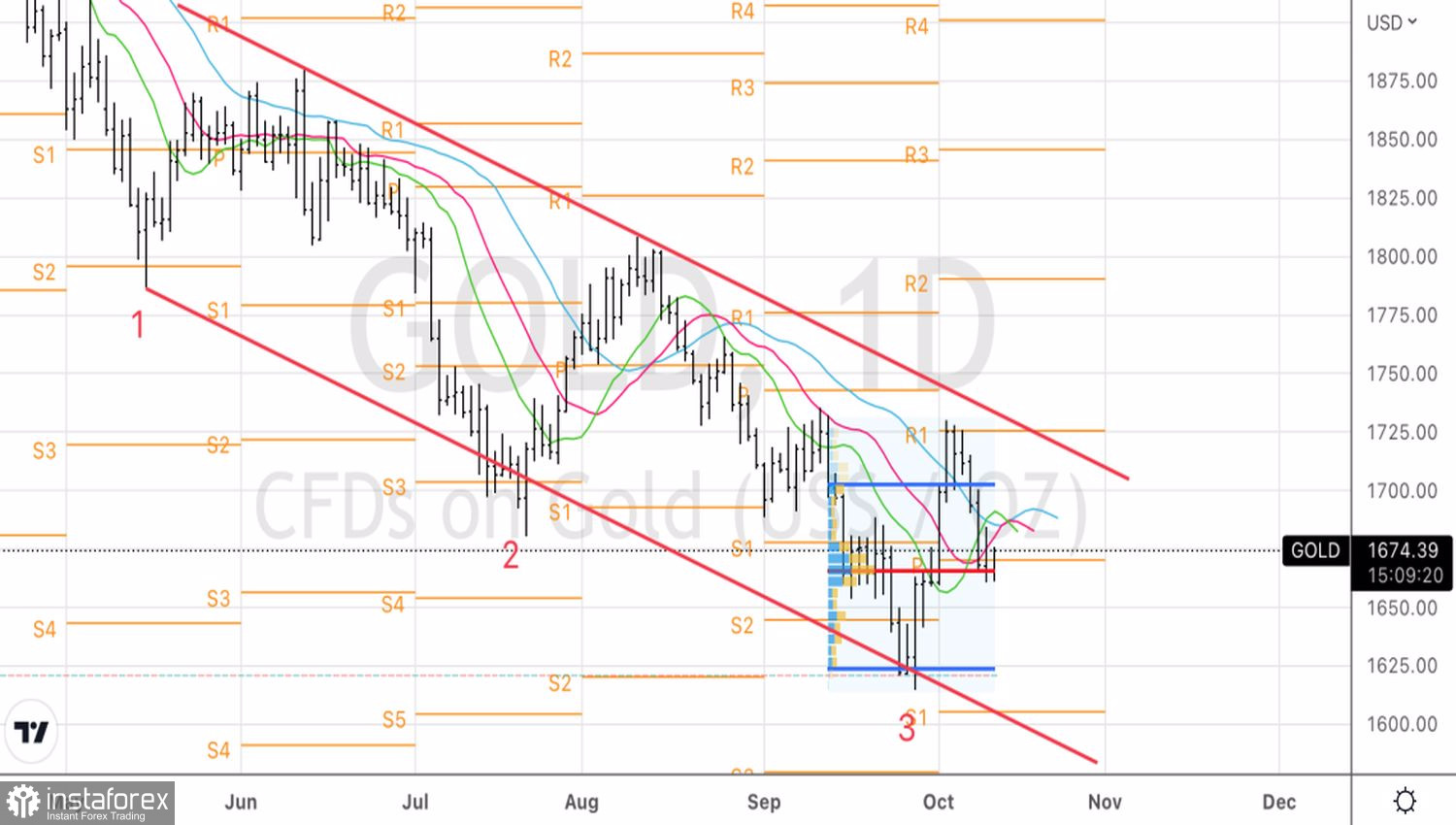

Dynamics of gold and US dollar

Finally, the current outbreak of COVID-19 in China convinces that global health problems are far from being solved. The return of a pandemic or new diseases threatening humanity keep investors on their toes. They are still capable of causing chaos, especially in regions where vaccination rates are low.

All these events support the demand for the US dollar as a safe-haven currency and form a downward trend for XAUUSD. The success of gold is local in nature due to a temporary weakening of the USD index or a decrease in the yield of treasury bonds.

In this regard, the slowdown in inflation in the United States will certainly tell the precious metal in which direction to move. According to Bloomberg experts, consumer prices in September slowed down from 8.3% to 8.1%, while core inflation, on the contrary, accelerated from 6.3% to 6.5%.

Technically, on the daily chart of gold, there is a fight for the fair value of $1,665 an ounce. A drop in quotes below this mark, followed by closing below this level, or a rebound from resistance at $1,685 and $1,695 are reasons for selling the precious metal.