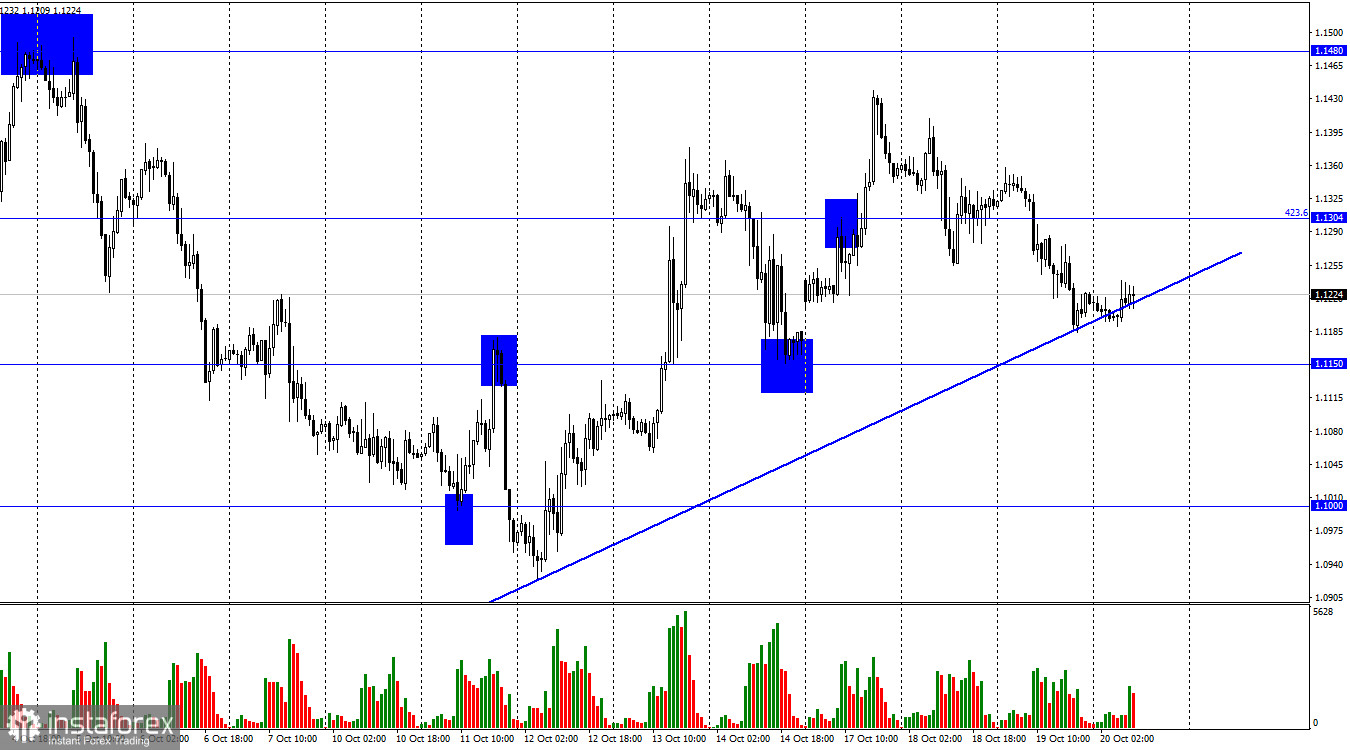

GBP/USD reversed in favor of the US dollar on the 1-hour chart and dropped to the ascending trendline. A rebound from this line will support the British currency which may resume growth towards 1.1480. A close below the trendline will increase the possibility of a decline to the levels of 1.1150 and 1.1000.

Yesterday, the CPI report published in the UK showed that inflation has accelerated once again. This was hardly surprising as the inflation rate in the UK shows no signs of a slowdown. Therefore, traders didn't take into account the fact that prices went lower last month as this was perceived as a slight inaccuracy. As for the Bank of England, it is facing the same challenges as the ECB. Rising inflation forces the regulator to introduce more rate hikes. However, this is a bearish factor for the pound sterling. The rate has been growing since the start of the year but GBP keeps falling despite this. It seems that at this time, there is no correlation between such notions as rising inflation, higher interest rates, and the strengthening of the currency.

