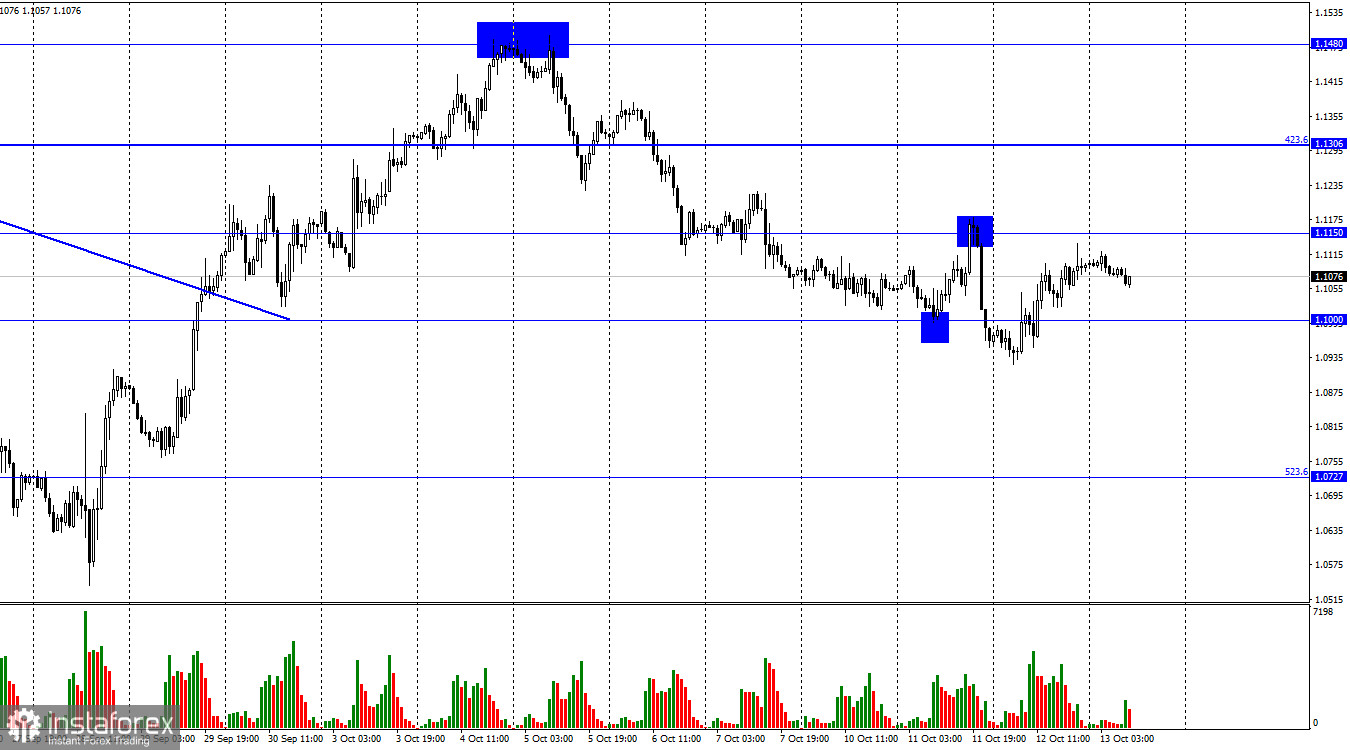

Good afternoon, dear traders! On the 1H chart, the GBP/USD pair made an upward reversal, touching the 1.1150 level. This time the pair did not rise higher from this level. However, it did not dip as well. Unlike the euro, the pound sterling is trading buoyantly. Today, its trajectory will largely depend on the US inflation report.

Why is this report so crucial? The thing is that the ECB, the BoE, the Fed, and some other central banks have voiced their main priority for the coming years - to reduce inflation to the 2% target. When inflation approaches this level, the economy may start expanding without exerting pressure on households and businesses. Currently, inflation, depending on the region, exceeds the target level by 4-5 times, there is still a long way to go to the 2% target. There are only two ways to cap soaring consumer prices: by raising the interest rate and selling off government bonds. During the pandemic, when the economy needed stimulus, central banks cut rates and bought back bonds. Now, they should do the opposite. The Fed, the ECB, and the Bank of England have already hiked their key rates sufficiently. However, inflation remains high even in the US despite aggressive rate hikes by the Fed. Therefore, the regulators are likely to stick to momentary tightening in the near future.

