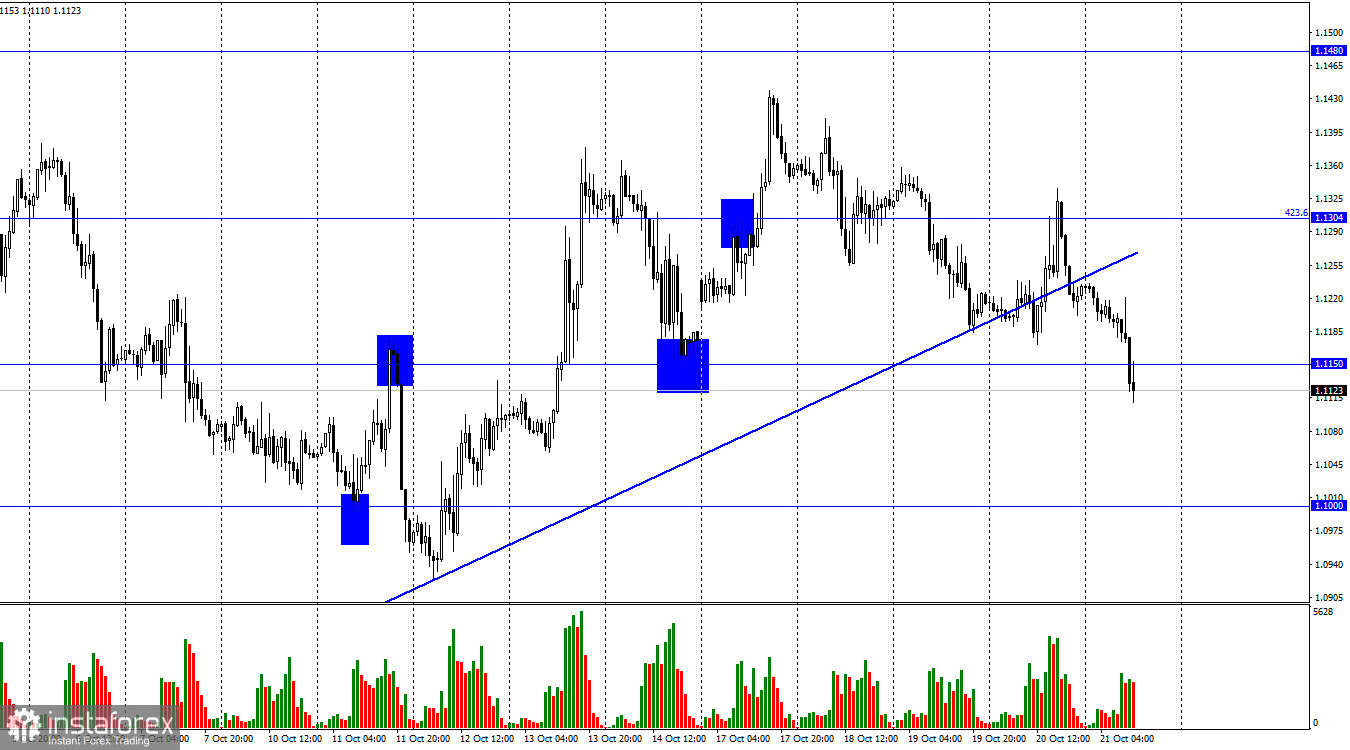

According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the US dollar and anchored under the ascending trend line. Thus, the mood of traders changed to "bearish," and on the 4-hour chart, it did not change to "bullish," despite the closure of the descending corridor. The fall of the British pound began last night when it was reported that Liz Truss was resigning, thus taking first place among all prime ministers in the history of the UK in terms of the brevity of the term in office-only 44 days.

In recent weeks, Truss has faced massive criticism for the failure of the economic stabilization program, which assumed tax cuts. This program was not even adopted, and the British markets immediately collapsed when its points became known. After the massive collapse, the Bank of England urgently entered the market and bought bonds to lower their yields. And this is despite the fact that a program of selling these bonds was supposed to slow inflation (along with an increase in interest rates) earlier this month.

Thus, the first initiative of Truss led to her resignation. I would also like to note that a vote of no confidence for Truss was announced. Even theoretically, it could not be announced in the first year of the new prime minister's rule. Truss resigned voluntarily, but I do not doubt that it was not without political pressure. New prime minister elections will begin next week, and Boris Johnson is leading in this fight, judging by the polls. The former prime minister of Great Britain can become the new prime minister for 44 days after he resigns. This is only possible in the UK.

