The EUR/USD currency pair was trading on Thursday according to the usual pattern: a weak movement in the European trading session and a stronger one in the American one. Although there were no important macroeconomic publications yesterday, either in the States or the EU, the movements became more active in the afternoon when American traders entered the market. The pair attempted to gain a foothold above the moving average line, although they had gained a foothold below it a day earlier. Now let's take a closer look at these events.

First, the pair's momentum is fading. After falling by 650 points in September, we saw the following movement turns: up by 450 points, down by 360 points, up by 230 points, and down by 120 points. As you can see, each next round of movement is weaker than the previous one. It's like a pendulum, which, without the support of an outside force, swings weaker and weaker. It turns out that the pair is consolidating now near the 98th figure, and further movement will require new reasons.

Second, the market is still paying much more attention to the United States, the fundamental background from overseas, and the US dollar. This can be seen by a much stronger reaction to American reports and events and by the fact that traders trade much more actively in American sessions. That is, absolutely everything now revolves around the dollar. And this is another great reason to expect a further fall in the pair. Of course, American traders can sell the dollar, but why sell if there is no reason for this?

The market is happy to ignore the fundamental background of the dollar's weakness. Both central banks are already raising rates. Moreover, the recession has already begun in the US. It can only begin in the EU. Inflation is high in both the EU and the US, but at the same time, demand for the dollar remains high, and the pair continues to be located near its 20-year lows and cannot adjust more than 400-450 points. We believe that the technical, fundamental, and geopolitical picture has not changed in recent days, so it is not worth waiting for changes.

Recession in the USA, recession in the European Union

We have repeatedly said that a recession is not an isolated case in the global economy in our time. After the world's central banks pumped their own economies with unsecured money, provoking economic growth artificially, now everyone has a "headache" about what to do with high inflation. Thus, both in the United States and in the European Union, there will be one or a type of "recession." We speak the same in this formulation, since any economic event can now be interpreted as you or anyone likes. For example, the Fed does not call a recession a "recession" but an "economic slowdown" or "recession." It doesn't sound so scary, but the essence is the same.

The European Union can avoid a serious recession because the ECB has pumped less money into the economy than the Fed. And because rates in the EU are unlikely to rise as much as in the US. However, this is a double-edged sword. If the recession is milder, then inflation will be higher, and the period of its high values will be longer. Therefore, one way or another, in one form or another, both the European Union and the USA will face economic problems. It's just that there is a problem with energy resources in Europe, which could potentially cause a greater economic decline. According to various information, gas storage facilities in the EU are 90% full. And Ursula von der Leyen said yesterday that Brussels had been preparing to abandon Russian gas and oil for 7–8 years, but it turned out that it had almost completely stopped importing for 7-8 months. The head of the European Commission said that 2/3 of supplies from Russia have already been replaced with energy carriers from other countries. Therefore, it is possible that there will not be an energy crisis in Europe yet, but this is little consolation for the euro.

