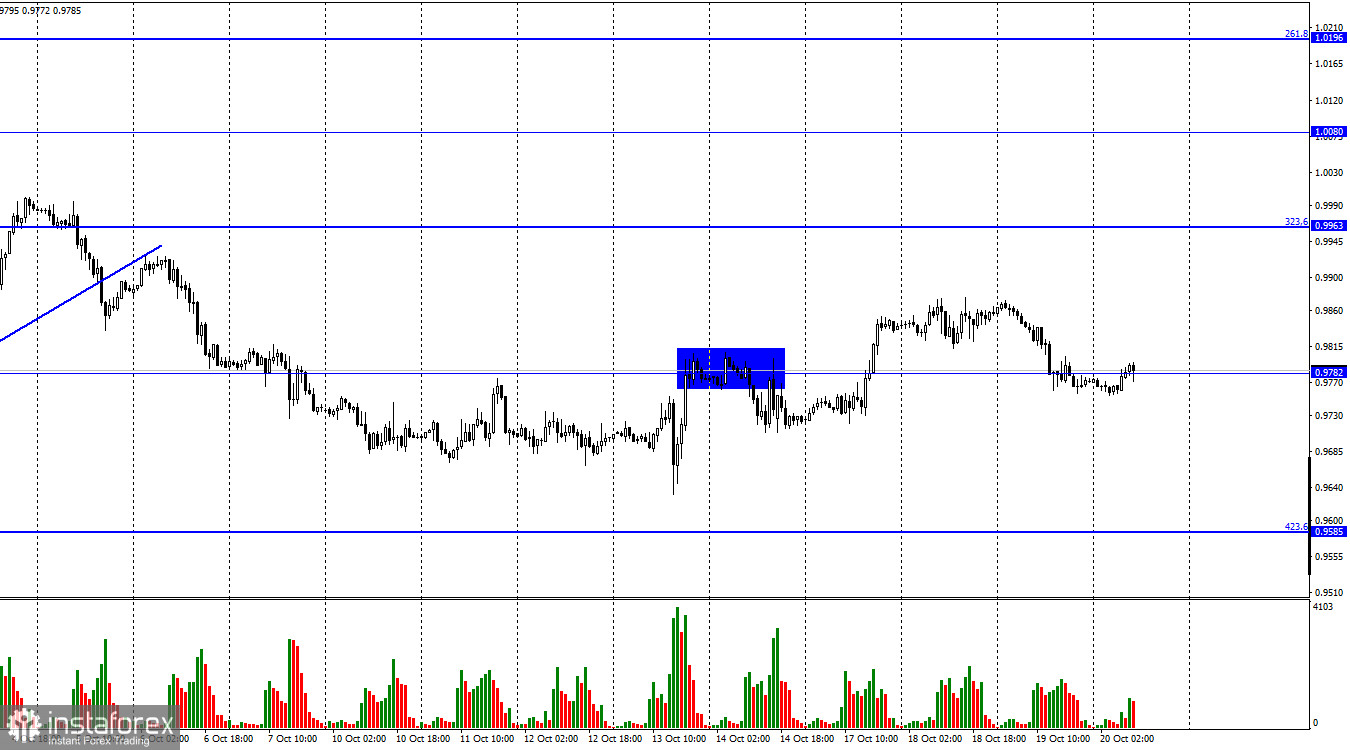

On Wednesday, EUR/USD reversed in favor of the US dollar and dropped to 0.9782. The pair neither rebounded nor settled below this level. Therefore, there were no sell or buy signals. I would like to note that bulls are hesitating to return to the market. The current information background is rather negative for the euro which explains the reaction of traders.

Yesterday, the EU released inflation data which revealed a rise to 9.9% in annual terms. Core inflation went up to 4.8% compared to the previous year. Unfortunately, this indicates that all efforts made by the ECB have been in vain so far as inflation continues to accelerate. At the same time, the increase in prices was a bit less than expected which adds some optimism. However, I think that an increase of just 0.1% in no way helps the euro. The fact that the CPI increased in September is already a negative sign for the economy.

As we know, inflation is closely correlated with the monetary policy of the central bank. Based on recent reports, the EU regulator is likely to adjust its policy. Although this statement is true, it does not necessarily mean that traders will rush to buy the euro on expectations of a higher ECB rate. The central bank has already hiked the rate by 0.50% and 0.75% but with zero effect on the euro. Traders fear that the ECB will raise the rate 1 or 2 more times and stops there. But these measures are hardly enough to slow down inflation. This makes the euro prone to more declines. It may show an uptrend within a day or a week but it is likely to fall deeper in the long term.

