The GBP/USD currency pair showed approximately the same movements as the EUR/USD pair on Thursday: a boring European session, a more active American one. It should be noted that there were no macroeconomic publications in the UK yesterday and only minor reports in the US. For example, the number of applications for unemployment benefits for the next week differs from the forecast by several thousand from time to time. It cannot provoke a strong market reaction. Data on the real estate market has never been significant at all. Therefore, the more active movement of the pair in the afternoon is not related to American statistics but the discovery of "America." As we have already said, everything in the foreign exchange market now revolves around the US dollar. It is not surprising that we see stronger movements than before in most cases.

As for the general fundamental background, there have recently been so many news reports that traders could get confused. For example, The Times recently wrote that the Bank of England would postpone the start of its balance sheet unloading program (QT), which is due to begin on November 1. This is logical since last week, the Bank of England bought bonds to stabilize financial markets. However, the Bank of England itself published an official statement saying no delays are planned, and the information in The Times is incorrect. And who to believe? Reducing the regulator's balance sheet is the same positive factor as the rate increase for the British pound. But if the rate hike did not help the pound in the fight against the dollar, why should the QT program help, especially since the Fed also conducts its QT program in the States?

Truss came to leave as soon as possible.

Sometimes, when we read political news from the UK, it seems that we are viewers of some series, the purpose of which is to attract the maximum audience and entertain it. Let's briefly summarize the results of recent significant events. In August, after Boris Johnson's resignation announcement, the election of a new prime minister was held. The voters were members of the Conservative Party, who chose Liz Truss by a majority vote. A month and a half has passed, and, judging by opinion polls, most conservatives favor the immediate resignation of Truss. How can this be? If the whole problem is in the "tax plan," why does she provoke so much negativity? Even before her election, she repeated, like a mantra, that she would lower taxes for the British so they could more easily bear the increased energy bills. It was immediately obvious that if taxes were reduced, it would create a certain budget deficit. Then why was Truss elected if there was Rishi Sunak, a former finance minister who, like no one else, would have done a better job with the economy? If Truss is more popular and can ensure the victory of the Conservatives in the next parliamentary elections, what has changed now?

Moreover, Liz has already made a "knight's move" and dismissed the Minister of Finance, Kwasi Kwarteng, putting all the blame on him. It turns out the following: Truss promised to lower taxes, then gave instructions to develop an appropriate financial plan, and then, when it "smelled fried," she fired her friend Kwarteng, making him responsible for the failure of her initiatives. The new Finance Minister, Jeremy Hunt, has already announced the cancellation of most of the tax initiatives of Truss, and it turns out that she will not keep her election promise. Consequently, a new tub of criticism will pour out on her, but now from the British themselves. In general, the situation is just a pun. We cannot say that the pound reacts in any special way to this political pun, but these events do not add calmness to traders. Perhaps the pound is not growing right now just because another political crisis is brewing in the Kingdom. Also, note that Truss cannot announce a vote of no confidence right now since not even a year has passed since she took office. But this is Britain, and the necessary law can be found on the sidelines or quickly "concocted."

