The CPI report yesterday increased the likelihood that the Fed will again raise interest rates by 0.75% at the November meeting. This probability, according to CME Group, is estimated by market participants at 99%. This is a strong bullish factor for the dollar.

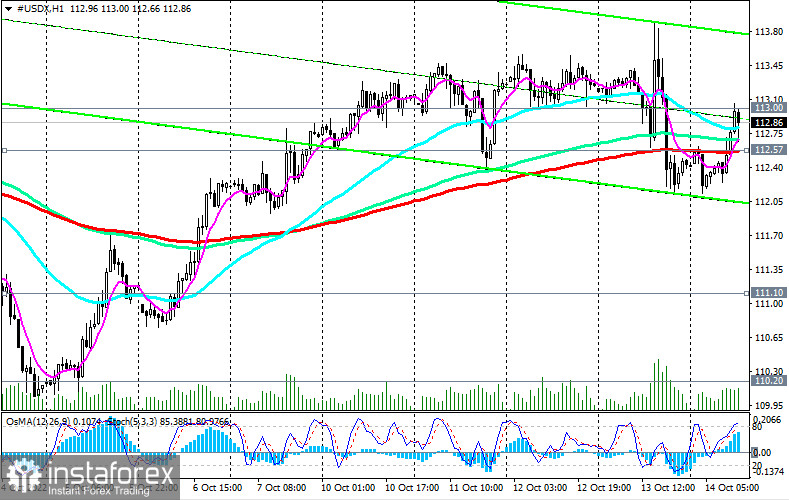

As of writing, the dollar index (CFD #USDX) is trading near 112.86, maintaining the potential for further growth. Today, the dollar's upward trend continues, pushing the DXY toward more than 20-year highs around 120.00, 121.00. The breakdown of the level of 113.00 and the next "round" resistance level of 114.00 will be a signal confirming our assumption.

In an alternative scenario, the signal for sales will be a breakdown of the support level of 112.57 (200 EMA on the 1-hour CFD #USDX chart) and the local support level of 112.14, while the important support levels of 111.10 (200 EMA on the 4-hour chart) and 110.20 (50 EMA on the daily chart) become the target for reducing DXY.

Further decline is unlikely, but theoretically (technically) possible. The targets are the key support levels 106.20 (144 EMA on the daily chart), 104.50 (200 EMA on the daily chart).

Support levels: 112.57, 112.14, 111.10, 110.20, 106.20, 104.50

Resistance levels: 113.00, 113.89, 114.00, 114.74, 115.00

Trading Tips

Sell Stop 112.10. Stop Loss 113.10. Take-Profit 111.10, 110.20, 106.20, 104.50

Buy Stop 113.10. Stop-Loss 112.10. Take-Profit 113.89, 114.00, 114.74, 115.00