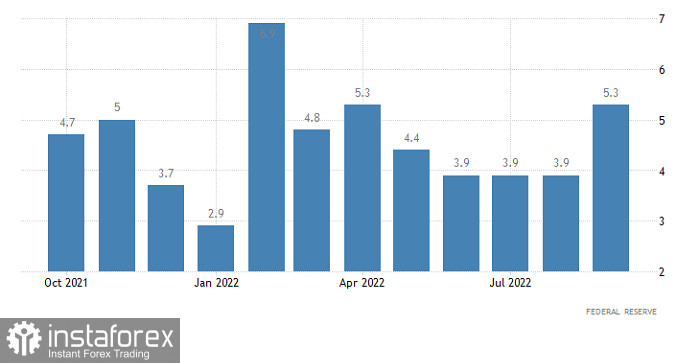

Data on industrial production in the United States were diametrically opposed to forecasts that predicted a slowdown in growth from 3.7% to 3.4%. Instead, they accelerated to 5.3%. At the same time, the previous data were revised up to 3.9%. So there is nothing surprising in the fact that the pound has declined. What is surprising is the scale of this very decline, which turned out to be extremely modest.

Industrial production (United States):

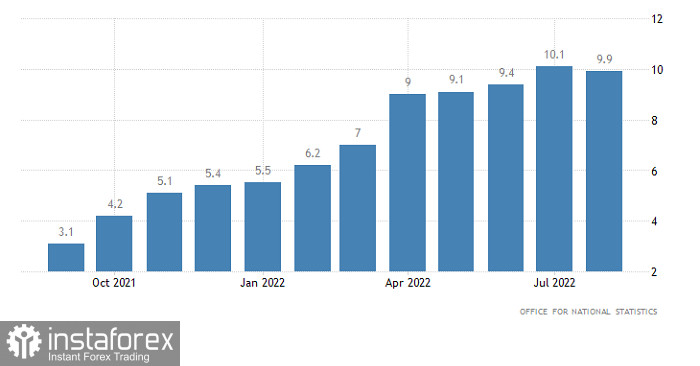

It is possible that such caution is associated with today's release of the UK inflation report. Investors simply do not intend to take risks ahead of such an important event. Moreover, inflation is expected to rise from 9.9% to 10.0%. If these forecasts are confirmed, the Bank of England will continue to raise the refinancing rate at the same pace. Although on Monday, the head of the British central bank announced further tightening of monetary policy. The question is only about the rate of growth of interest rates. Will it be a 75 basis point hike or a 50 basis point hike. The inflation report should answer this question. The scale of the pound's growth, which will follow the release of inflation data, also depends on this answer.

Inflation (UK):

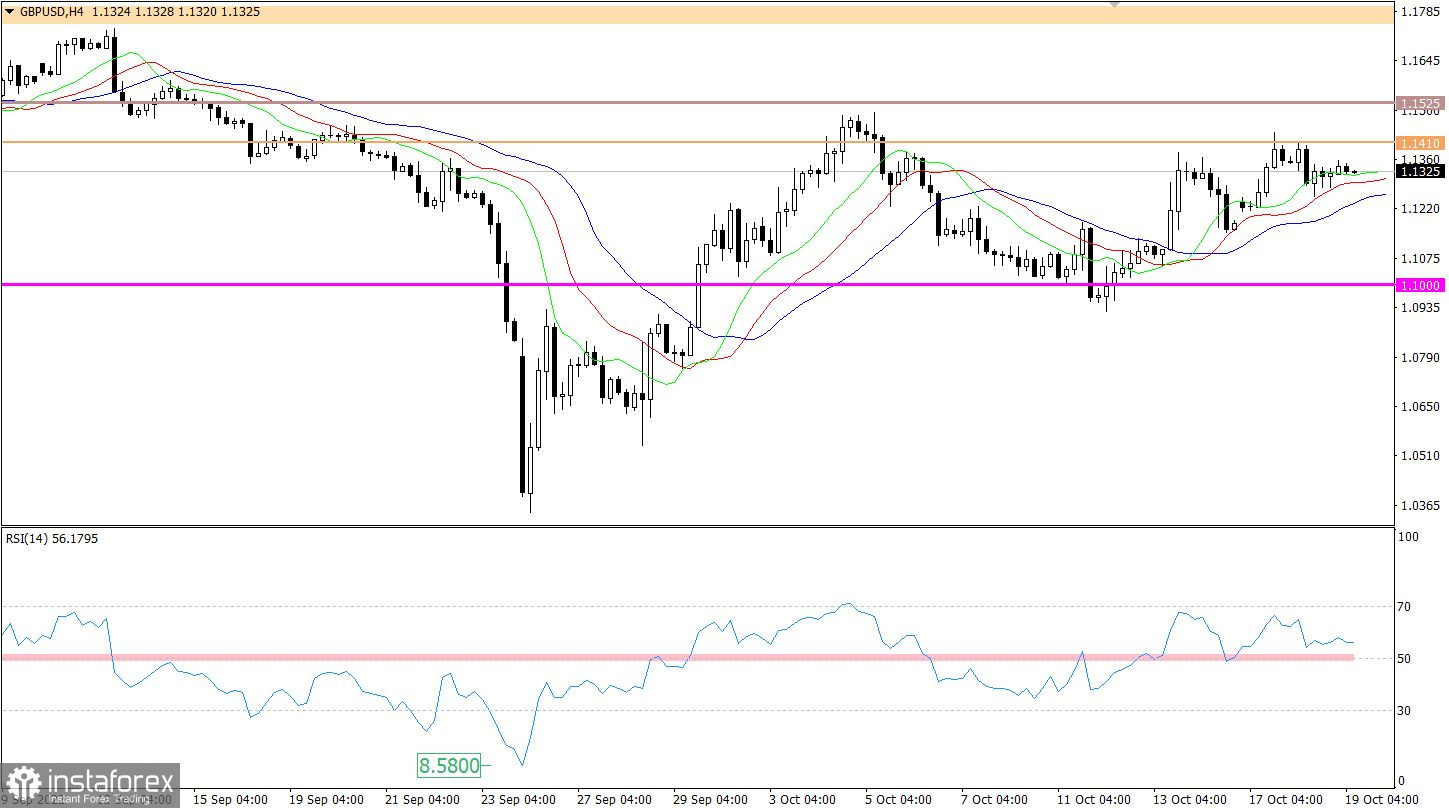

During the recent upward movement, the GBPUSD currency pair approached the resistance area of 1.1410/1.1525. This is the third consecutive convergence of the price by the control area, which once again led to a slowdown and rebound.

The RSI H4 technical instrument is moving in the upper area of the 50/70 indicator, which indicates the prevailing bullish mood.

The moving MA lines on Alligator H4 are directed upwards, which corresponds to an ascending cycle.

Expectations and prospects

In this situation, bulls are under pressure from the resistance area, for this reason there is no clear technical signal to buy the pound. To prolong the upward cycle, the quote must first stay above the 1.1410 mark. This step will indicate the possibility of a breakdown of the resistance area. A confirmation signal about the breakthrough will occur after the price is held above the value of 1.1525.

Until then, the risk of a natural price rebound remains in the market.

Complex indicator analysis in the short-term and intraday periods has a variable signal due to stagnation in the area of the peak of the ascending cycle.