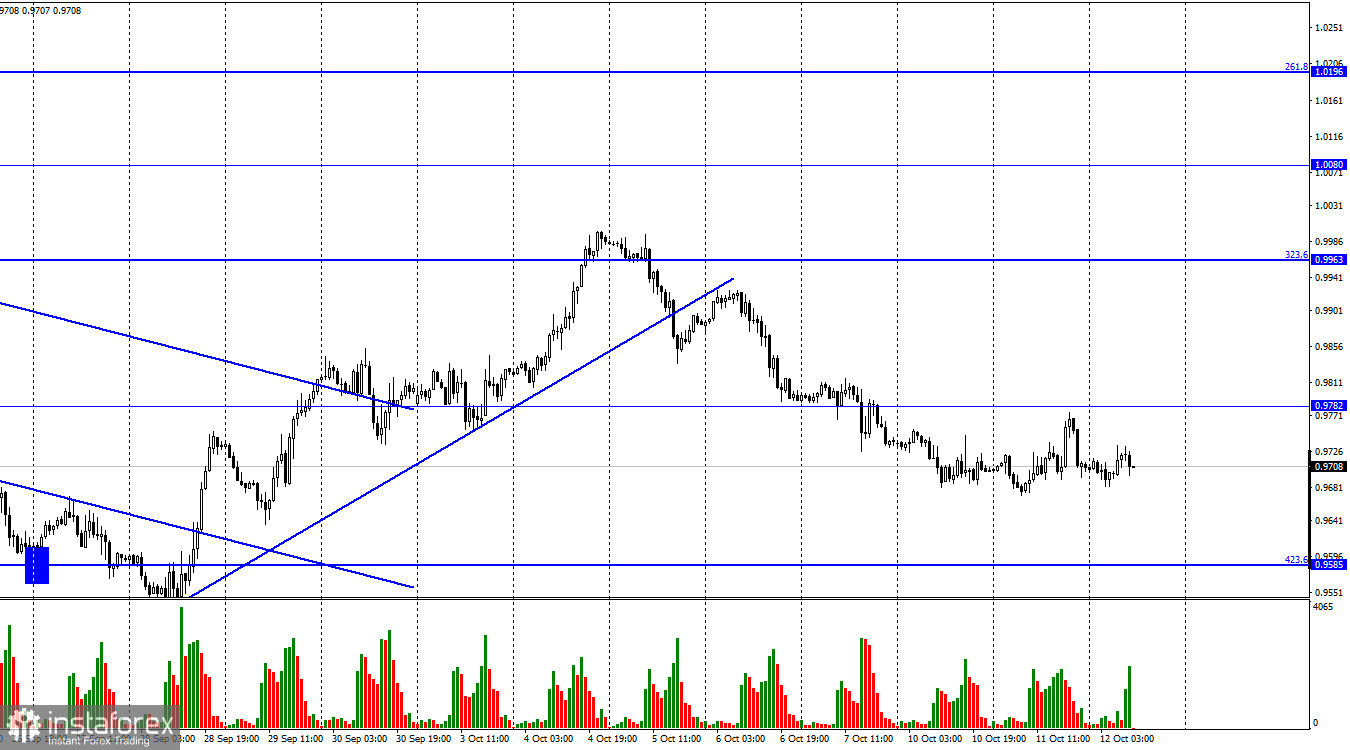

On Tuesday, EUR/USD was trading in a sideways manner which has been observed for the past few days. This is not typical of the pair which has been showing strong trend movements lately. A close below 0.9782 will make a further decline towards the retracement level of 423.6% at 0.9585 more likely. This will open the way to the 20-year low.

The information background is rather weak this time. No important reports have been issued both in the EU and the US. Today, the EU revealed the industrial production data for August. The indicator unexpectedly rose by 1.5% compared to the previous month while forecasts predicted a smaller increase. Yet, the results of the daily session show that this data hasn't caused any reaction in the market.

