Very soon, the Bank of England, the European Central Bank, and the Federal Reserve will disclose their meeting results. Yesterday, I said that the likelihood of the 75-basis-point hike by all three central banks is about 70-80%. This fact has been capping demand for the euro and the pound sterling. The fact is that the US Fed continues raising the key interest rate and is doing this faster and more aggressively than the ECB and the BoE. The US inflation has been slackening for the third month in a row, whereas the Fed's interest rate exceeded the one of the ECB and the BoE long ago. During 2022, the benchmark rates of the central banks have been rising, whereas demand for the euro and the pound sterling has been falling. That is why this trend will hardly change in late October-early November.

If the ECB and the BoE were able to hike interest rates faster, they would surely do this. However, the monetary policy tightening of 50-75 basis points is a significant change. It is better not to accelerate the process since financial markets may get a terrible shock. The mentioned banks are trying to avoid this shock by raising the benchmark rate at the highest possible pace. What is more, there are such levels that there is no reason to exceed. The faster the key interest rate increases, the more pressure it exerts on the economy. However, now interest rates are raised in order to curb inflation. That is why it is necessary to keep a balance between the biggest possible slackening in the CPI and the smallest economic downturn. No one knows what a decline GDP may show amid a particular interest rate. That is why every month and a half, monetary authorities have to check how inflation and GDP will react to the next tightening.

Against the backdrop, economic growth and the magnitude of its decline are of primary importance now. In the US, the economy managed to recover after the pandemic thanks to various stimulus programs. The UK's and EU's economies were also recovering, though at a slower pace. The Fed has an opportunity to allow the GDP to lose 1-2% to push inflation to the target level of 2%. The BoE and the ECB do not have such a chance. Most analysts suppose that at the beginning of 2023, the Fed's key interest rate will total 4.5%. Since the UK's inflation is higher, the key interest rate should be raised to 5-6%. In this case, GDP may tumble by more than 1-2%. This means that someone will lose their job, as well as production and investment will decrease. Central banks fear that the economy will enter a tailspin. It will take many years to improve the situation. So far, British and European regulators are afraid to raise the rate too much. In this light, demand for the US dollar may resume rising.

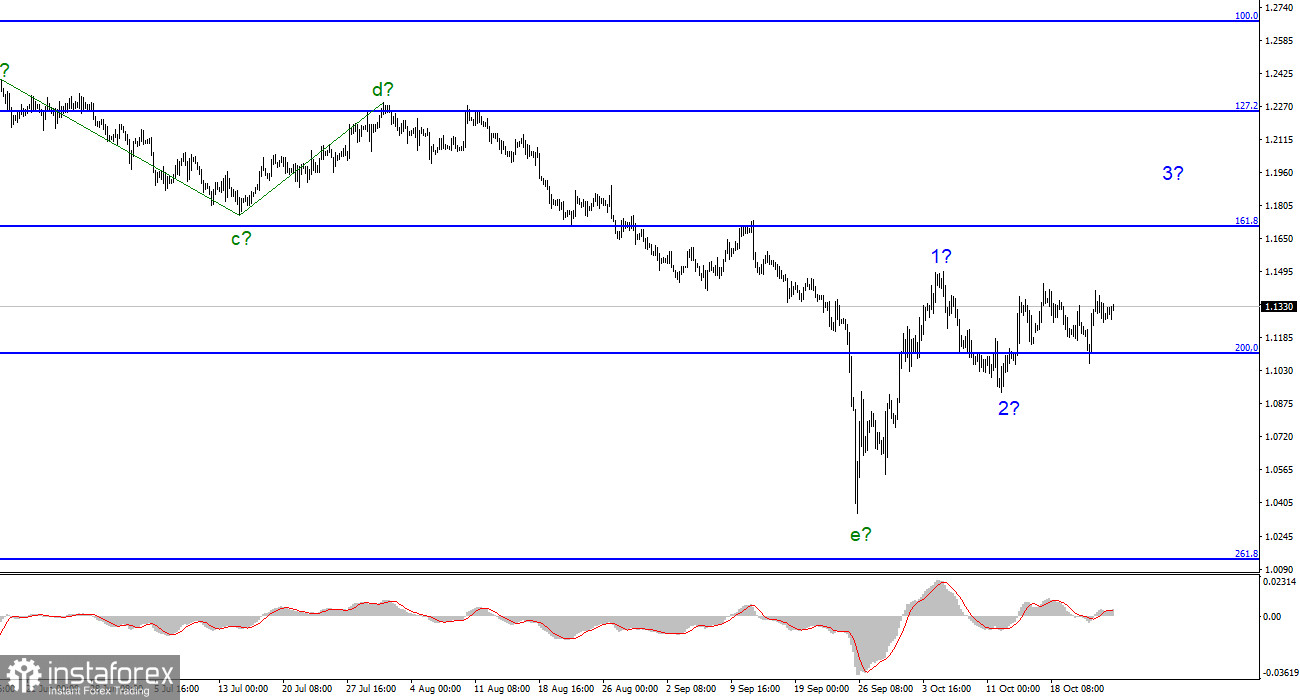

According to the wave analysis, the pound/dollar pair will form a new upward section of the trend. That is why I recommend that traders buy the asset with the target at 1.1705, which is the 161.8% Fibonacci level. Buyers and sellers should be very cautious since the downward section of the trend could become more complicated.