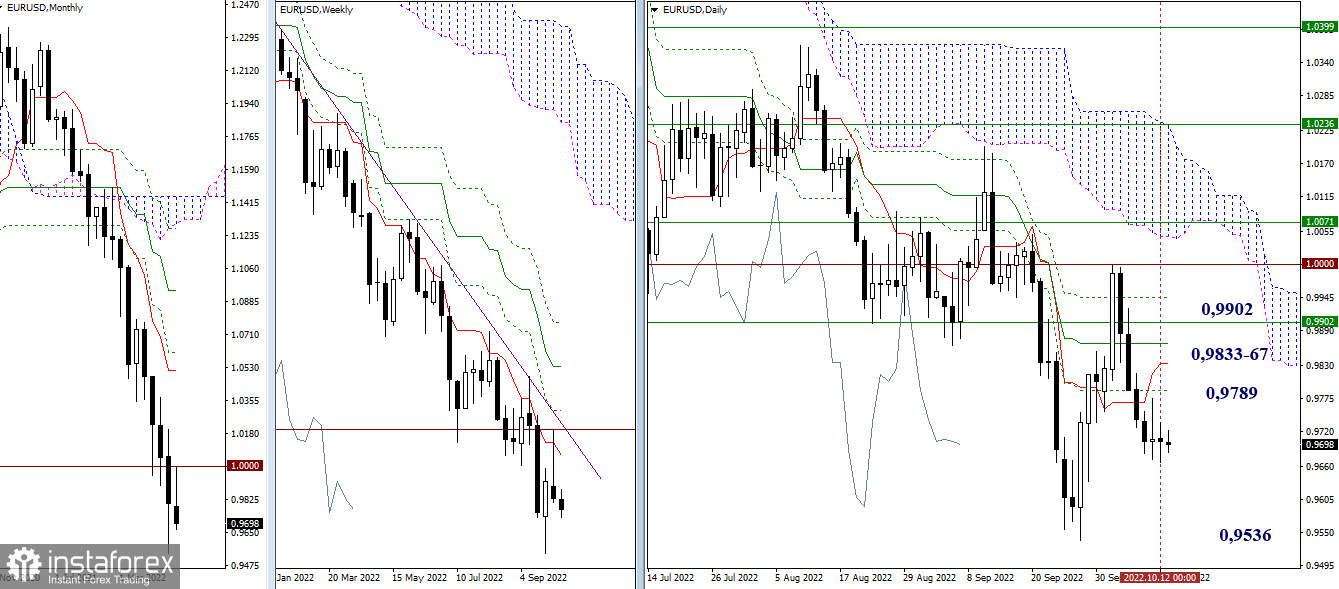

EUR/USD

Higher timeframes

The slowdown continues. Uncertainty in the EUR/USD pair market dominates. The current benchmarks retain their location and significance. For bears, the update of the low (0.9536) and the restoration of the downward trend at all higher timeframes are still of primary importance at this stage. The path of bulls will pass through the resistance of the daily cross 0.9789 - 0.9833 - 0.9867 - 0.9945, reinforced by the weekly short-term trend (0.9902).

