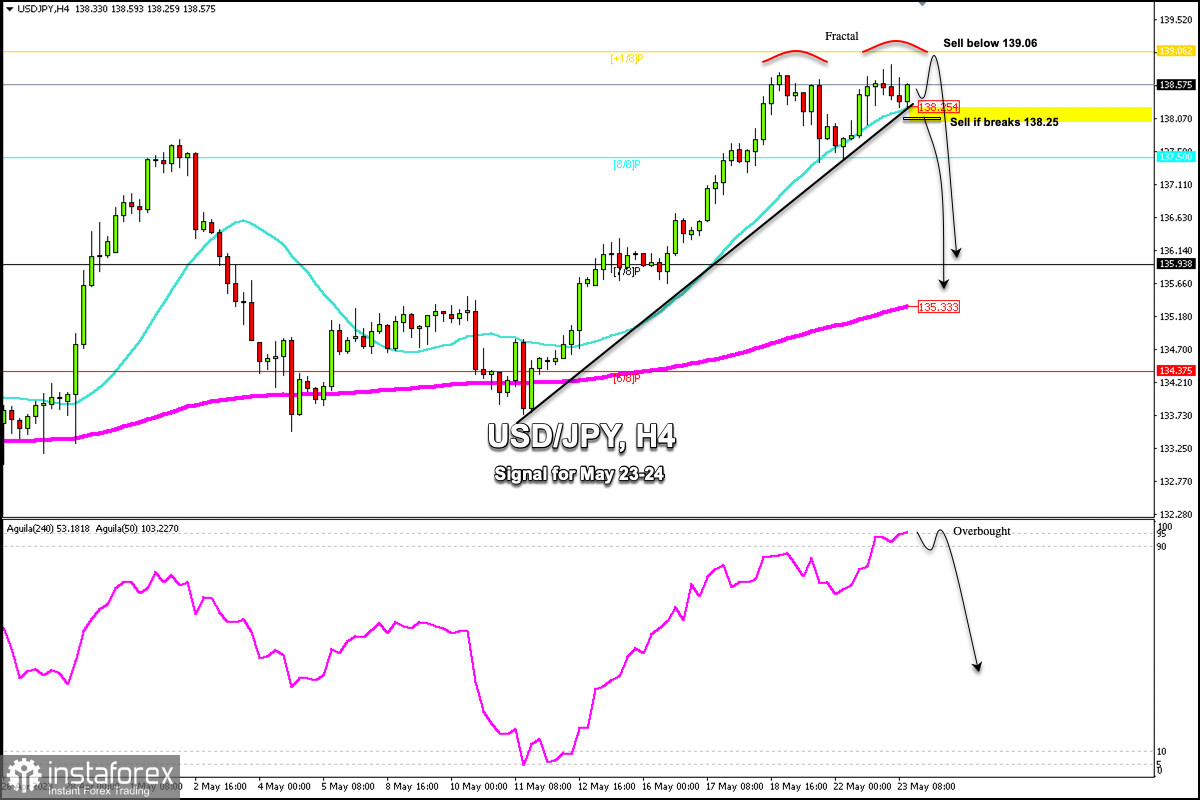

Early in the American session, the Japanese Yen is trading around 138.57, forming a fractal at around the 138.70 zone. During the European session, USD/JPY printed a high of 138.90, an area that coincides with the +1/8 Murray level, which represents strongly overbought levels and a probable change in trend.

In the event there is a break below the 21 SMA located at 138.25 in the next few hours, this could be a clear signal to sell because a break of the uptrend channel could be confirmed and USD/JPY could fall and reach 8/8 Murray located at 137.50 and finally could drop to 7/8 Murray at 135.93.

On the other hand, in case the bullish movement continues, it is expected that there will be a strong rejection around 139.06 (+1/8 Murray). This level could also be seen as an opportunity to sell because according to the Eagle indicator it is in an extremely overbought zone and a technical correction is imminent in the next few hours.

Since May 22, the Eagle indicator has been producing an extremely overbought signal. Thus, a technical correction is expected to occur in the next few hours, but for this, we should wait for a close below 138.25 on the 4-hour chart.

Our trading plan for the next few hours is to sell the Japanese Yen in case there is a pullback towards 139.06 or in case there is a break below 138.25 (21 SMA) with targets at 135.93 (7/8) and 135.33 (200 EMA).