EUR/USD reversed on the 4-hour chart and began to rise towards the upper line of the descending trend channel. The market is clearly bearish in this time frame. Only a firm hold above the descending channel will allow the euro to notably advance towards the Fibonacci retracement level of 127.2% at 1.0173. If the price bounces off the upper boundary of the channel, it will resume the fall to the level of 161.8% at 0.9581. The bullish divergence of the CCI increases the chances of a further uptrend.

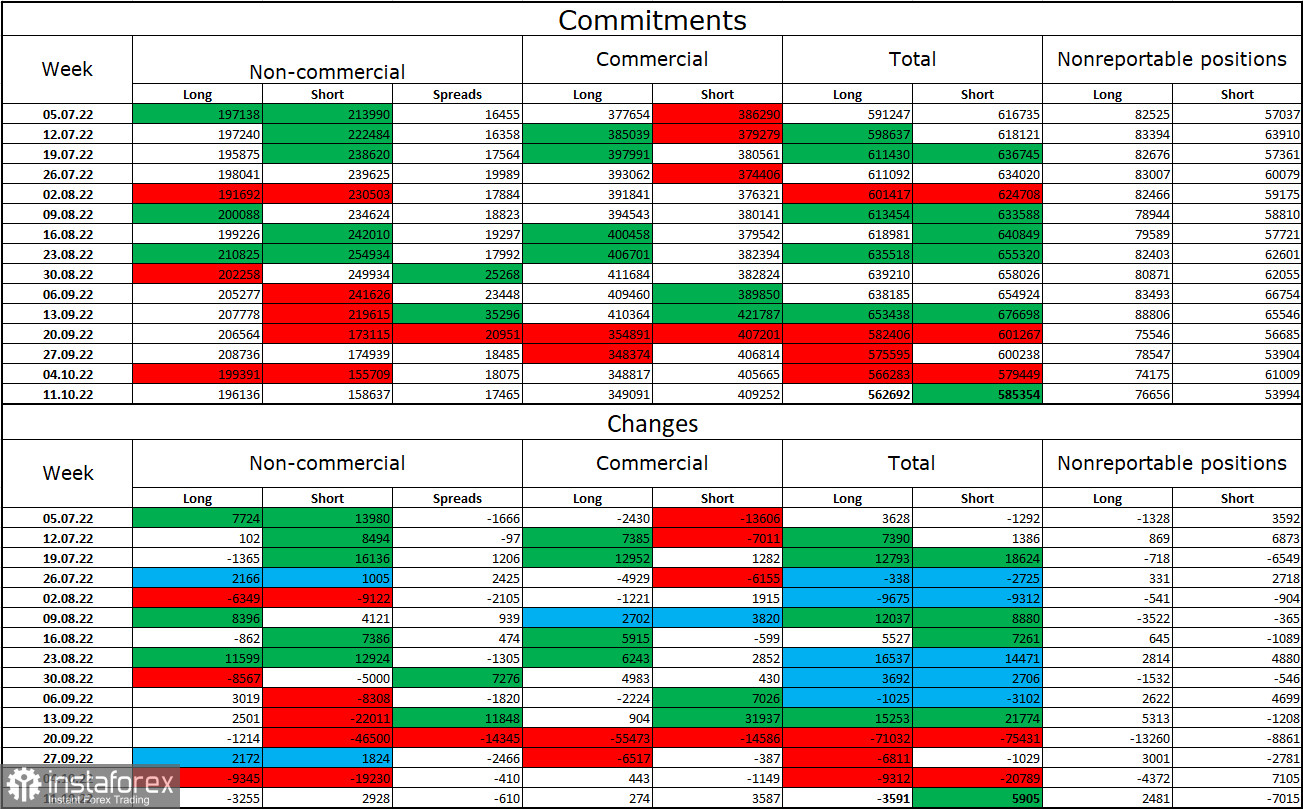

Commitments of Traders (COT) report:

Last week, traders closed 3,255 long contracts and opened 2,928 short contracts. This means that large market players became less bullish on the pair. The total number of long contracts opened by traders is 196,000 while the number of short contracts stands at 158,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. It is also recommended to monitor geopolitical news as it tends to greatly affect the market sentiment. Even the bullish sentiment of larger market players does not allow the euro to develop growth.

Economic calendar for US and EU:

EU - EU Leaders Summit (10-00 UTC).

US - Philadelphia Fed Manufacturing Index (12-30 UTC).

US - Initial Jobless Claims (12-30 UTC)

On October 20, none of the economic calendars has any important events. A few minor economic reports are unlikely to influence the market sentiment.

EUR/USD forecast and trading tips:

I would recommend selling the pair if the price bounces off the upper line of the channel on the 4-hour chart. The target in this case should be the level of 0.9581. Buying the pair will be possible when the price holds firmly above the upper line of the channel on the H4 chart with the target at 1.0638.