Update: Liz Truss has resigned

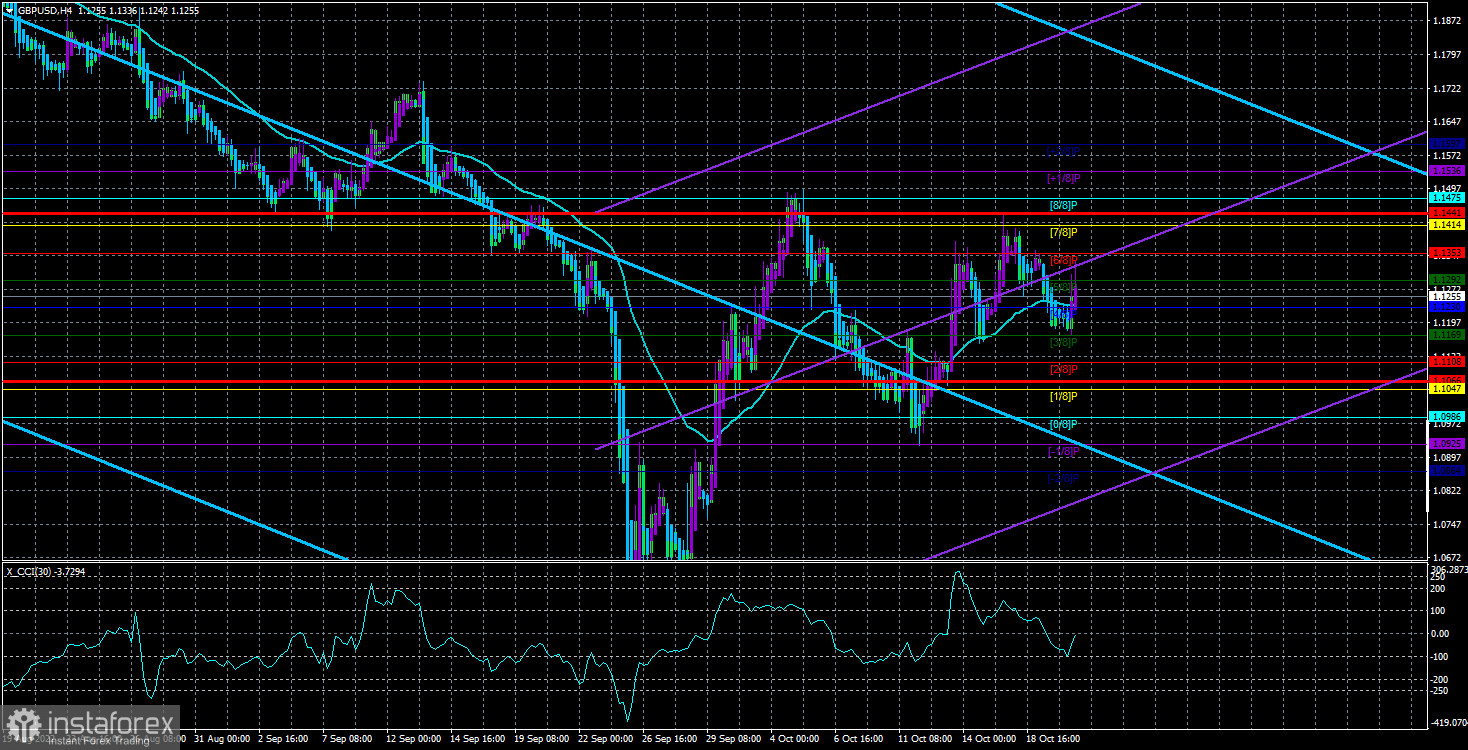

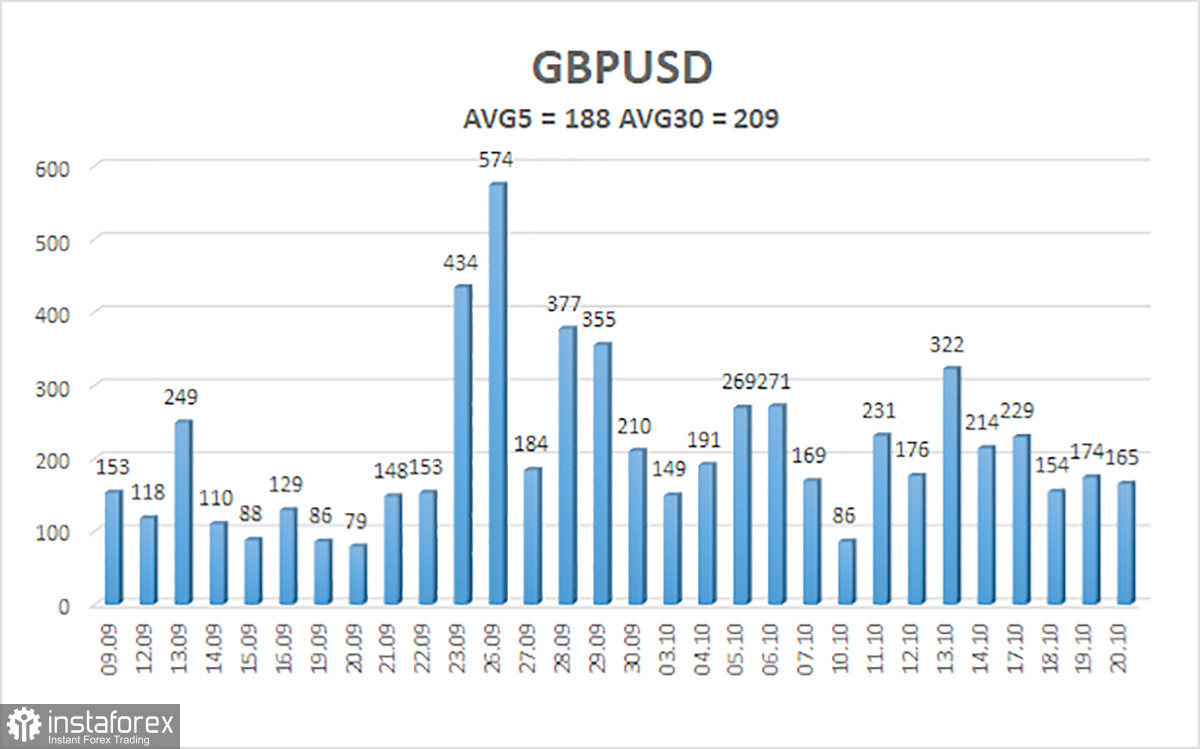

The average volatility of the GBP/USD pair over the last five trading days is 188 points. This value is "very high" for the pound/dollar pair. On Friday, October 21, thus, we expect movement inside the channel, limited by the levels of 1.1066 and 1.1441. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading Recommendations:

The GBP/USD pair has started a new upward movement in the 4-hour timeframe. Therefore, at the moment, buy orders with targets of 1.1353 and 1.1414 should be considered before the Heiken Ashi indicator turns down. It is necessary to open sell orders when the price fixes below the moving average with the goals of 1.1108 and 1.1066.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.