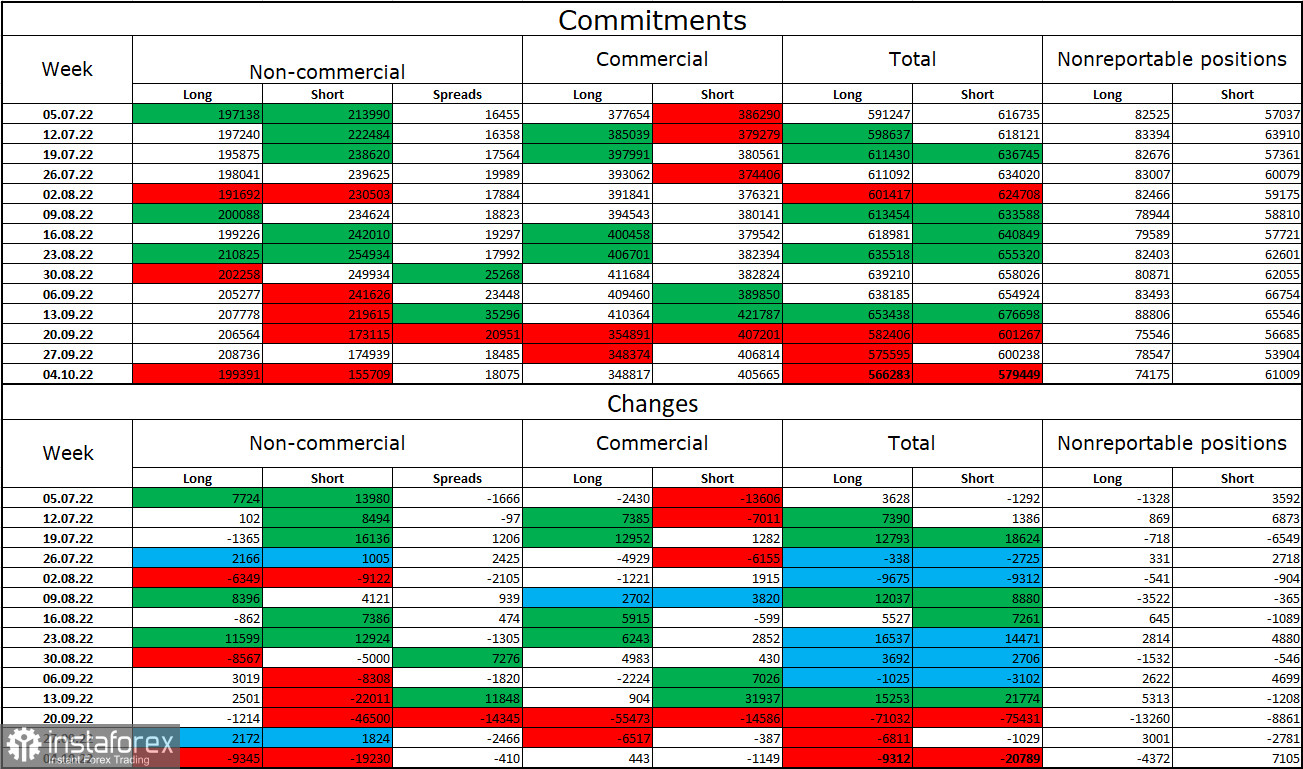

Traders seem to have taken a break. Bears are still prevailing in the market despite the COT report that signals the opposite. I think that the COT report cannot be trusted at this time as it reflects the situation for a particular currency, for example, the euro. Meanwhile, the currency pair shows the supply and demand ratio for two currencies. In better times, when there were no geopolitical and monetary jitters, COT reports were good indicators of demand and supply for a particular currency, thus allowing traders to foresee any changes in the pair dynamic. As for now, the whole world rushed to buy the US dollar as the United States doesn't take part in the geopolitical conflict in Europe and in is located at a safe distance from it. Meanwhile, the ongoing events have shaken the European region and put its economy under a big threat. Therefore, investors are seeking safety in the US economy and its currency. This is how surging demand for the US dollar is simply not reflected in the COT report.

