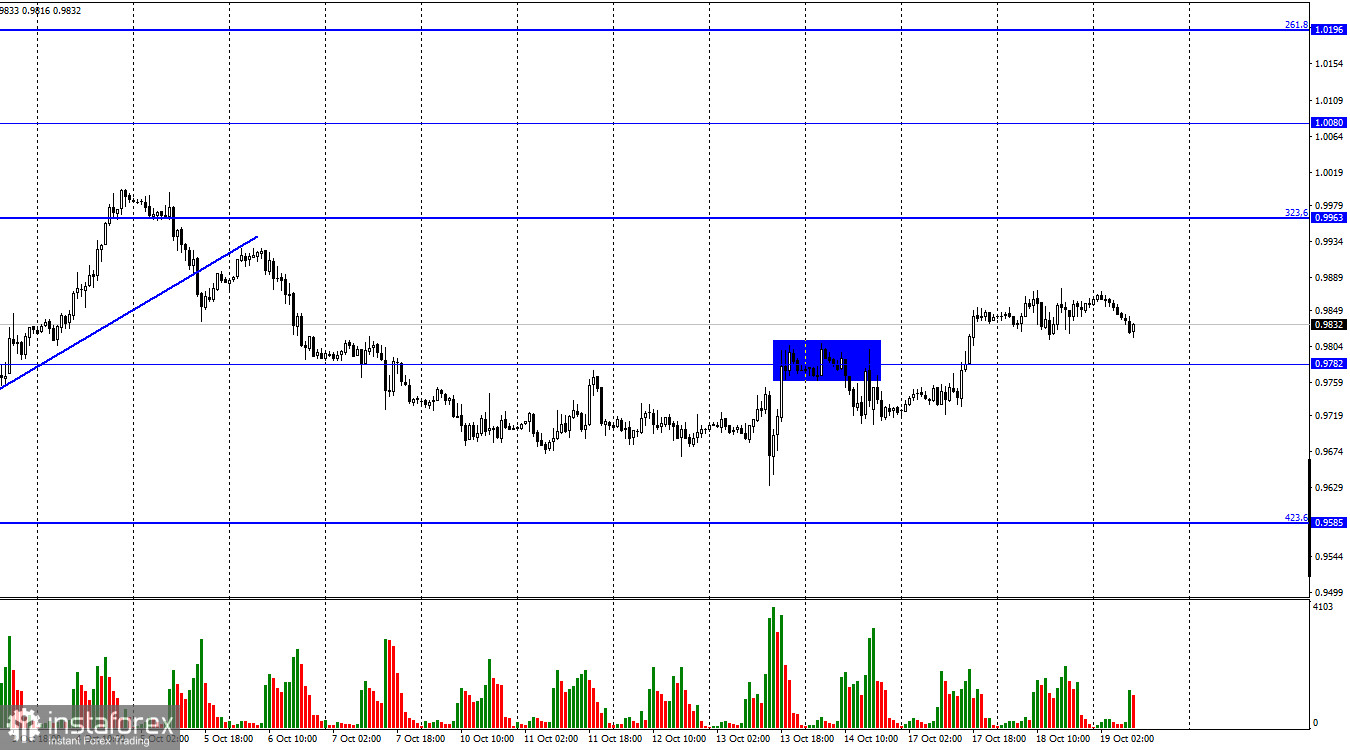

Hello, dear traders! On Tuesday, the euro/dollar pair was trading sideways on the one-hour chart. This movement could be defined as a pause ahead of the publication of the eurozone inflation figures. Thus, the consolidation above 0.9782 may allow the euro to climb toward the 323.6% correctional level located at 0.9963. However, if the price closes below 0.9782, the US dollar will rise, thus causing a decline in the euro toward the 423.6% Fibonacci level located at 0.9585. Notably, in the last few days, the euro has increased by approximately 230 pips. Last week, the pair was trading sideways. I suppose that the pair had enough time to start or resume rising. However, bulls failed to make use of the situation.