At the same time, traders doubt that the Bank of England can raise the rate as much as it takes to reduce inflation. Now economists say it is necessary to raise it to 5-6%, which could result in losses of 5-6% of GDP for the British economy.

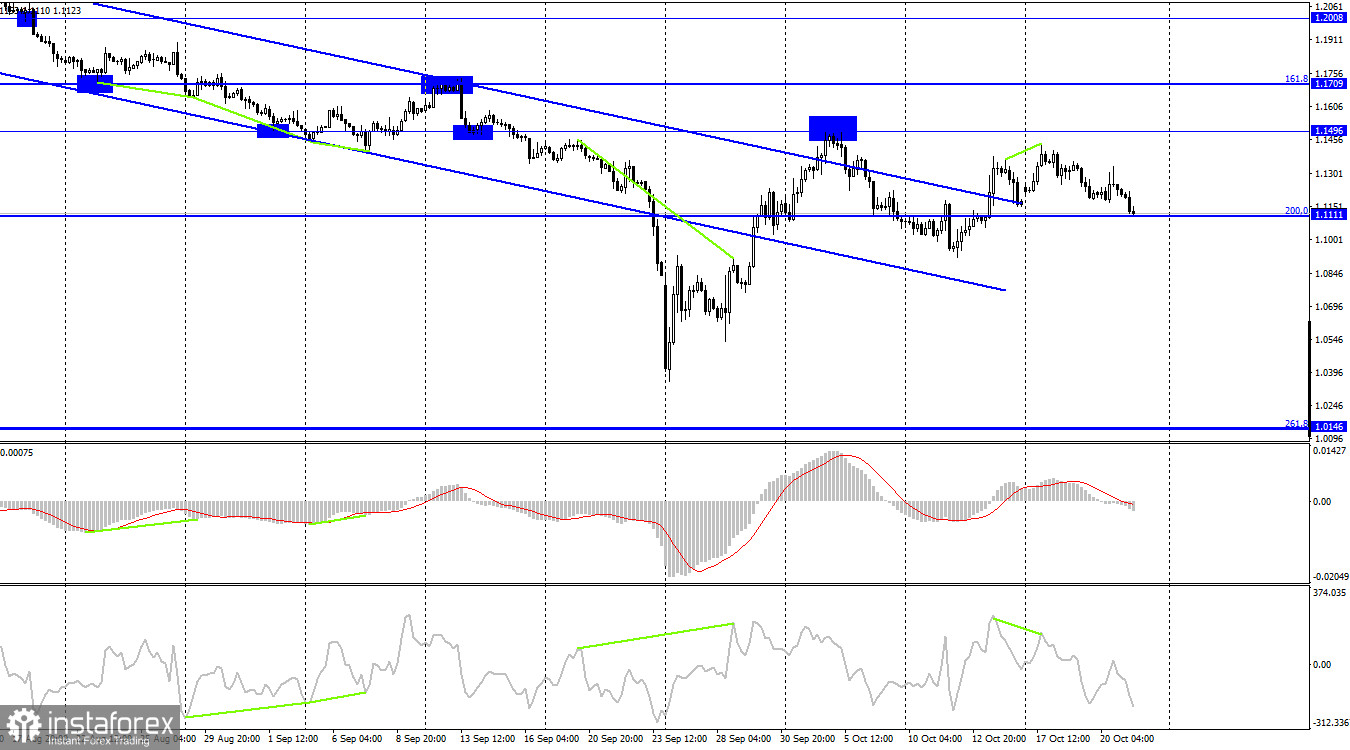

On the 4-hour chart, the pair performed a new closure over the descending trend corridor. Still, after the formation of a "bearish" divergence at the CCI indicator, it reversed in favor of the US currency and began a new fall in the direction of the Fibo level of 200.0% (1.1111). The consolidation of quotes below the level of 1.1111 will increase the likelihood of continuing to fall in the direction of the annual low.

