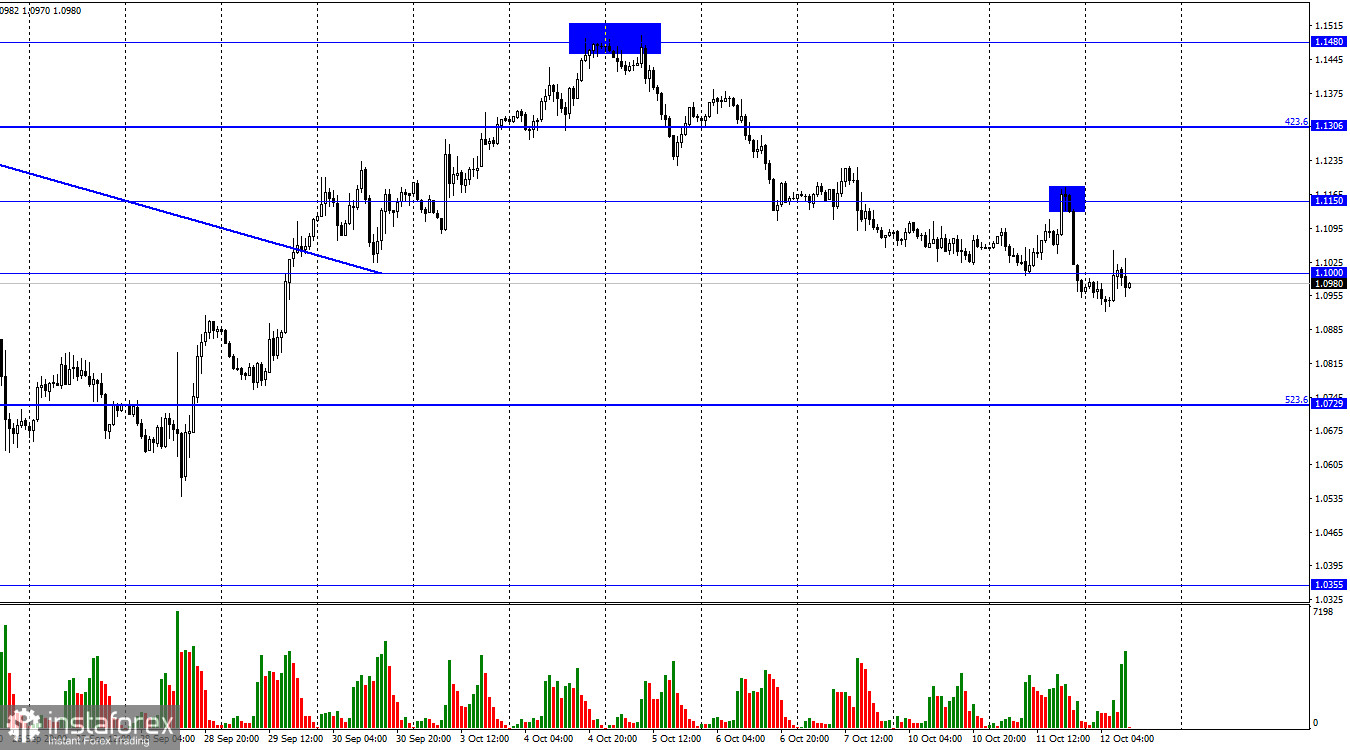

On Tuesday, GBP/USD rebounded from the 1.1000 level which I outlined as a target. After that, the price advanced to the level of 1.1150, and the pound had a good chance to close the day on a positive note. However, a new fall happened just 2 hours before the end of the session, bringing the quote under the level of 1.1000. This indicates that bears have not given up. Today, the pair reversed again in favor of the British pound and showed a slight upward movement. It seems that GBP traders have taken a breather for now.

This week is more eventful for the pound than for the dollar or the euro. Tomorrow, the US will release the key inflation report. However, the UK has already revealed a bunch of important macroeconomic data. On Tuesday, the employment report showed a decline to 3.5% from 3.6%. Besides, the average earnings including bonuses went up by 6%. This morning, it was reported that GDP for August declined by 0.3% while traders expected 0% changes. Moreover, industrial production contracted by 1.8% in August compared to the previous month. Therefore, the data released on Wednesday was clearly negative, reflecting the real state of the UK economy at the moment. It is not only about missed expectations. It is actually about a serious drop in GDP and industrial production. So, fears about a recession are getting real.

