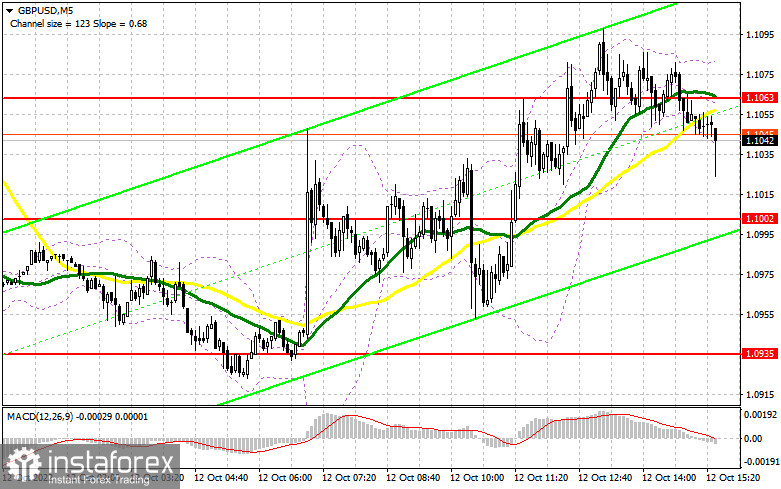

I paid attention to several levels in my morning forecast, but I managed to get a good entry point, only around 1.1063. Let's look at the 5-minute chart and figure out what happened. I did not wait for the pound to fall to 1.0935, nor did I wait for adequate signals to enter the market around 1.1002. After moving up to 1.1063, a false breakdown was formed, leading to a sell signal, and the pound was down by 40 points. However, putting an adequate stop order in those conditions wasn't easy, so whoever ignored the entry point from 1.1063 did the right thing.

To open long positions on GBP/USD, you need:

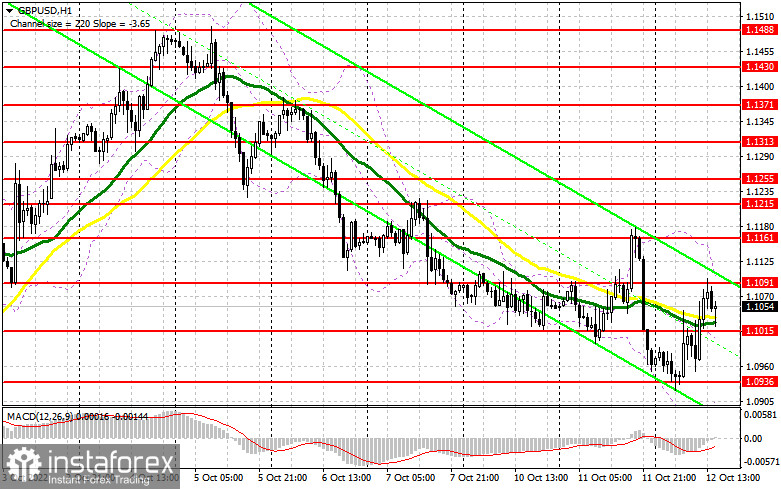

If the pair moves down in the afternoon after strong data related to US producer prices, only the formation of a false breakdown in the area of the new support of 1.1015, formed at the end of the first half of the day, will give an excellent entry point to the market to return to the level of 1.1091. Once above this range, it will be possible to discuss building a new upward correction and a partial defeat of sellers. The target of the movement will be the 1.1161 area. But the resistance of 1.1215 will be much more interesting, the update of which will lead to a fairly large capitulation of sellers and a leveling of the market situation before tomorrow's important data. I recommend fixing profits there. If GBP/USD falls against the background of strong statistics and the absence of buyers at 1.1015, the pressure on the pound will increase. In this case, I recommend postponing long positions to 1.0936. I recommend that you only buy there if you have a false breakdown. It is possible to open long positions on GBP/USD immediately on a rebound from 1.0876, or around the minimum of 1.0800, with the aim of a correction of 30–35 points within a day.

