The unexpected, but at the same time expected, resignation of the extremely incompetent populist L. Truss from the post of Prime Minister of Great Britain temporarily supported the exchange rate of the British currency. However, it is unlikely to save the local economy from collapse.

Truss's resignation, after all the nonsense she did after she was elected head of government, was brewing and resulted in a complete failure at the end of her 45-day reign. Of course, now, many of the economic and political problems of the "UK" will be blamed on her. However, the crisis is not her creation but has a deep and systemic character that Britain is unlikely to be able to survive in the coming years.

Locally, after the news, the pound sterling received short-term support and rose against the dollar. But this increase was of a limited nature and was purely speculative. After takeoff, everything went back to normal again. And the main reason for this is the extremely difficult economic situation in the country against the background of high inflation since the 70s of the last century.

So what can we expect from the dynamics of the pound sterling in the near-foreseeable future?

We believe that it has no chance of growth against the dollar. And here, the main negative reasons are large-scale economic problems, high inflation, confusion, and uncertainty among the power elite. The disruption of trade relations due to the country's exit from the EU (Brexit) weakened the local economy. It made it highly vulnerable to the consequences of its pumping of an unsecured money supply during the COVID-19 pandemic.

There are similar problems in the US, but not as deep as in Britain. In addition, unlike the pound sterling, the dollar is perceived by investors as a safe-haven currency. Moreover, the difference in interest rates against the background of renewed growth in the treasury yield only supports the strength of the US currency against the British one.

In the best case, we believe that it will consolidate in a sideways range against the dollar. In the worst case, its fall may resume next week on the wave of uncertainty about the actions of the new prime minister in the UK and government reshuffles.

The forecast of the day:

GBPUSD

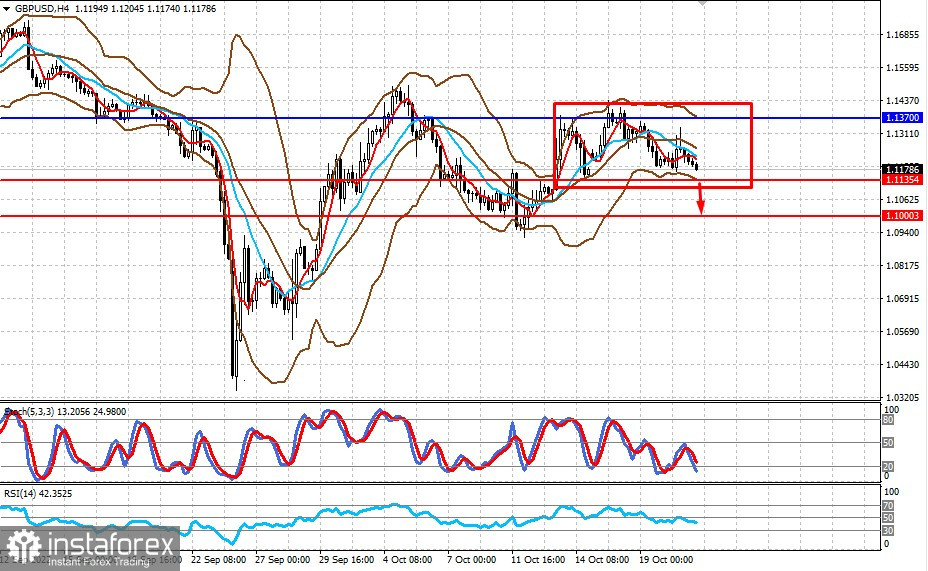

The pair is trading in the range of 1.1135 and 1.1370. It is likely to remain in this range today with the prospect of leaving it down to 1.0000 next week.

EURUSD

The pair is still trading above the 0.9755 level. A breakthrough at this level with a high probability will lead to its fall to 0.9680.