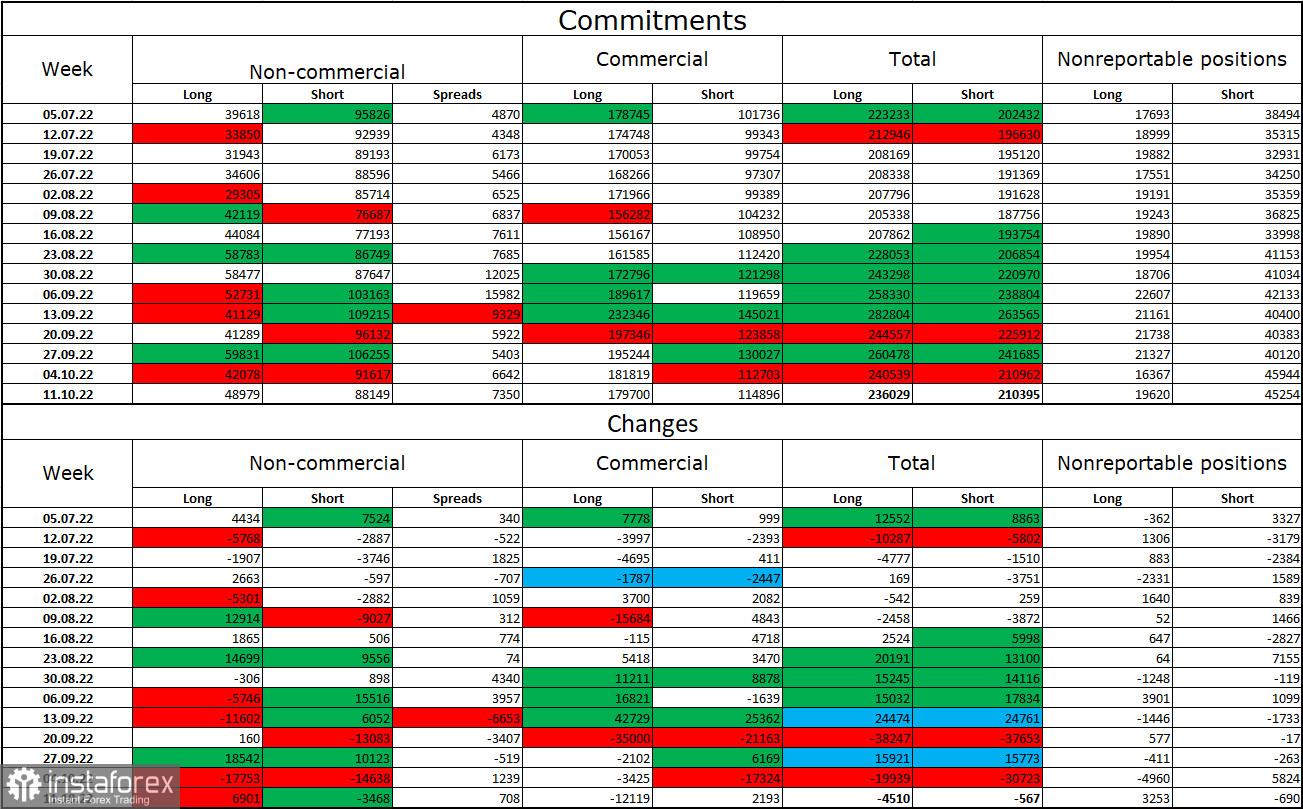

Commitments of Traders (COT) Report:

Over the past week, the mood of the "non-commercial" category of traders has become less "bearish" than a week earlier. The number of long contracts in the hands of speculators increased by 6,901 units, and the number of short contracts fell by 3468. But the general mood of the major players remains the same – "bearish," and the number of short contracts is still much higher than the number of long contracts. Thus, in general, large traders remain mostly in the pound sales, and their mood has gradually changed towards "bullish" in recent months. However, this process is too slow and too long. The pound can continue to grow if there is a strong (for itself) information background, with obvious problems observed in recent months. I draw attention to the fact that the mood of speculators on the euro has long been "bullish," but the European currency is still very cheap paired with the dollar. And for the pound, even COT reports do not give grounds to buy it.

News calendar for the USA and the UK:

UK – retail trade volumes (06:00 UTC).

On Friday in the UK, the economic events calendar contains one entry. Retail sales turned out to be negative, leading to a new British dollar drop. The influence of the information background on the mood of traders for the rest of the day will be absent since the US calendar is empty.

GBP/USD forecast and recommendations to traders:

I recommended new sales when closing below the trend line on the hourly chart with targets of 1.1000 and 1.0727. Now, these deals can be kept. I do not recommend buying the pound yet.