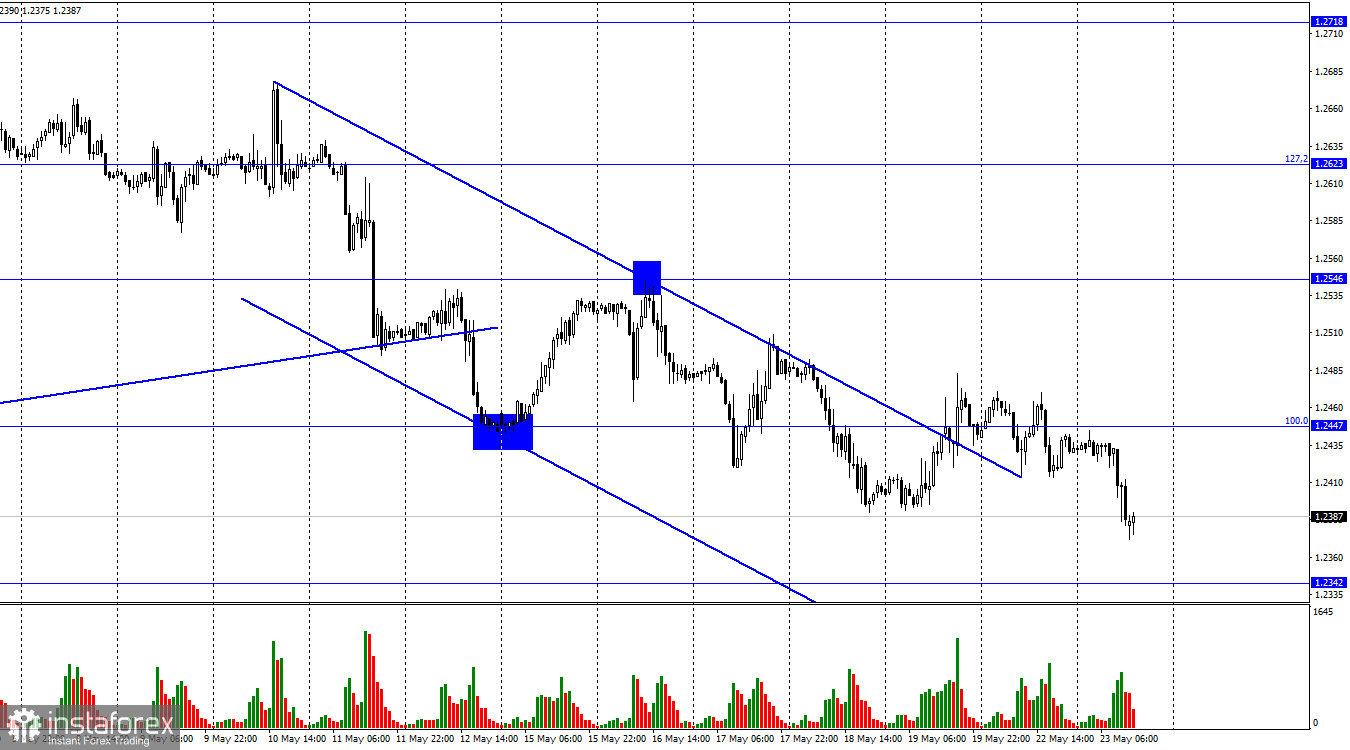

On the hourly chart, the GBP/USD pair reversed in favor of the American currency on Tuesday and resumed its downward movement, despite closing above the descending trend corridor. Thus, the market sentiment remains "bearish." The decline of the pair may continue toward the next level at 1.2342. I would only count on the British pound's growth later.

The information background in the UK was weak on Tuesday. The manufacturing sector's business activity index fell again and now stands at 46.9. The services sector index also decreased slightly and insignificantly to 55.1. However, the most interesting part started a bit later. Several Bank of England's Monetary Policy Committee members, including Governor Andrew Bailey, made speeches. The head of the regulator stated that the risks of maintaining high inflation persist, and his colleagues noted that an error was made in forecasting inflation, leading the country to face unusually high prices.

Inflation in the UK is above 10%, and even after twelve interest rate hikes, it remains above this level. Only tomorrow's inflation report for April may indicate a decrease below the 10% level, which would be the first significant slowdown. The peak inflation level was much lower in the European Union and the United States. Andrew Bailey has repeatedly lamented the high price pressure, expressing hope that the indicator will slow down over time. Whether it will happen or not, we will have the opportunity to see it tomorrow.

The inflation report may exert even stronger pressure on the British pound, as the correctness of Andrew Bailey would mean that the Bank of England will no longer aggressively raise interest rates. After twelve consecutive tightening measures, a pause seems natural. Whether inflation will decline in the summer and autumn is a big question. However, the Bank of England's capabilities are not limitless, so I do not expect a significant tightening of policies in the remaining part of the year. Thus, the British pound's reasons for price growth sharply decrease. Today, the business activity indexes in the United States and data on the construction market will be released. If they become weak, the bears may slightly retreat from the market, but I don't think it will lead to a significant decline in the dollar.

On the 4-hour chart, the pair once again consolidated below the level of 1.2441, which allows traders to anticipate further decline toward the next corrective level of 127.2% (1.2250). No new emerging divergences are observed today in any indicator. I am not currently counting on a strong rise in the British pound. I expected the pair's decline a month ago when it closed below the ascending trend corridor.

News calendar for the US and the UK:

UK - Manufacturing Purchasing Managers' Index (08:30 UTC).

UK - Services Purchasing Managers' Index (08:30 UTC).

US - Building Permits (12:00 UTC).

US - Manufacturing Purchasing Managers' Index (13:45 UTC).

US - Services Purchasing Managers' Index (13:45 UTC).

On Tuesday, the economic events calendar contains several interesting entries, most of which must be published. The impact of the information background on traders' sentiment may be present in the remaining part of the day.

Forecast for GBP/USD and trader advice:

I advised selling the British pound upon a new close below 1.2441 on the 4-hour chart, with a target of 1.2342. I advised buying the British pound upon a close above the corridor on the hourly chart, with a target of 1.2546. However, I am now ready to adjust the recommendation: stronger signals for buying are needed.