Prices paid to US producers rose more than expected in September, suggesting that inflationary pressures will take time to ease, keeping the Federal Reserve on track to aggressively raise interest rates.

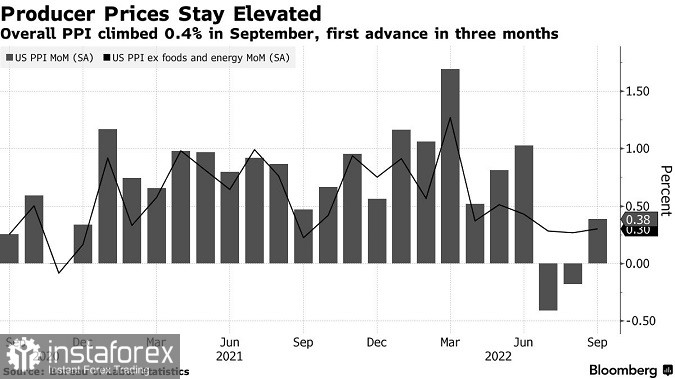

The producer price index for final demand rose 0.4% since August, the first increase in three months, and rose 8.5% from a year ago, Labor Department data showed on Wednesday.

Excluding volatile food and energy components, the so-called Core CPI rose 0.3% in September and 7.2% year-over-year.

The median estimates of economists polled by Bloomberg suggested a 0.2% monthly PPI increase and a 0.3% increase in the core index.

While supply chain disruptions have improved overall, spending on energy, food and services has risen. Two-thirds of the PPI growth was related to services such as travel and accommodation prices, food retail, securities portfolio management, and hospital inpatient care.

The government's consumer price index is expected to post another strong growth on Thursday, highlighting still-fast and widespread inflation that is likely to force Fed officials to raise their benchmark interest rates by another 75 basis points next month.

Many companies have successfully rolled back most, if not all, of the increase in production and labor costs, but it's unclear how long they can continue to do so as consumers begin to resist higher prices.

Geopolitical events threaten to push commodity prices back up. The Russo-Ukrainian war continues with disruptions in the supply of commodities such as wheat.

Meanwhile, the decision of the OPEC+ alliance to cut oil production threatens to lead to higher oil prices in the coming months.

Recent polls point to easing price pressures for manufacturers. An index of prices that manufacturers pay for raw materials, from the Institute of Supply Management, fell to a two-year low in September. S&P global data also pointed to a slowdown in manufacturing costs.

The value of processed goods for intermediate demand, which reflects prices previously in production, has risen. However, excluding food and energy, this figure has been declining for the third month.