Analysis of EUR/USD, M5

On Friday, the euro/dollar pair was trading calmer than on Thursday. The fact is that on Thursday, the US published its inflation report, which was one of the most important reports of the previous week. On Friday, only data of minor importance was published. However, traders also showed reaction to these reports. Thus, the US retail sales data was weaker than expected and caused a slight drop in the US dollar. However, by the end of the day, the US dollar recovered and the pair closed the day near the critical level from which it needs to drop just by 200 pips to hit a 20-year low. In other words, the euro is still trading near its 20-year low and is showing no intention to launch a new uptrend. Notably, a long and strong trend should end by a sharp and strong movement in the opposite direction. Bears should start closing their positions. However, at the moment, most of them are keeping their positions opened. As for trading signals, on Friday, during the better part of the day, the pair was moving near the Kijun-sen line, the Senkou Span B lines, and near the level of 0.9747, between which there were 20-30 pips. Thus, just after a signal was formed, the price immediately moved to the next line or level. That is why it was impossible to enter the market. What is more, traders could place stop loss orders only 60-70 pips from the entry points. This could have led to serious losses. That is why it was better to avoid trading on Friday.

COT report

The euro COT reports for 2022 could be used as good examples. In the first part of the year, the reports were pointing to bullish sentiment among professional traders. However, the euro was confidently losing value. Then, during several months, reports were reflecting bearish sentiment and the euro was also falling. Now, the net position of non-commercial traders is bullish again and the euro is still dropping. This could be explained by high demand for the US dollar amid the difficult geopolitical situation in the world. Even if demand for the euro is rising, high demand for the greenback prevents the euro from growing. In the given period, the number of long non-commercial positions dropped by 3,200, whereas the number of short non-commercial positions jumped by 2,900. As a result, the net position declined by 6,100 contracts. However, this fact will hardly influence the market since the euro is still hovering near its multi-year lows. Now, professional traders still prefer the greenback. The number of long contracts exceeds the number of short contracts by 38,000. Thus, the net position of non-commercial traders may grow further without affecting the market. Although the total number of buy and sell positions is approximately the same, the euro continues falling. Thus, we need to wait for changes in the geopolitical and/or fundamental background to influence the foreign exchange market.

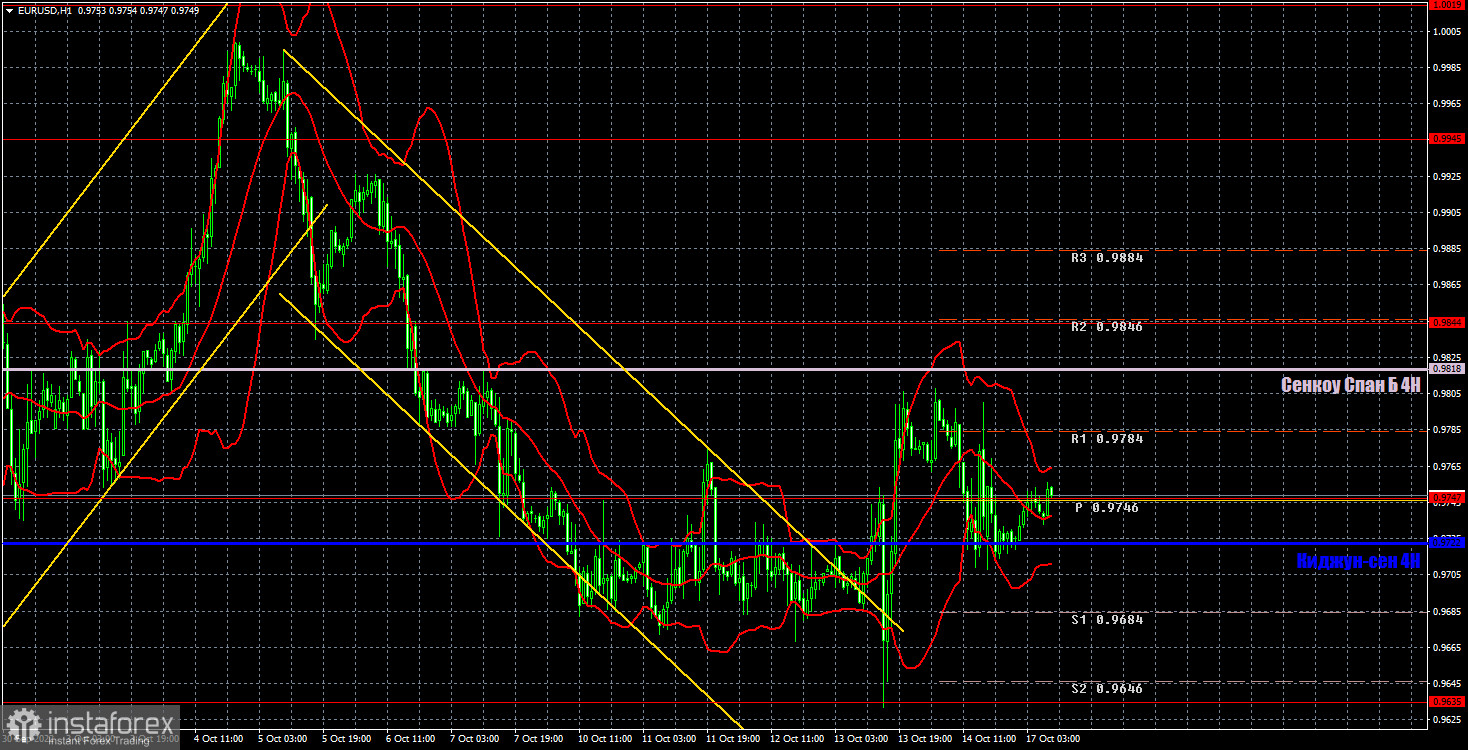

Analysis of EUR/USD, H1

On the one-hour chart, the downtrend is still in force despite a significant rise seen on Thursday. The price consolidated above the critical line, but its further movement could hardly be predicted. The fact is that above this level, there is an important and strong line Senkou Span B. On Monday, the pair could trade at the following levels: 0.9553, 0.9635, 0.9747, 0.9844, 0.9945, 1.0019, 1.0072 as well as at the Senkou Span B (0.9818) and Kijun-sen (0.9722) lines. Lines of the Ichimoku indicator may move during the day. This should be taken into account when determining trading signals. There are also additional support and resistance levels, but signals do not appear near there. Rebounds and breakouts of extremes and lines could act as signals. Do not forget about placing stop loss orders at breakeven if the price covers 15 pips in the right direction. This will protect against possible losses if the signal turns out to be false. No important events or publications are scheduled for October 17 in the European Union and the United States. Thus, there will be nothing to react to today. In this light, the pair may trade sideways.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.