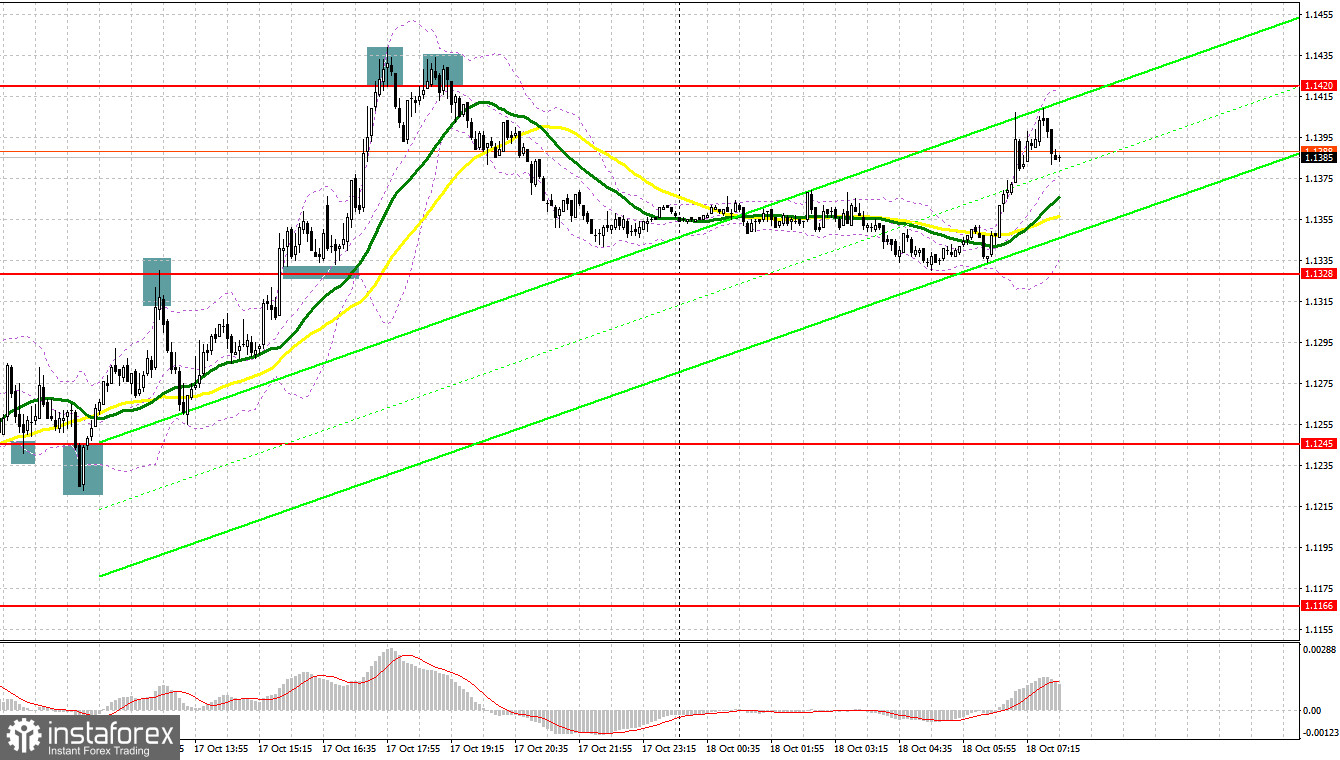

Quite a lot of excellent market entry signals were formed yesterday. Let's take a look at the 5-minute chart and figure out what happened. I paid attention to the 1.1245 level in my morning forecast and advised making decisions on entering the market there. The decline and false breakout in this range resulted in an excellent buy signal, which resulted in an increase of more than 40 points. The bulls again defended this range toward the middle of the day, giving a buy signal, which led to an increase of 60 points already. The unsuccessful first attempt to break through above 1.1328 in the afternoon resulted in a sell signal and a move down more than 50 points. After the pound's rapid growth in the middle of the US session, short positions on the rebound from 1.1420 brought about 30 points.

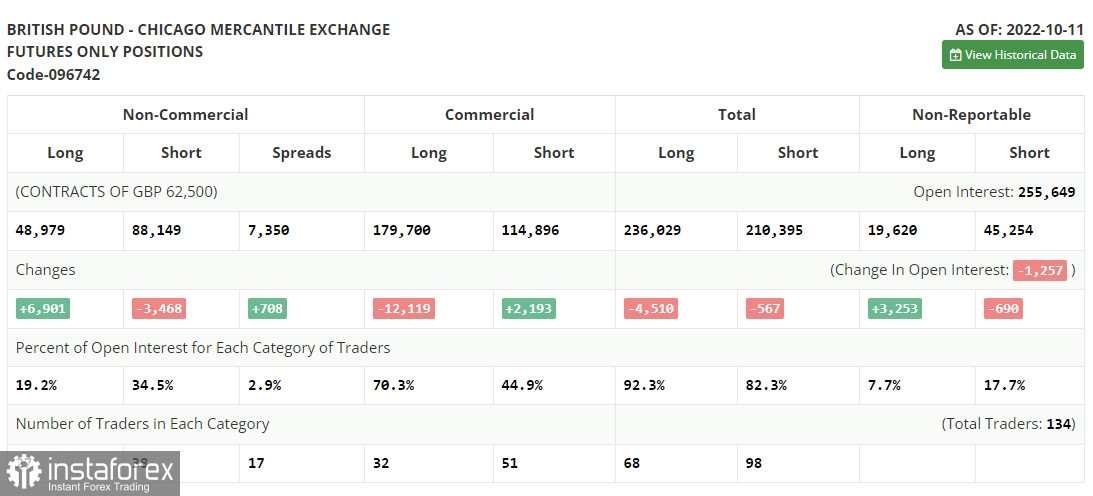

COT report:

