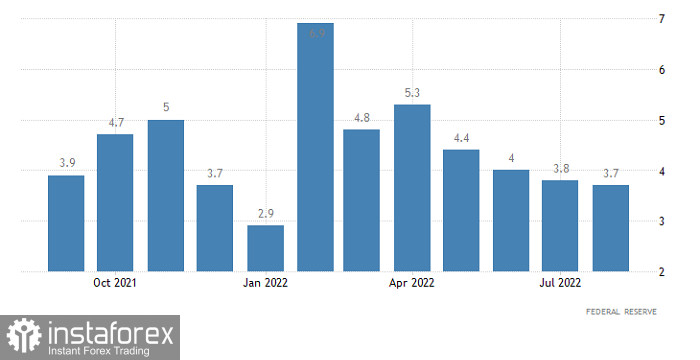

Governor Bailey's short statement was enough for the pound to rally and for the euro to follow suit. The head of the Bank of England showed support for the new Chancellor of the Exchequer, Jeremy Hunt, as he shares the regulator's economic views and aspirations to achieve stability. The governor also added that the Bank of England would keep its hawkish stance on monetary policy. This announcement was enough for the greenback to get weaker. Today, the trend is likely to go on amid a possible slowdown in industrial production growth in the United States to 3.4% versus 3.7% year-over-year. On a monthly basis, the reading is expected to fall by 0.1%. In the previous month, industrial production dropped by 0.2%. In other words, the figures have shown a decrease for the second straight month. If the results come in line with the market forecast, the greenback is likely to tumble.

United States Industrial Production:

GBP/USD has approached the resistance zone of 1.1410/1.1525 for the third straight time. This reflects the intention of the bulls to stay in the uptrend. Notably, the trend would extend should the price settle above 1.1525. Until then, the quote may pull back or come to a standstill.