To open short positions on GBP/USD, you need:

The bears retreated after the news that the Bank of England would still extend the emergency bond purchase program. The conversations around this decision may support the pound in the afternoon. The optimal scenario for sale is now a false breakdown in the resistance area of 1.091, the test of which may occur after data on producer price inflation in the United States. However, a more important task is to return the 1.1015 level under control. A breakout and a reverse test from the bottom up of this range will return pressure on the pair and give a chance for a larger drop with a breakdown of the 1.0936 minimum. Going beyond this range will determine the entry point for sale with a fall to 1.0876, but the 1.0800 area will be a much more interesting target, where I recommend fixing the profits. But such a large movement will be possible only tomorrow when reports on the consumer price index are released. In the absence of sellers at 1.091, which also cannot be excluded, I recommend postponing sales to 1.1161. Only a false breakout at this level forms an entry point into short positions based on the pound's movement down. In case of a lack of activity there, there may be a jerk up to 1.1215, where I advise you to sell GBP/USD immediately for a rebound, counting on a correction down by 30-35 points within a day.

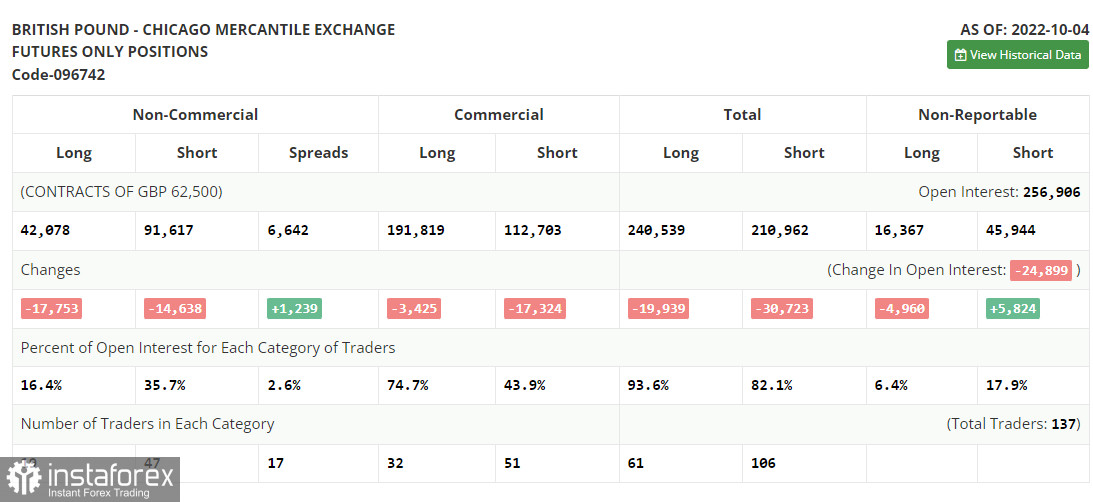

The COT report (Commitment of Traders) for October 4 recorded a sharp reduction in both long and short positions. The report has already recorded that the pound fell by more than 10% in two days, and then its sharp recovery against the background of the intervention of the Bank of England. Now that the situation has stabilized, it is clear that those who want to buy and sell the pound have sharply decreased. Given that the prospects for the British economy are deteriorating sharply and it is unclear how the government will continue to deal with the cost-of-living crisis and high inflation, let me remind you that the previous tax reduction plan failed; a further recovery of the pound is unlikely. Activity in the UK private sector and the service sector continues to decline, which also does not add confidence to investors. A lot will depend on the Fed's policy, which is directly related to the US inflation report expected this week.

For this reason, I do not bet on further growth of the pound in the current conditions and prefer the US dollar. The latest COT report indicates that long non-commercial positions decreased by 17,753 to 42,078. In contrast, short non-commercial positions decreased by 14,638 to 91,617, which led to a slight reduction in the negative value of the non-commercial net position to -49,539, against -46,424. The weekly closing price recovered, and it was 1.1494 against 1.0738.

Signals of indicators:

Moving Averages

Trading is conducted in the area of 30 and 50-day moving averages, indicating market equilibrium building.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator in the area of 1.091 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.