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for October 11 logged a sharp reduction in short positions and an increase in long positions. The Bank of England's intervention has affected many traders who are now betting on the strengthening of the pound in the medium term. More recently, it was reported that the central bank has decided to temporarily suspend its quantitative tightening program, better known as QT, to help the bond market recover a bit after a sharp collapse caused by the actions of British Prime Minister Liz Truss. However, one should not count on a sharp rise in the pound in the medium term, as there is an economic recession and an aggressive policy on the part of the Federal Reserve, which will make the US dollar more attractive. The latest COT report indicated that long non-commercial positions rose by 6,901 to 48,979, while short non-commercial positions decreased by 3,468 to 88,149, resulting in a slight reduction in the negative non-commercial net position to -39,170 versus -49,539. The weekly closing price dropped to 1.1036 versus 1.1494.

When to go long on GBP/USD:

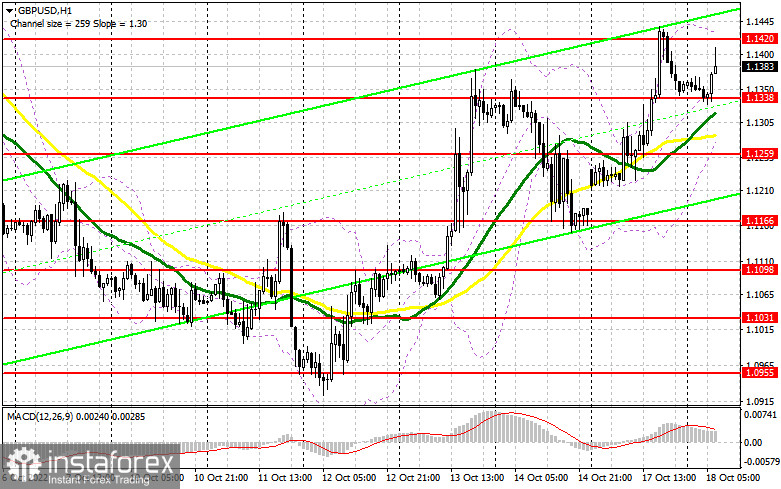

Today there are no statistics on the UK, so if the bulls show themselves around the nearest support at 1.1338, you can count on the continuation of the upward trend, because without updating yesterday's highs, it will be difficult for bulls on the pound to count on building a bull market at the beginning of the week. As I wrote above, there are plenty of reasons for optimism, therefore, in the event of a decrease in GBP/USD, the optimal scenario for buying would be forming a false breakout around 1.1338. This will provide an excellent entry point with a target to 1.1420. After getting above this range it will be possible to talk about the continuation of the upward correction for the pair. A breakdown of 1.1420, as well as a reverse test from top to bottom, will open the way to a monthly high of 1.1488, where it will become more difficult for bulls to control the market. A more distant target will be the area of 1.1539, which will lead to a fairly large capitulation of bears - I recommend taking profit there.

In case the GBP/USD falls and there are no bulls at 1.1338, the pressure on the pound will return. If this happens, I recommend postponing long positions to 1.1259, where moving averages are slightly higher, playing on the bulls' side. I advise you to buy there only on a false breakout. You can open long positions on GBP/USD immediately for a rebound from 1.1166, or in the low area of 1.1098 with the goal of correcting 30-35 points within the day.

When to go short on GBP/USD:

Yesterday, the BoE said it would support the bond market and not sell them, suspending the quantitative tightening program, better known as QT. This jeopardizes the return to the bear market and pushes back the prospects for a new annual low and makes talk of achieving parity of the pound against the dollar much more strange. An important task for today is to protect the resistance at 1.1420, formed on the basis of yesterday's results. Bears should not release the pair outside this range, as this will provoke new buying, allowing the bulls to strengthen their position in the market. In case GBP/USD grows, forming a false breakout at 1.1420 creates a sell signal, counting on the return of the bearish trend and a decrease to the nearest support at 1.1338. A breakthrough and reverse test from the bottom up of this range will provide an entry point for short positions already with the update of the low of 1.1259. A more distant target will be the area of 1.1166, where I recommend taking profits.

In case GBP/USD grows and the bears are not active at 1.1420, the bulls will regain control of the situation, which will lead to an increase in GBP/USD to the area of 1.1488. A false breakout at this level creates an entry point into short positions, counting on a new downward movement of the pair. In the absence of activity there, there may be a surge up to a high of 1.1539. There, I advise you to sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within the day.

Indicator signals:

Trading is conducted above 30 and 50 moving averages, which indicates further growth of the pound.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the indicator's upper border in the area of 1.1420 will lead to a new wave of growth of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.