There is also the Bank of England who is trying to do its best to stabilize financial markets. Recently, it intervened to reduce the bond yield. Actually, this is a stimulating measure for the economy which can fuel inflation instead of cooling it down.

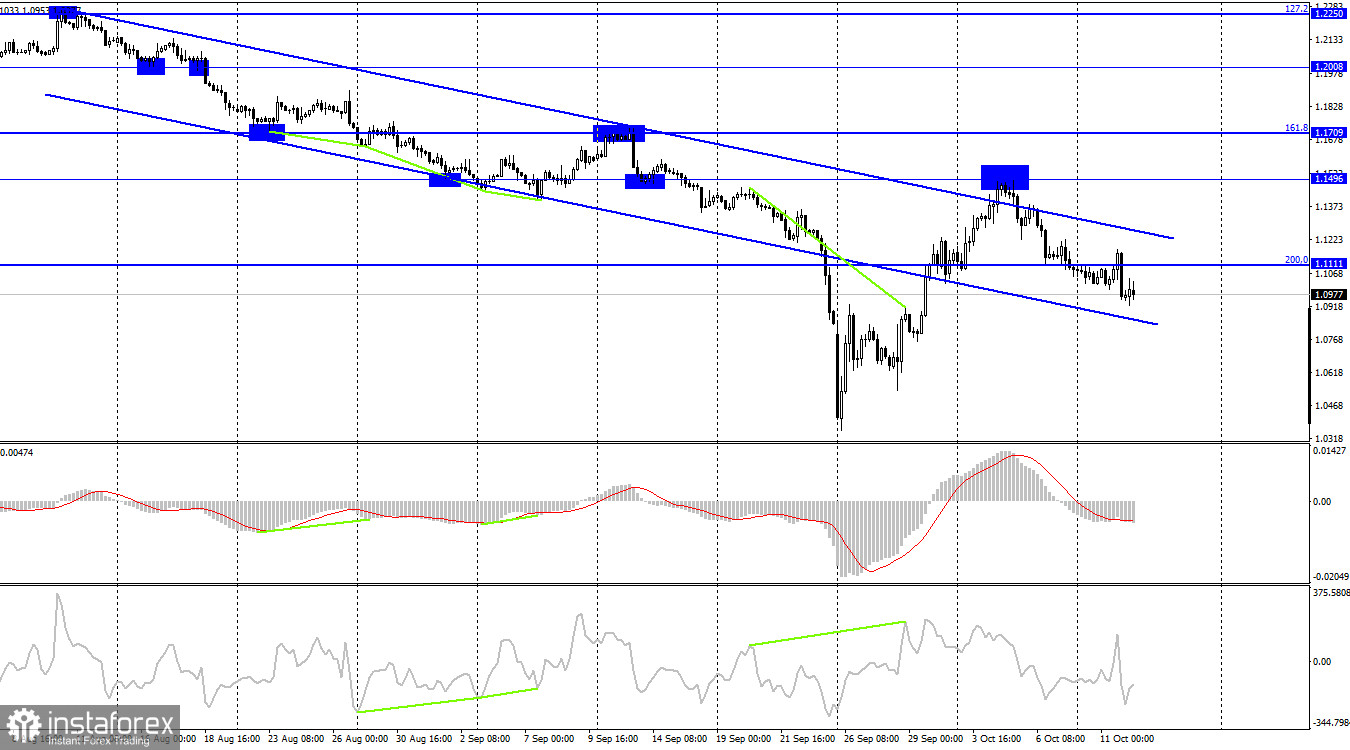

The pair reversed in favor of the US dollar on the 4-hour chart and settled below the Fibonacci retracement level of 200.0% at 1.1111. So, the price may continue to decline towards the low of 2022 located at 1.0350. Even though the pair has closed above the descending channel, the market sentiment is still bearish. A rebound from the level of 1.1496 allowed sellers to return to the market.

