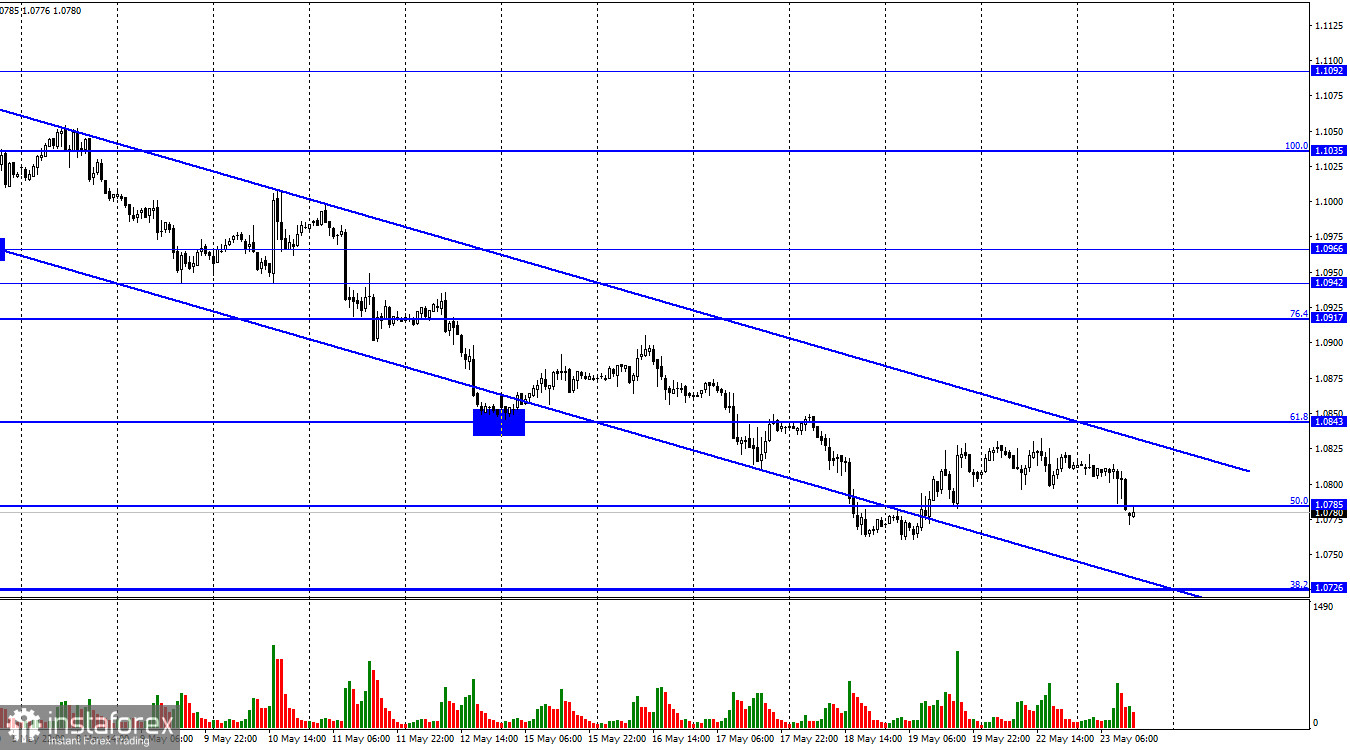

On Tuesday, the EUR/USD pair reversed in favor of the US dollar and resumed its downward movement. An hour ago, there was a close below the corrective level of 50.0% (1.0785), which allows for the expectation of further decline toward the next Fibonacci level at 38.2% (1.0726). The descending trend corridor continues to characterize traders' sentiment as "bearish." The chances of an upward movement for the euro will only arise after a close above the corridor.

On Monday, the information background in the European Union and the United States was virtually absent, but on Tuesday, the first economic data started to come in. The Manufacturing Purchasing Managers' Index (PMI) for the EU in May decreased from 45.8 to 44.6, while traders expected growth. This is not the first decline in the index, indicating a deteriorating situation in the industry and manufacturing. In Germany, the Manufacturing PMI also declined from 44.5 to 42.9. The lower the index is below the 50.0 mark, the worse the situation. Thus, the European currency's decline in the day's first half is justified.

On the other hand, the Services PMI in the EU and Germany increased, but they did not cause any concerns among traders as they have long been above the 50.0 mark. That is why traders paid more attention to the manufacturing sector. Economic indicators in the European Union remain negative, with many figures decreasing or slowing down from month to month. As stated by the leadership of the European Union and the ECB, a recession will be avoided, but as we can see, even without a recession, Europe faces enough problems. The rate has risen more slowly than in Britain or the United States, but even at such a level, the economy should be able to withstand it. Since inflation is falling relatively slowly, maintaining rates at a high level will take a long time. During this time, the economy will face pressure.

