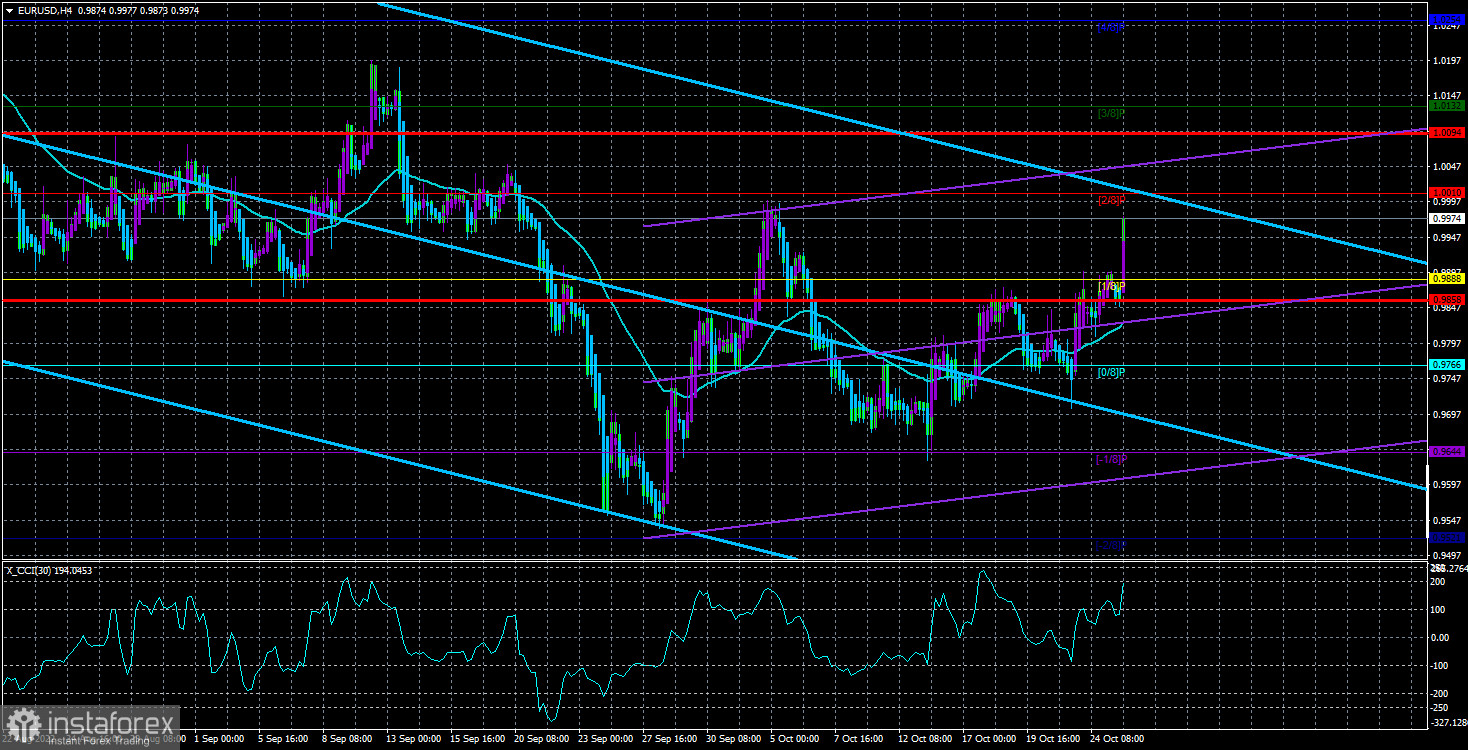

The EUR/USD currency pair is moving upwards with difficulty. It continues to be located above the moving average line. Still, the upward movement does not look confident and capable of continuing for a long time. Let's pay attention to the fact that the pair still cannot update its last local maximum, near the Murray level of "2/8"-1.0010. It cannot reach any of its local maximums in 2022. And if each price peak is lower than the previous one, how can such a trend be called? That's right, descending. Thus, although the European currency has grown by 300–400 points in the last month, we cannot say that the global downward trend that has continued over the past two years is over. And if so, it can resume at any time.

At the moment, the pair is trading between 98 and 100 levels. We said earlier that we expect consolidation around the 0.9800 level. So far, everything is going according to plan, and the pair may even spend a few weeks in this area. There was no reason to buy euros from traders, and there was no reason to sell euros. Why, then, should the pair show growth? Has geopolitics changed recently? No. Has the fundamental background changed? No. Has the European economy started to show higher statistics? No. On the contrary, early Monday showed us that business activity continues to fall - a sure sign of a negative trend in the economy. True, it should be noted that business activity in the United States is also falling, but this does not mean anything for the dollar. The American economy was the first to show signs of recession, and its GDP has been shrinking for two quarters. And did it somehow prevent the US currency from growing? Almost everything depends on the Fed rate and the geopolitical conflict in Ukraine. The Fed rate continues to rise, and the conflict continues to persist. The ideal basis for the continued growth of the US currency.

Relations between the EU and the Russian Federation continue to deteriorate.