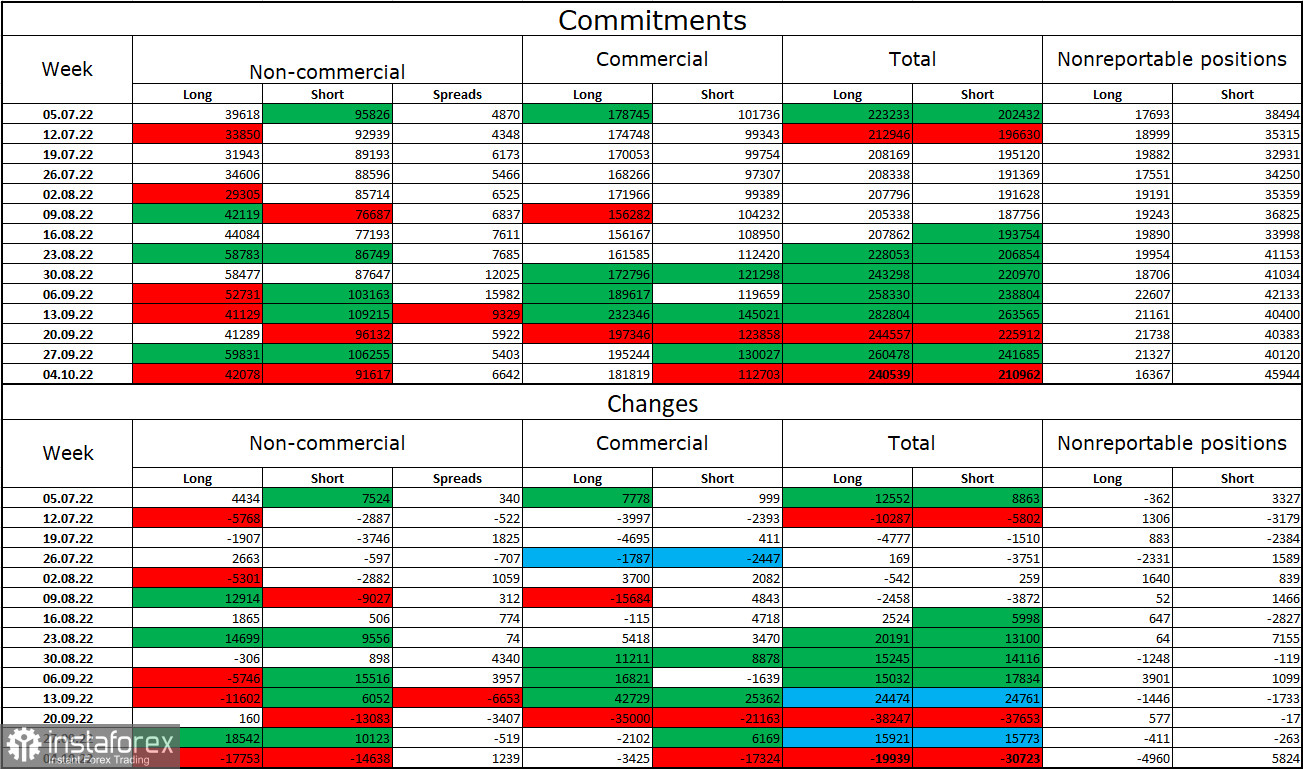

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became more bearish on the pair than the week earlier. Traders closed 17,753 long contracts and 14,638 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

UK – Monthly GDP Change (06-00 UTC).

UK – Industrial Production (06-00 UTC).

US – FOMC Meeting Minutes (18-00 UTC).

On Wednesday, all important reports have already been published in the UK. Yet, they haven't caused any reaction in the maker. The pound is rising on its own, paying no attention to reports. Meanwhile, the US economic calendar is almost empty. So, the impact of the news background on the market will be very weak today.

GBP/USD forecast and trading tips:

I would recommend selling the pair with the targets at 1.1111 and 1.1000 that have already been tested. New short positions can be opened when the price closes below 1.1000 with the target at 1.0729. Buying the pair will be possible when the quote settles above the descending channel on the 4-hour chart.