At the same time, the latest market turmoil caused by Liz Truss's plans to cut tax rates has come to an end. The influence of this negative factor has finally faded away. Now markets are focused on the upcoming meetings of the US Federal Reserve and the Bank of England. The Fed's rate is slowly approaching its final level. It is also possible that the US regulator may put its monetary tightening cycle on hold within 2-3 months. If this happens, the pound will get a chance to recover. Until then, GBP is likely to extend losses.

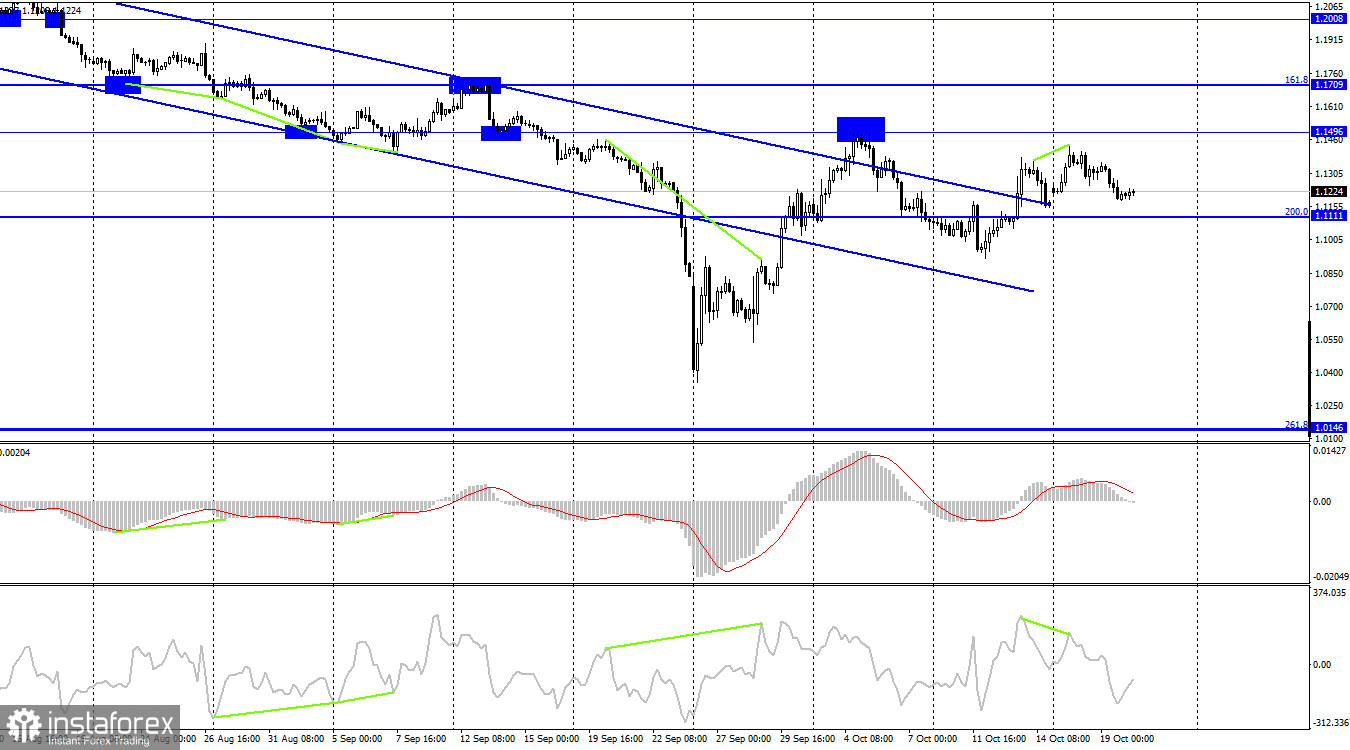

On the 4-hour chart, the pair closed above the descending trend channel. As this is the second time the pair settles there, the chances of a further uptrend towards at least 1.1496 are getting higher. At the same time, the information background may put pressure on GBP/USD. The bearish divergence of the CCI supported the US dollar. So, the pair began to decline towards the Fibonacci retracement level of 200.0% at 1.1111. In general, the technical setup on the H4 chart does give a clear idea about the further trajectory of the pound.