This week, the news flow has been rather weak. Today, the eurozone will publish its second inflation report for September. The second estimate is likely to meet the initial one, which unveiled a rise to a two-digit reading of 10%. There are whispers that the ECB will hardly keep up with the Fed and raise the benchmark rate by 4-4.5%. That is why economists doubt that the regulator is able to curb inflation and push it to 2%. I suppose that this factor may allow bears to return to the market. Judging by rumors, the ECB is not ready to raise the benchmark rate by 0.75% at the next meeting. However, this will be the right decision amid the growing inflation. If the predictions meet reality, it will mean that the ECB is switching to a more dovish approach. The fact is that it is too early to soften the policy since inflation has not started slackening yet. In this light, the euro may resume falling unless it receives support from a very strong informational flow.

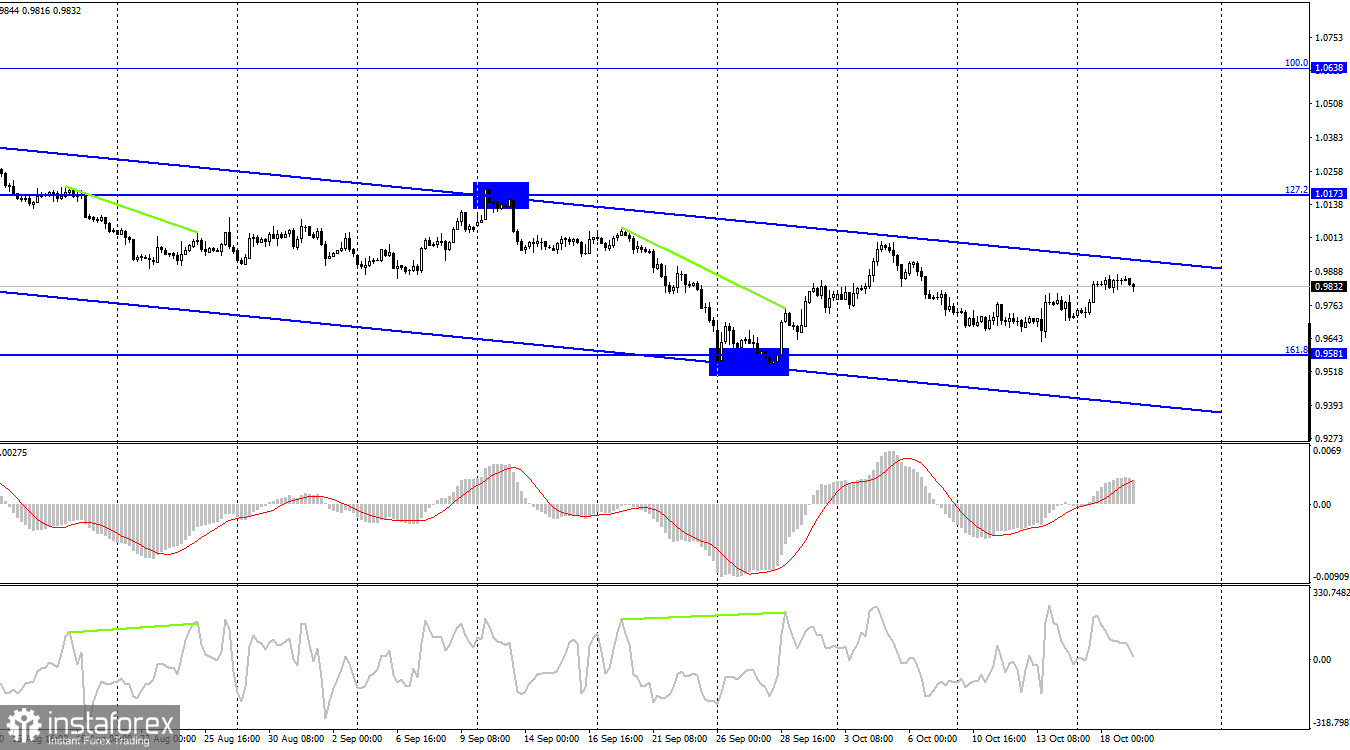

On the four-hour chart, the euro/dollar pair reversed and started climbing toward the upper limit of the downtrend channel. However, traders' sentiment remains bearish on this chart. Only consolidation above the downward channel will allow the pair to advance to the 127.2% correctional level located at 1.0173. If the price bounces off the upper limit of the channel, it will resume falling to the 161.8% Fibonacci level located at 0.9581.