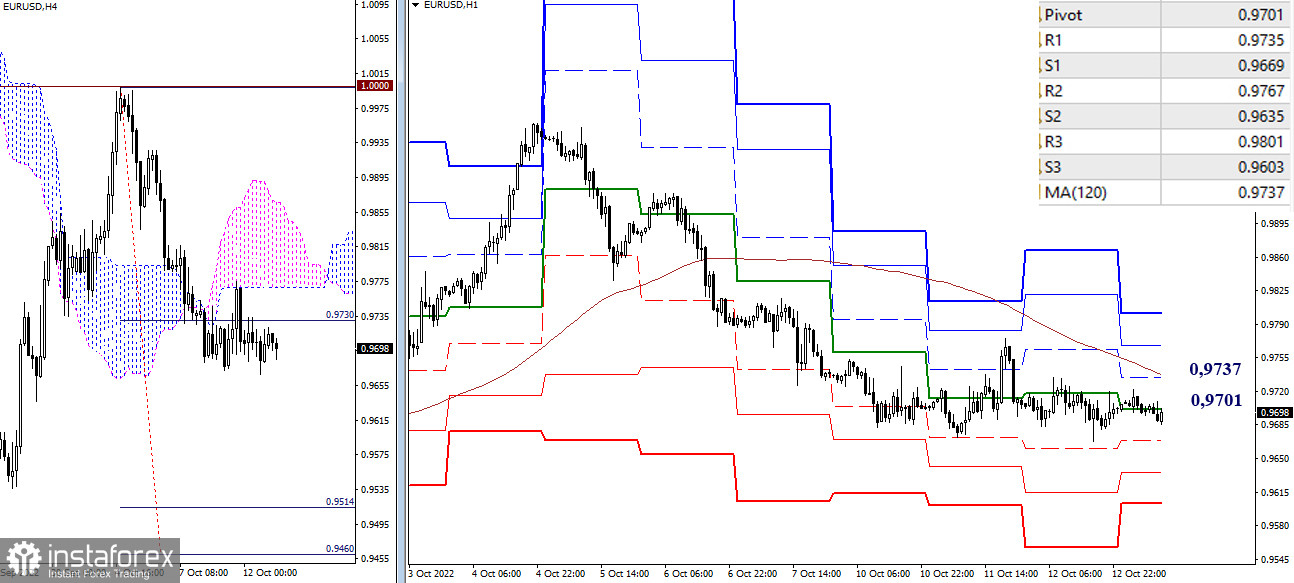

H4 – H1

The uncertainty can be seen in the lower timeframes. The center of attraction for a long time is the central pivot point of the day (0.9701). The downward trend intraday benchmarks can be identified on the support of the classic pivot points (0.9669 - 0.9635 - 0.9603) and the H4 target for the breakdown of the cloud (0.9514 - 0.9460). Bulls must update the resistance of the weekly long-term trend (0.9737) and securely consolidate higher. The reversal of the moving average will help change the current balance of power. The next reference points are 0.9767 and 0.9801 (resistance of classic pivot).

