US stock index future trading was calm on Friday after recouping its losses on Thursday. JPMorgan Chase & Co's earning reports largely matched expectations and did not cause panic in the market. Bonds increased alongside UK gilts, which found support in reports that the UK government is ready to reconsider some of its controversial tax cuts.

S&P 500 and Nasdaq 100 futures traded at around their opening price, while Dow Jones futures gained 0.2%. Shares of JPMorgan advanced slightly in pre-market action after the company reported that its earnings and revenue exceeded Wall Street estimates slightly. In the meantime, Morgan Stanley lost about 3% after its quarterly profit per share fell short of market estimates.

The US stock market hit a new yearly low yesterday but quickly recovered afterwards thanks to strong demand and continuing optimism, despite hot US inflation data. According to the latest report by the US Bureau of Labor Statistics, core CPI, which does not include food and energy prices, increased by 6.6% in September y/y and reached the highest level since 1982. The continuously high inflation remains a cause of concern for politicians as price growth accelerated in August as well. Yesterday's data suggests that the US regulator would likely increase interest rates by 75 bps at the final two policy meetings of 2022. Investors have largely ignored disappointing US CPI data, but weak Q3 earnings reports would have a greater impact on market sentiment. This would make significant recovery less likely in the near future.

UK government bonds increased sharply amid expectations that Liz Truss could cancel some of her tax cut plans. In addition, the UK prime minister has sacked Chancellor of the Exchequer Kwasi Kwarteng. Liz Truss's mini-budget plans led to turmoil in the UK market and forced the Bank of England to launch an emergency bond-buying program, which is set to end today.

Oil prices decreased over the past week as signs of a global economic downturn and monetary tightening by the world's central banks threaten to weigh down on energy consumption. The International Energy Agency warned earlier that cuts to oil production planned by OPEC+ could push commodity prices up and lead to a recession in the global economy. Crypto assets went up, while Bitcoin hit a weekly high but remained near $20,000.

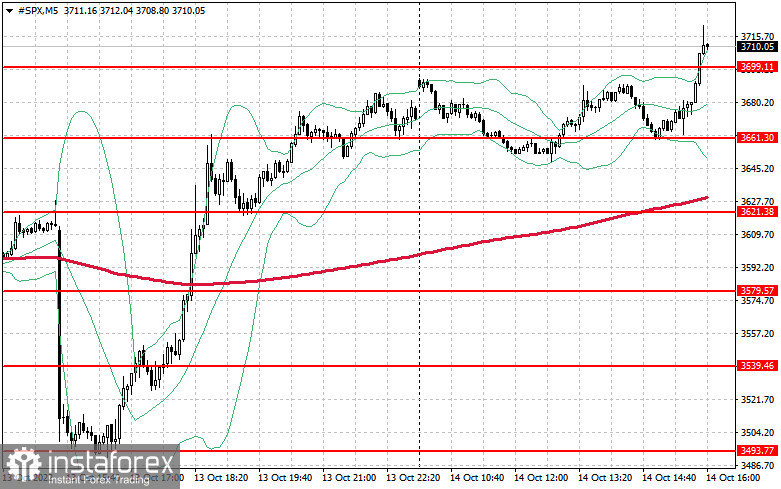

On the technical side, the S&P 500 experienced high volatility yesterday but quickly managed to recover afterwards. Now, the index is trading below $3,699, making even a short term recovery for the index difficult. However, bullish traders are clearly set to break through this level at the beginning of the trading session. A breakout above this level would make an upward correction more likely. If the S&P 500 breaks through $3,699, it could then rise towards the resistance at $3,735, as well as $3,773 further ahead. If the index continues to move downward, bullish traders would come into play once again near $3,611. However, a breakout below this level would send the index towards $3,621 and open the way towards the support, as well as the new yearly low at $3,579.