And the European currency, which has been showing growth for several months, is now falling almost daily. The situation is best seen on the 4-hour chart, which we will discuss shortly. The current information background justifies the decline of the European currency. Still, the US dollar could be better positioned as the FOMC is unlikely to raise rates. On the other hand, the ECB may tighten its monetary policy twice. Thus, the rise of the dollar will continue but with limited potential.

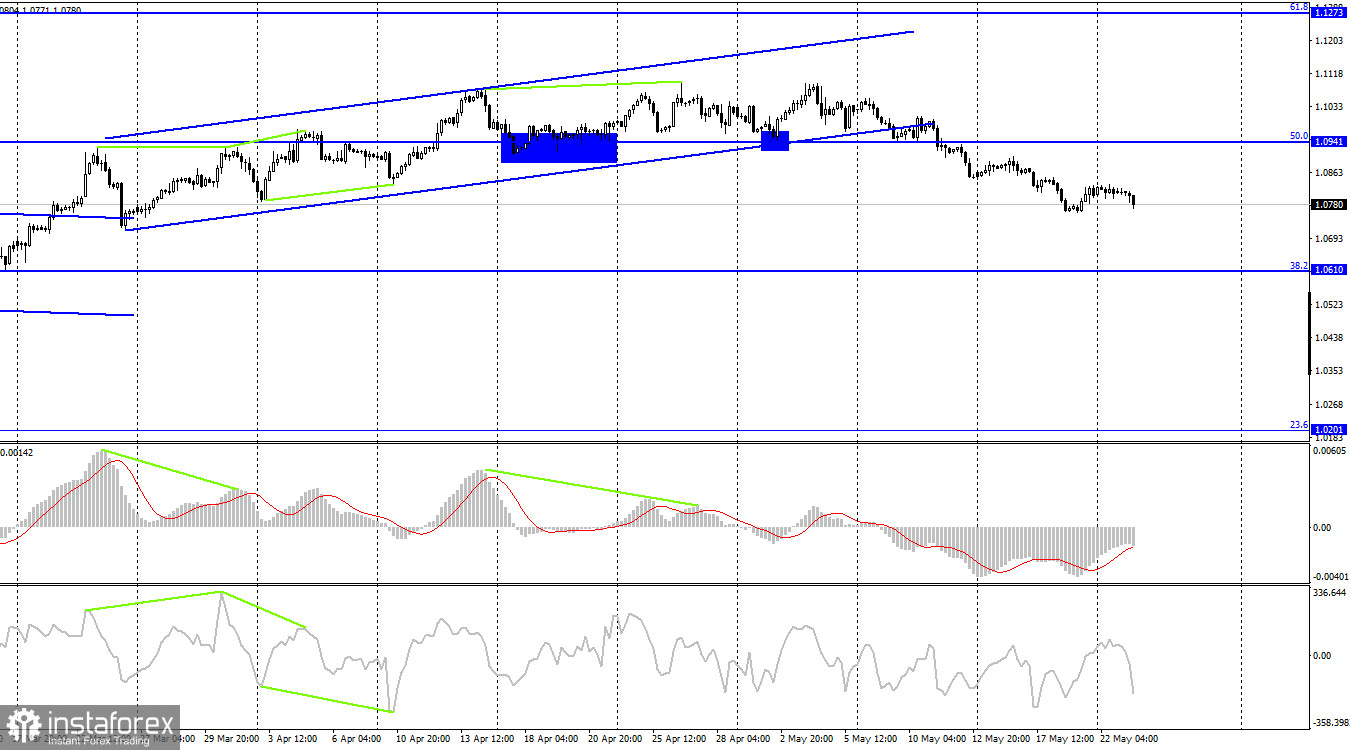

On the 4-hour chart, the pair consolidated below the ascending trend corridor and the corrective level of 50.0% (1.0941), which suggests the expectation of further decline towards the next corrective level of 38.2% (1.0610). If the quotes consolidate above the level of 1.0941, it will favor the euro and a resumption of growth towards the level of 1.1273. The "bullish" divergence developing in the MACD indicator has ultimately been canceled.

News calendar for the United States and the European Union:

Germany - Manufacturing Purchasing Managers' Index (07:30 UTC).

Germany - Services Purchasing Managers' Index (07:30 UTC).

European Union - Manufacturing Purchasing Managers' Index (08:00 UTC).

European Union - Services Purchasing Managers' Index (08:00 UTC).

USA - Number of Building Permits Issued (12:00 UTC).

USA - Manufacturing Purchasing Managers' Index (13:45 UTC).

USA - Services Purchasing Managers' Index (PMI) (13:45 UTC).

On May 23rd, the economic events calendar includes a lot of entries. The impact of the information background on traders' sentiment for the remaining part of the day will be moderate in strength.

Forecast for EUR/USD and trading advice:

New pair sales can be opened upon closing below the level of 1.0785 on the hourly chart with a target of 1.0726. I advise against buying until there is a close above the descending trend corridor on the hourly chart with a target at 1.0917.