***

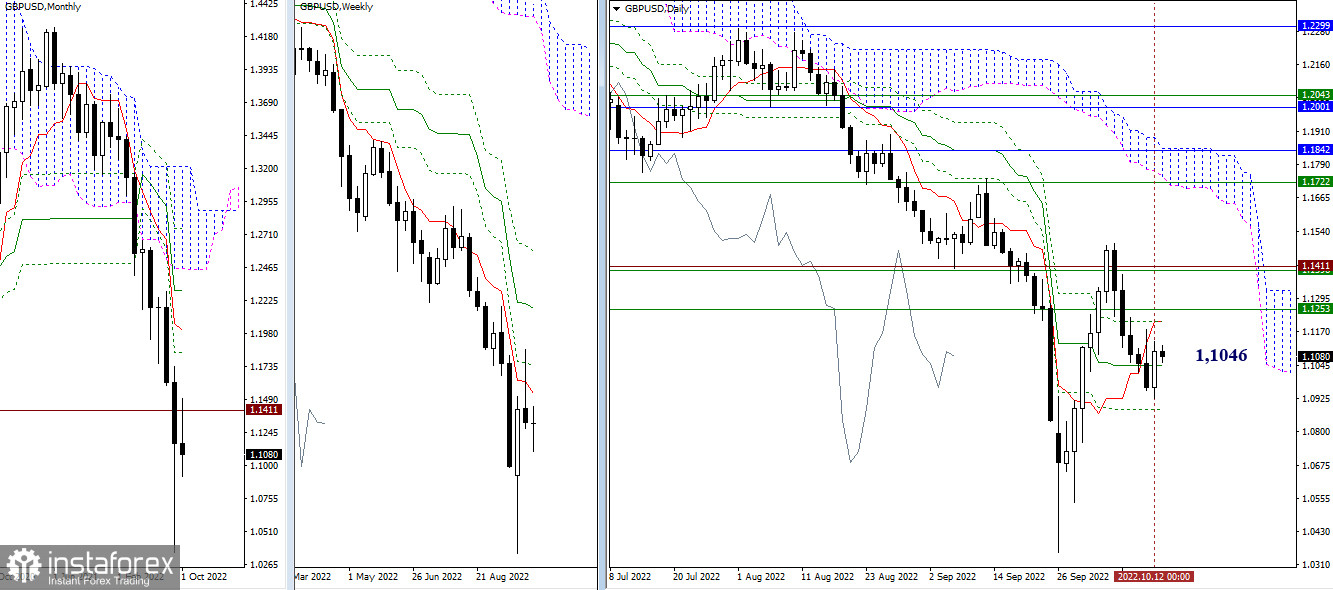

GBP/USD

Higher timeframes

The decline has stopped. The pair continues to work in the zone of attraction and influence of the daily medium-term trend (1.1046). Going below the support of the final level of the daily cross (1.0883) will open an opportunity for a decline and testing the strength of the low (1.0355). For bulls, the location of key levels has not changed—1.1209-53 - 1.1400-11 (levels of daily and weekly Ichimoku crosses).

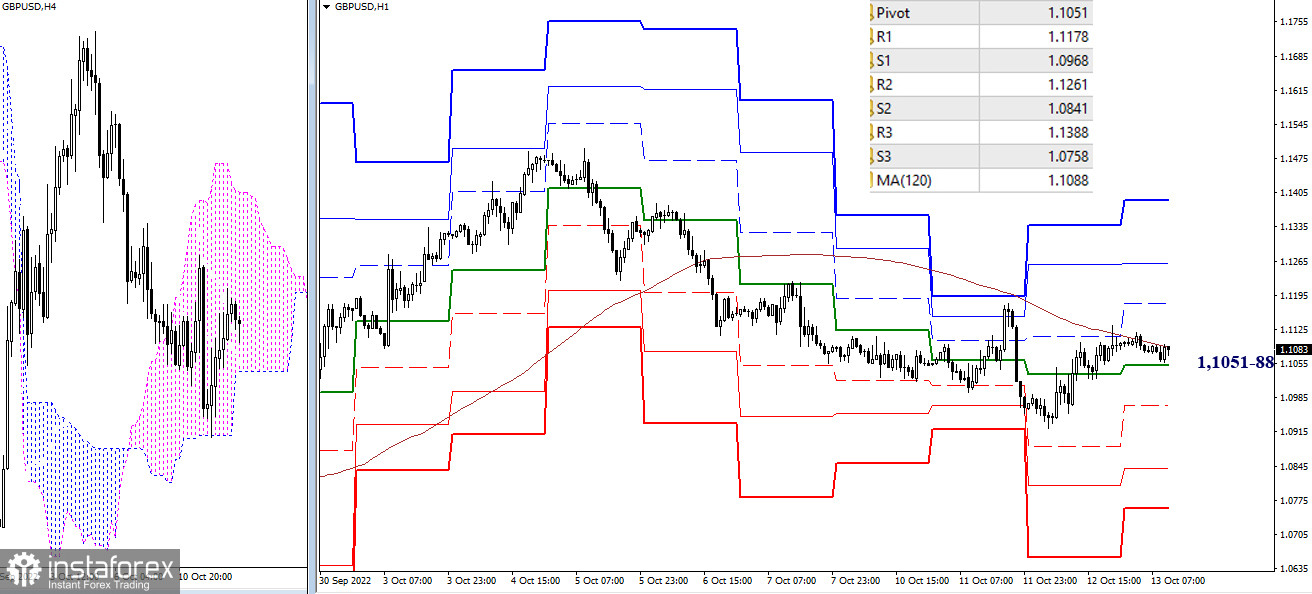

H4 – H1

The upward correction may soon end with the victory of bulls and the transition of the weekly long-term trend (1.1088) to the side of bulls. The next upward benchmarks are the resistance of the classic pivot points (1.1178 – 1.1261 – 1.1388) and the update of the high (1.1495). For bears, the benchmarks are today located at 1.0968 - 1.0841 - 1.0758 (support of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)