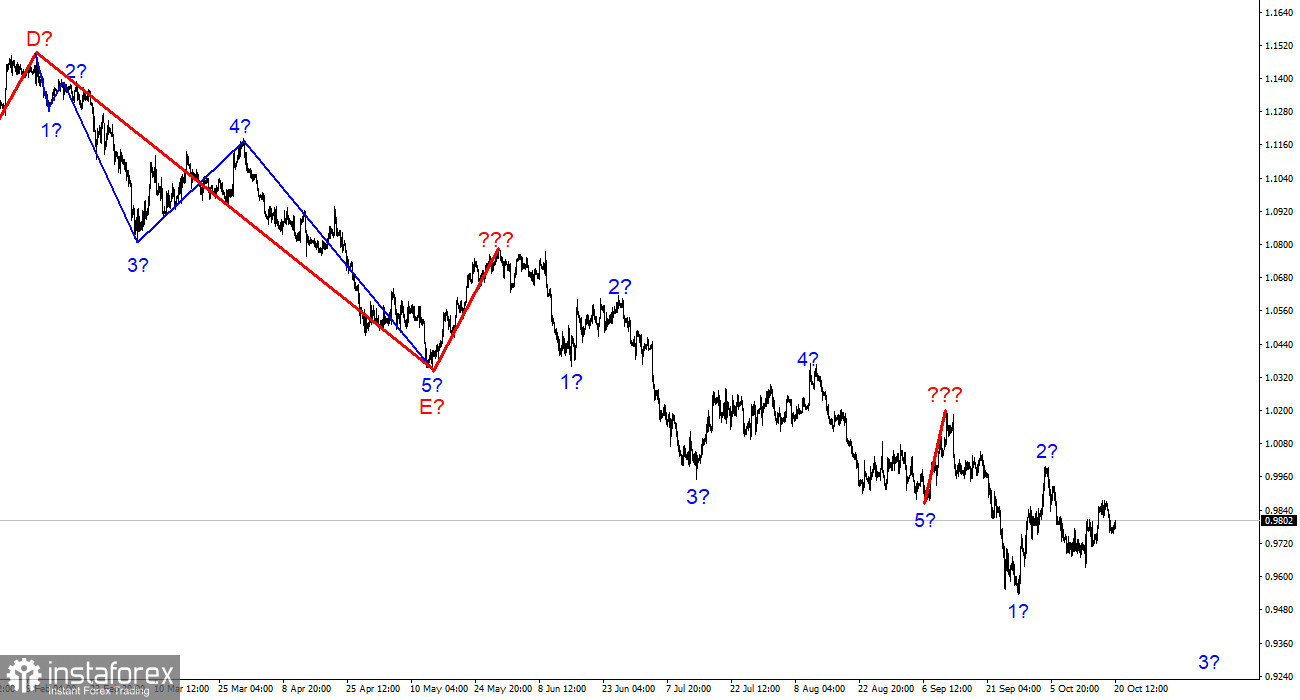

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than ever in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There has been no talk of any classical wave structure (5 trend waves, 3 correction waves) for a long time. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down-a weak corrective wave up." Even now, when the construction of a new upward wave seems to have begun, which may be 3 as part of a new upward trend section, the entire wave marking can transform into a downward one, and the waves built after October 4 will be waves 1 and 2 in 3.

Germany is too dependent on Russian gas

The euro/dollar instrument rose by 30 basis points on Thursday. The trading amplitude is very small today and may remain so until the end of the week since all the news and reports for this week have already been published. No important news is expected today or tomorrow. After a whole week of horizontal movement, the European currency has slightly increased but prefers to move to the left rather than up or down. Over the past two weeks, the instrument's amplitude has been only 120 basis points. And I can't even say that the market is waiting for something right now. Most likely, he is waiting for new important data, but there is none in the near future. The current wave markup allows for both a decrease in quotes and an increase.

There has been so much talk about the recession in the US, the European Union, and the UK. There has been a lot of talk about high inflation and high rates that slow down economic growth. But all this is just talk, and the market continues to believe in the dollar, no matter what happens in the USA. I note that the recession in America has already begun. This indicator, like many others, can be viewed from different angles. In quarterly terms, the recession has already begun, and in annual terms, it may not even have started yet, although most analysts predict its beginning by the end of next year. The European Union has the same picture. Germany, which is most dependent on gas imports from Russia and which has now lost this source of hydrocarbons, may show a strong decline in industrial production this winter and in the coming year. Other EU countries that do not produce as many goods as Germany are likely to show minimal economic growth, but a drop in GDP in Germany may also lead to a drop in the GDP of the entire Eurozone. In any case, Europe will not escape from the recession either.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section cannot be considered completed yet, but it can be completed at any time. At this time, the instrument can build a new impulse wave, so I advise selling with targets near the calculated mark of 0.9397, which equates to 423.6% by Fibonacci, by the MACD reversals "down." I urge caution, as it is unclear how much longer the overall decline of the instrument will continue and whether the current wave structure will transform into an upward one.

At the higher wave scale, the wave marking of the downward trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them. One of these five waves can be just completed, and a new one has begun its construction.