However, traders will ask which is worse. There is always a place to roll down further. Any international relationship takes years, if not decades, to develop. The year 2022 showed how long they could be destroyed. The European Union has been working to replace Russian oil and gas with alternative ones from other countries. And it can't be said that it didn't succeed. At least the "energy crisis" can be avoided since the gas storage facilities of the European Union are 90% full, and Christine Lagarde said recently that 2/3 of gas supplies from Russia have already been replaced with "blue fuel" from other countries. However, this does not mean the EU economy will feel fine this winter. You still have to save money. This means that production volumes may still be reduced due to the high price of gas or due to its shortage. In addition, the ECB woke up and began to raise the rate, which will have a "cooling" effect on the economy. On the one hand, this is good since inflation will decrease. On the other hand, it is bad since some problematic EU countries may enter a new crisis themselves. And the most important thing is that the ECB rate hike does not help the euro currency. The market still prefers to buy the dollar, as the American economy has much fewer risks.

Meanwhile, four explosions occurred in the Gulf of Finland, 40 km from Vyborg, where the Nord Stream originates. The Helsinki Institute of Seismology reported this. The institute stated that it was not an earthquake, but the causes of the explosions and their exact location have not yet been established. However, what could explode at the bottom of the sea in an area where there is nothing but a gas pipeline? Thus, the Nord Stream has been subjected to a new diversion, although it is entirely unclear why it undermines an already non-functioning gas pipeline. Nevertheless, there is less and less chance that gas will flow from Russia to the European Union again. So far, only the gas pipeline that passes through Ukraine remains intact.

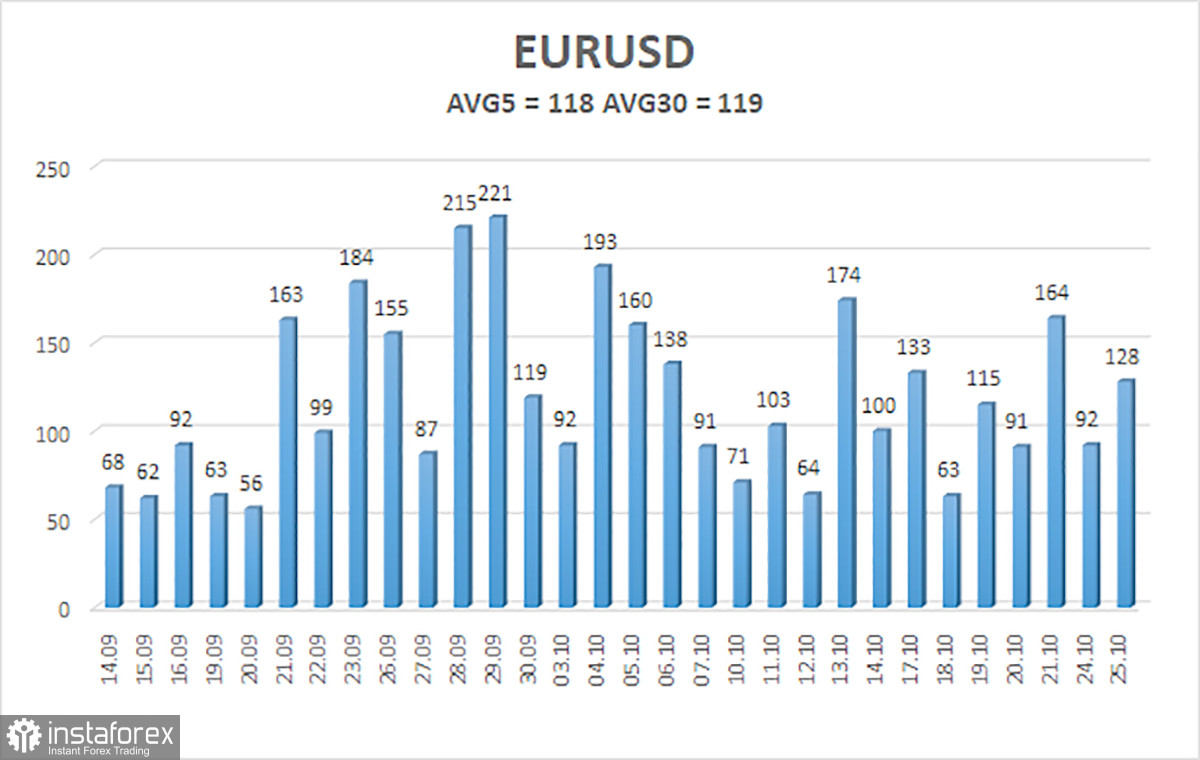

The average volatility of the euro/dollar currency pair over the last five trading days as of October 26 is 118 points and is characterized as "high." Thus, on Wednesday, we expect the pair to move between the 0.9858 and 1.0094 levels. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9766

S3 – 0.9644

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0132

R3 – 1.0254

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, it is necessary to stay in long positions with targets of 1.0010 and 1.0094 until the Heiken Ashi indicator turns down. Sales will become relevant again no earlier than fixing the price below the moving average with a target of 0.9766. The probability of a "swing" remains high.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.