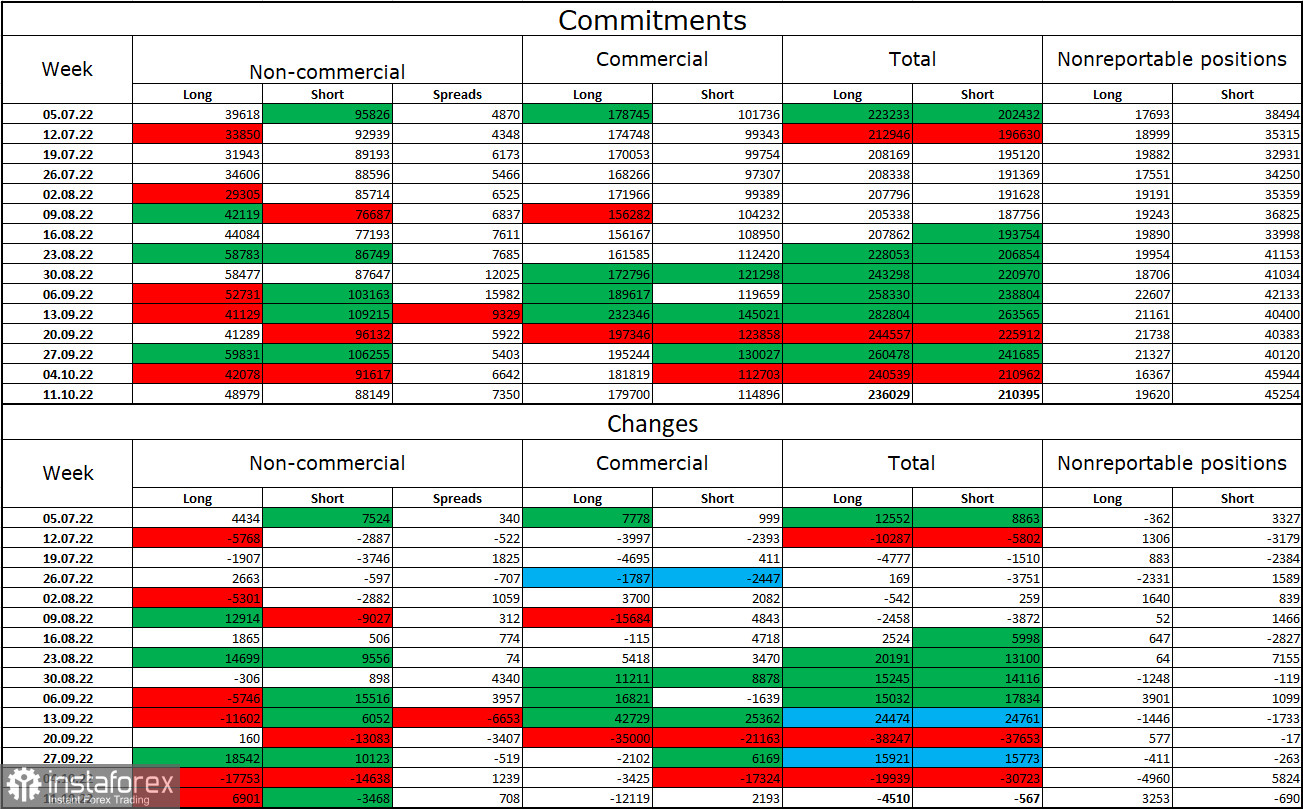

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became less bearish on the pair than the week earlier. Traders added 6,901 new long contracts and closed 3,468 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

US - Philadelphia Fed Manufacturing Index (12-30 UTC).

US - Initial Jobless Claims (12-30 UTC).

The UK economic calendar is completely empty on Thursday. As for the US, the current reports are of minor importance today. Therefore, the impact of the information background on the market sentiment will be rather weak.

GBP/USD forecast and trading tips

I recommend selling the pair when the price closes below the trendline on the H1 chart with the targets at 1.1000 and 1.0727. It is better to buy the pound after a rebound from the trendline on the 1-hour chart with the target located at 1.1480.