Notably, aggressive tightening usually boosts the national currency. At the moment, both the Bank of England and the Fed stick to a hawkish stance. Yet, the US dollar is the main reserve currency. It is used more frequently in foreign settlements. On top of that, the Fed has been hiking rates more aggressively than the British regulator. This is why the US dollar is likely to grow higher amid expectations of new sharp rate increases.

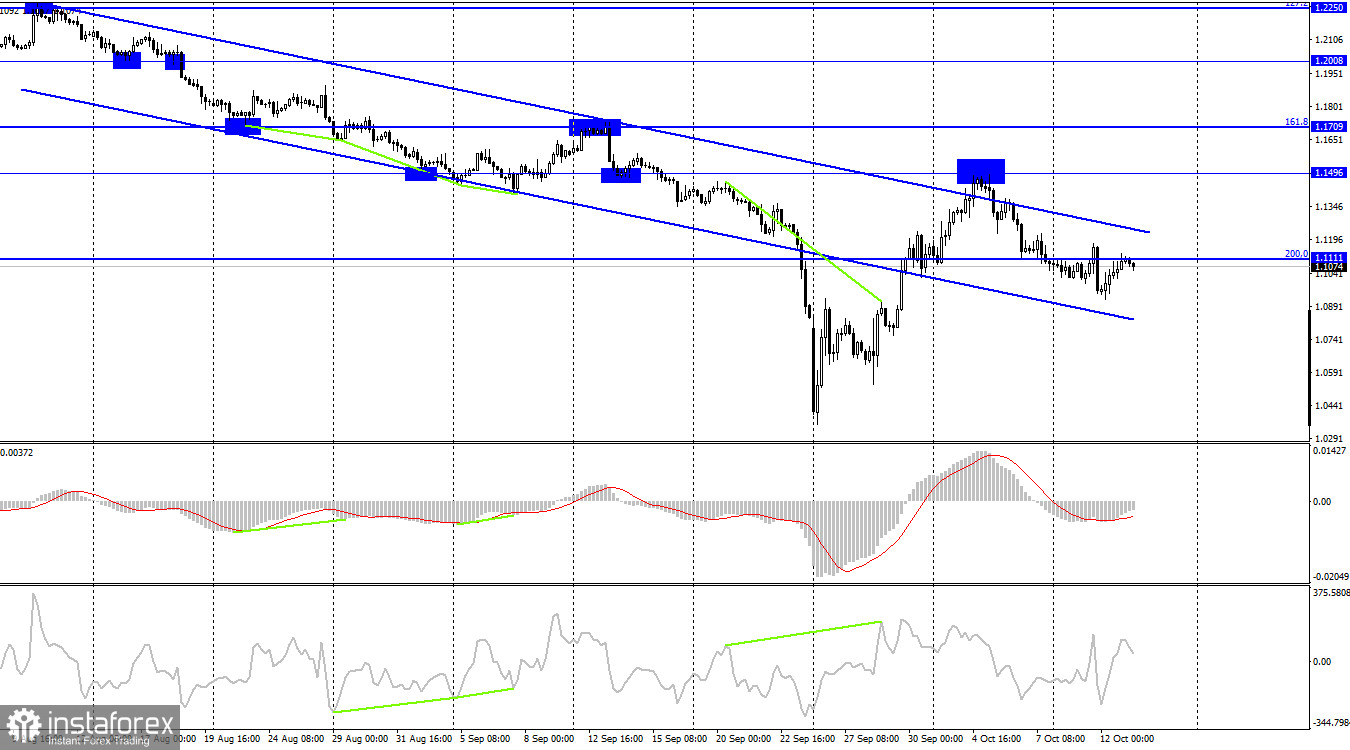

On the 4H chart, the pair slipped below 1.1111, the Fibo level of 200.0%. It may decrease to a low of 2022, located near the level of 1.0350. Although the pair has closed over the downtrend corridor, I believe that for now, the sentiment remains bearish. A retreat from 1.1496 will help the bears to return to the market.