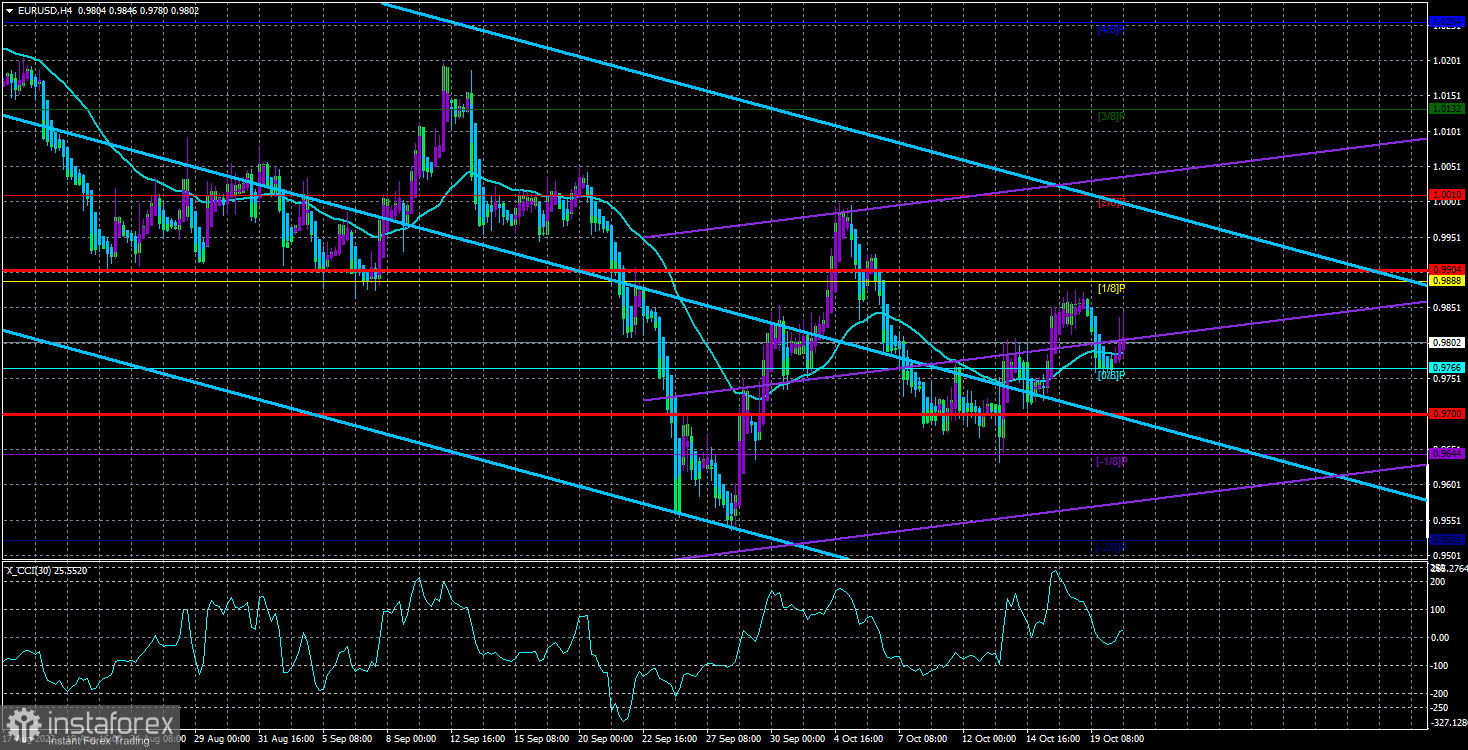

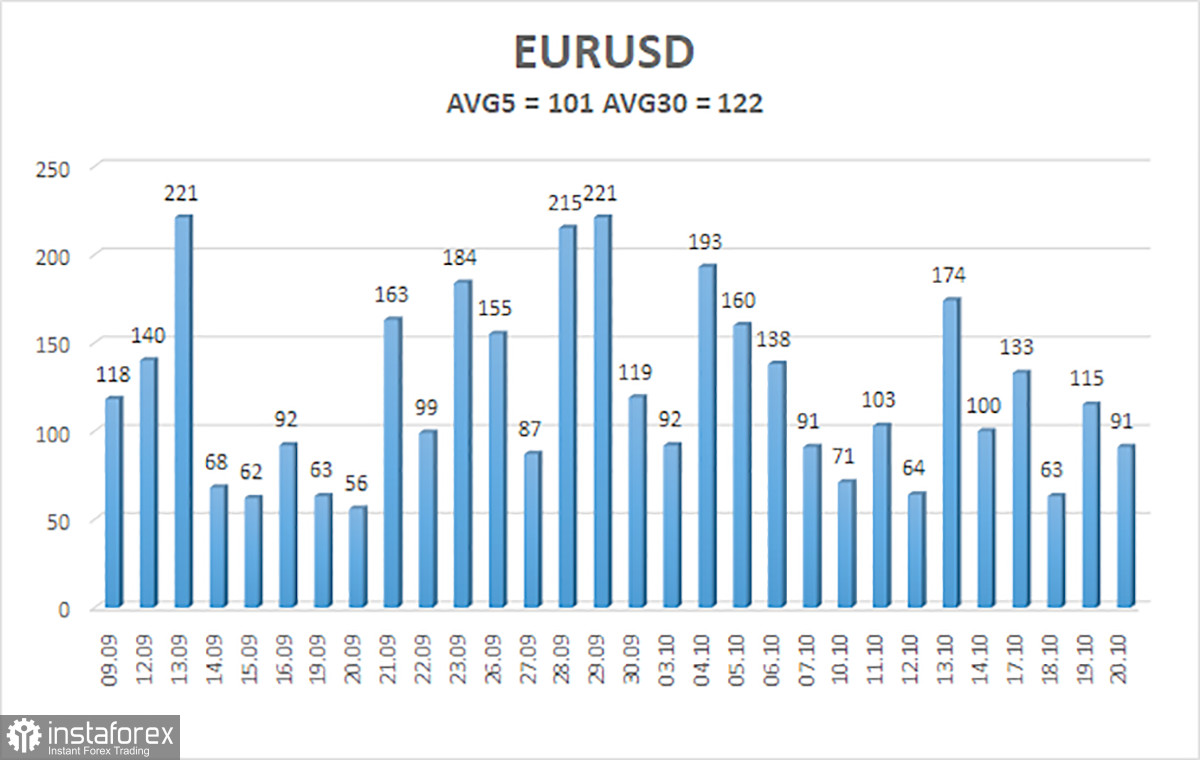

The average volatility of the euro/dollar currency pair over the last five trading days as of October 21 is 101 points and is characterized as "high." Thus, on Friday, we expect the pair to move between 0.9700 and 0.9904 levels. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair continues to be near the moving average. Thus, now we should consider new long positions with targets of 0.9888 and 0.9904 before the Heiken Ashi indicator turns down. Sales will become relevant again no earlier than fixing the price below the moving average with goals of 0.9700 and 0.9644.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.