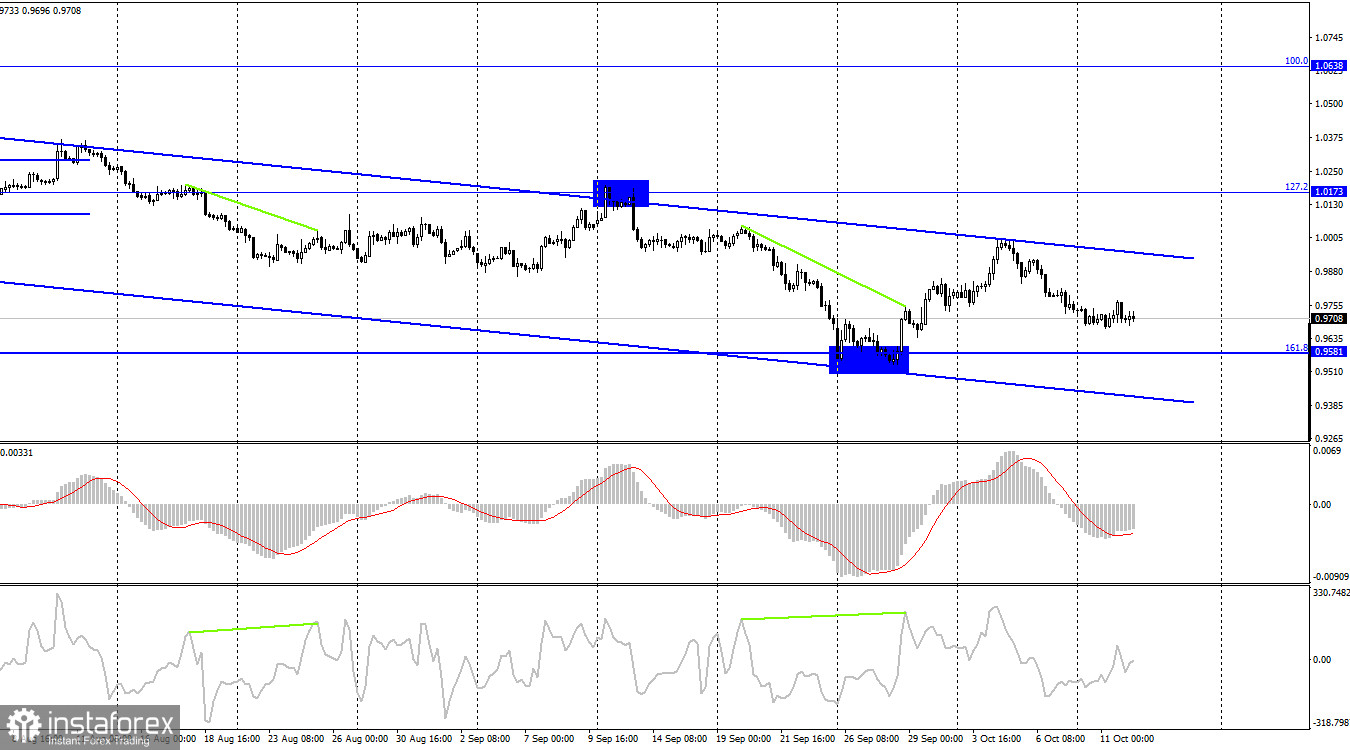

The EUR/USD pair reversed in favor of the US dollar on the 4-hour chart and started to decline towards the Fibo retracement level of 161.8% at 0.9581 following the existing descending channel. So, the overall market sentiment remains bearish. Only a firm hold above the descending channel will allow the euro to develop growth.

Commitments of Traders (COT) report:

Last week, traders closed 9,345 long contracts and 19,230 short contracts. This means that large market players became even more bullish on the pair. The total number of long contracts opened by traders is 199,000 while the number of short contracts stands at 155,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. It is also recommended to monitor geopolitical news as it tends to greatly affect the market sentiment.

Economic calendar for US and EU:

EU – Industrial Production (09-00 UTC).

EU – ECB President Lagarde Speaks (13-30 UTC).

US – FOMC Meeting Minutes (18-00 UTC).

On October 12, the EU and US economic calendars have events to display. However, only one of these events is important - the speech by ECB President Christine Lagarde. The impact of the information background on the market can be moderate today..

EUR/USD forecast and trading tips:

I would recommend selling the pair if the price bounces off the upper line of the channel on the 4-hour chart. The target in this case should be the level of 0.9581. Another option is to sell when the quote settles below the trendline on H1 or closes under 0.9782 with the target at 0.9585. Buying the pair will be possible when the price holds firmly above the upper line of the channel on the H4 chart with the target at 1.0638.