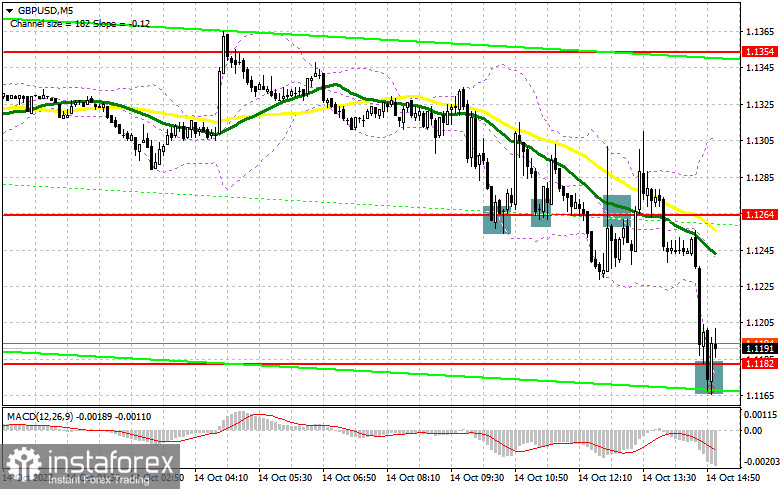

In my morning forecast, I paid attention to the 1.1264 level and recommended deciding on entering the market there. Let's look at the 5-minute chart and figure out what happened. The decline and false breakdown in this range led to an excellent signal to buy the pound, which increased by more than 40 points. However, I did not wait for the rapid recovery of the pair because the UK financial market is again under threat of a major fall. I talked about this in detail in my morning forecast. The breakthrough and the reverse test of 1.1264 from the bottom to the top led to an excellent sell signal, but information about the UK budget worried traders. The technical picture was not revised for the second half of the day.

To open long positions on GBP/USD, you need the following:

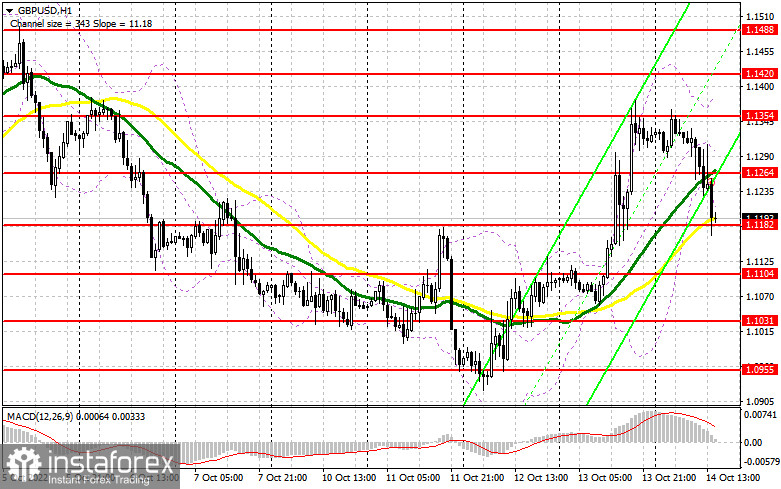

The entire focus is now on the report on retail sales in the US, and it will "rule the ball" during the American session. Suppose the final data turns out to be higher than economists' forecasts. In that case, demand for the US dollar will increase, which will only increase pressure on the pound, which is already experiencing problems due to the uncertain UK budget and the corporate tax freeze. If the data shows a reduction in retail sales, it is a signal to buy the pound, as the probability of a more active slowdown in inflation in the US will increase. In the case of a decline in the pair, only the repeated formation of a false breakdown at 1.1182, by analogy with what I discussed above, will allow you to enter long positions in the continuation of the upward correction. The movement's goal will be 1.1264, the breakthrough of which will only occur if the British Prime Minister finds a way out of the current situation. A breakout and a top-down test of 1.1264 will create a direct road to the 1.1354 area, which will resume the bull market. Going beyond this level will allow you to test 1.1420, where I recommend fixing the profits. In the scenario of a fall in GBP/USD against strong statistics and the absence of buyers at 1.1182, which is more likely, the pressure on the pound will increase. In this case, I recommend postponing long positions to 1.1182. I advise you to buy there only on a false breakdown. It is possible to open long positions on GBP/USD immediately for a rebound from 1.1104, or around the minimum of 1.1031, with the aim of a correction of 30–35 points within a day.

To open short positions on GBP/USD, you need the following:

The bears continue to advance, and their nearest target is the support of 1.1182, which has already been tested during the European session. But a much more optimal scenario for sales is a false breakdown in the resistance area of 1.1264, a test that may take place after the release of retail sales data in the United States – if they turn out to be much worse than economists' forecasts. In this case, a breakthrough and a reverse test from the bottom up of 1.1182 will give a chance for a larger drop with a breakdown of the minimum of 1.1104. Going beyond this range will return the bear market and determine the entry point for sale with a fall to 1.1031. A more interesting target will be the 1.1031 area, where I recommend fixing profits. In the absence of sellers at 1.1264, which also cannot be excluded, I recommend postponing sales until 1.1354. Only a false breakout at this level forms an entry point into short positions based on the pound's movement down. In the event of a lack of activity, there may be a jerk up to 1.1420, where I advise you to sell GBP/USD immediately for a rebound, counting on a correction down by 30-35 points within a day.

For this reason, I do not bet on further growth of the pound in the current conditions and prefer the US dollar. The latest COT report indicates that long non-commercial positions decreased by 17,753 to 42,078. In contrast, short non-commercial positions decreased by 14,638 to 91,617, which led to a slight reduction in the negative value of the non-commercial net position to -49,539, against -46,424. The weekly closing price recovered, and it was 1.1494 against 1.0738.

Signals of indicators:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, which indicates market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper limit of the indicator in the area of 1.1400 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.