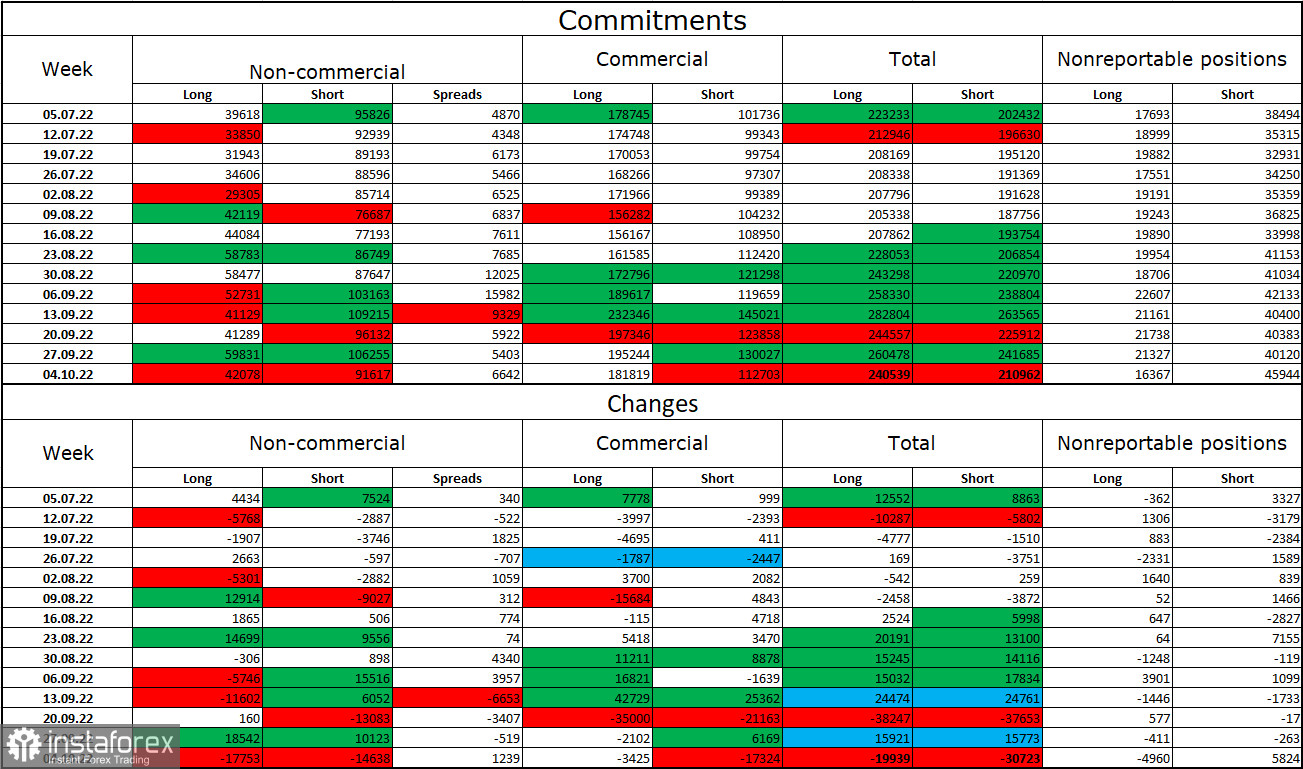

Commitments of Traders (COT):

Over the past week, the non-commercial group of traders became more bearish on the pair than the week earlier. The number of long positions decreased by 17,753 and the number of short ones dropped by 14,638. The overall sentiment of large traders remains bearish. The number of short positions still exceeds the number of long ones. It means that big speculators are prone to open short positions even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound sterling may continue its uptrend only amid strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound sterling, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

US – CPI Index (12:30 UTC).

US – Initial Jobless Claims (12:30 UTC).

Today, the economic calendar for the UK is completely empty. The US is going to release the inflation report. The impact of fundamental factors on the market sentiment today will be high.

Outlook for GBP/USD and trading recommendations:

I recommended selling the pair at the target levels of 1.1111 and 1.1000. The pair reached these levels. I would advise traders to open new short positions if the pair closes below 1.1000 with the target level of 1.0729. A retreat from 1.1150 will also give a sell signal with the prospect of a decline to 1.1000. It is recommended to open long positions if the pair consolidates over the downtrend corridor on the 4H chart.