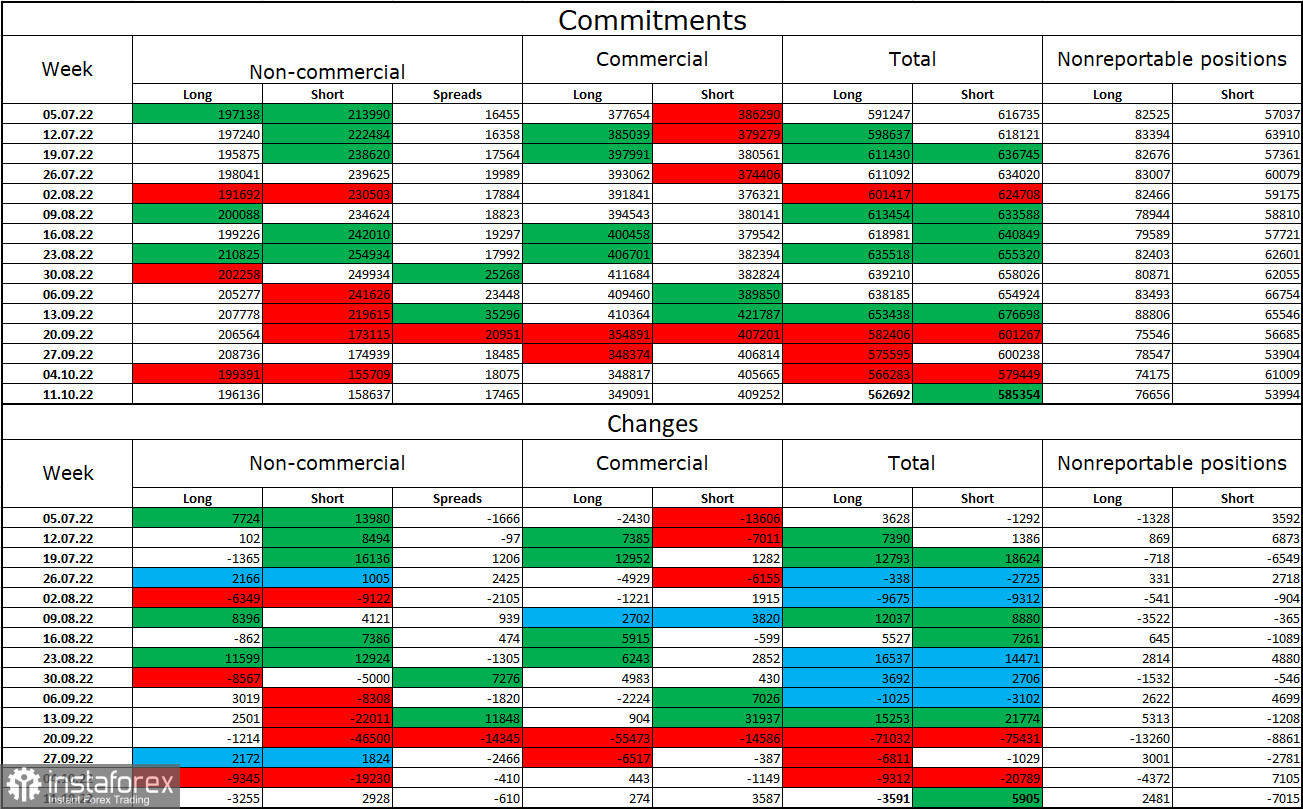

COT report

Last week, speculators closed 3,255 long contracts and opened 2,928 short contracts. This means that the mood of big traders has become a little less bullish than before. The total number of long positions opened by speculators totals 196 thousand, whereas the number of long positions is 158 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the euro's appreciation were growing, but traders prefer the US dollar to the euro. Therefore, I would now bet on an important downward channel on the 4-hour chart, above which the euro failed to close. I also suppose that traders should carefully monitor geopolitical news as they greatly affect market sentiment. As we can see, the euro cannot show a rise despite bullish sentiment among big traders.

Macroeconomic data published in the US and the eurozone:

EU – Consumer price index

US – Building permits

US - Beige Book

On October 19, the EU and the US macroeconomic calendars contain only several important events. All eyes are likely to be turned to the eurozone inflation figures. However, the new flow will hardly affect the market sentiment today.

Outlook for EUR/USD and trading recommendations:

Traders may go short after a bounce off the upper limit of the channel on the four-hour chart with the target at 0.9581. It is possible to open buy orders if the price consolidates above the upper limit of the channel in the same time frame. The target is located at 1.0638.