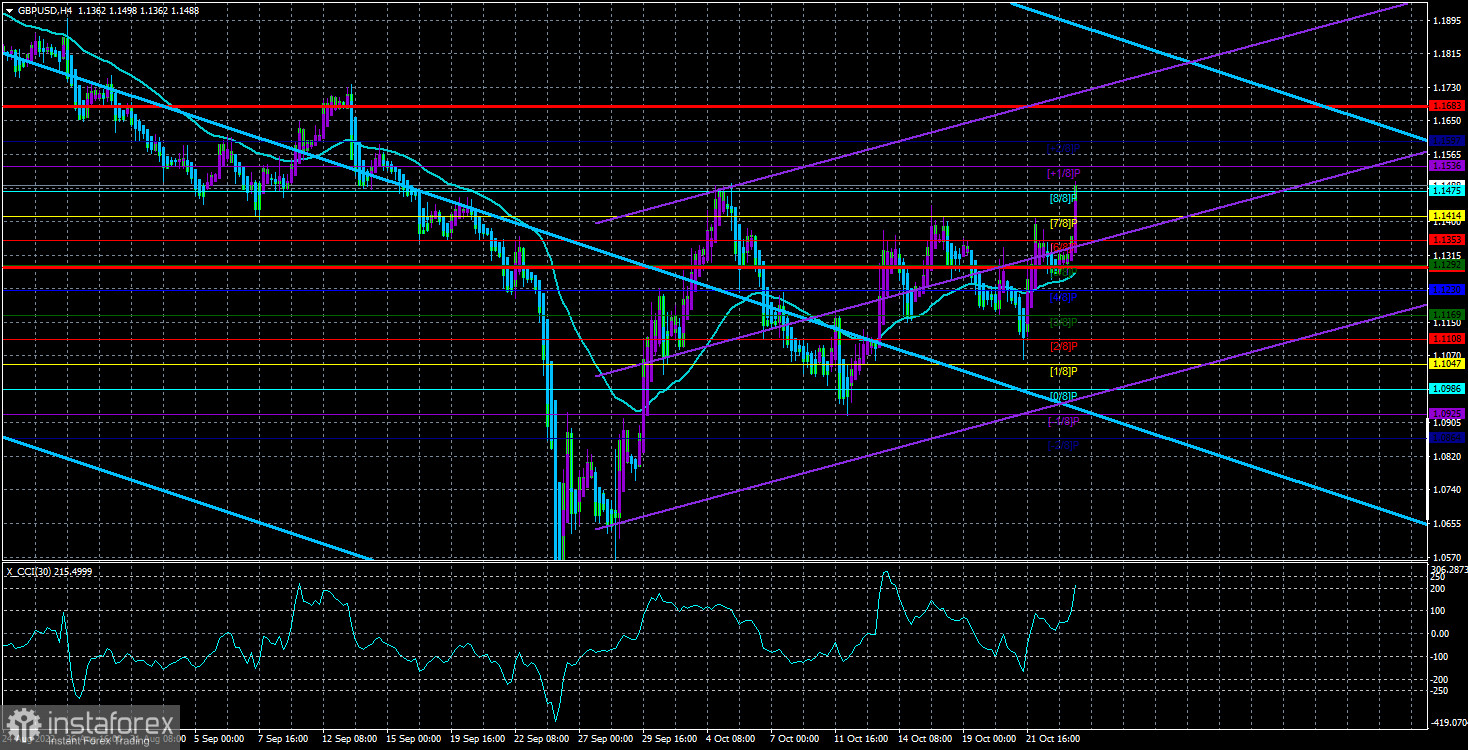

The GBP/USD currency pair was trading quite volatile again on Tuesday, but only due to movements in the American trading session. Currently, the British currency is slightly moving and has the same problem as the euro. It cannot update or overcome its last local maximum in any way. Even in the illustration above, it is visible that each subsequent price maximum is lower than the previous one. Thus, we can only draw the same conclusion as for the euro – the global downward trend cannot be considered complete with a 100% probability.

Earlier, we said that one of the brightest signs of the end of a long trend is a sharp departure in the opposite direction of the trend. A few weeks ago, such a departure when the pair grew by 1100 points. However, we also said that this growth has a sufficient accidental basis. If former British Prime Minister Liz Truss had not started her cadence so badly, the pound would not have collapsed by 1000 points and then would not have grown by 1100. We consider that segment of growth by 11 cents only as a market response to the cancellation of the tax reduction initiative, which could lead to a financial catastrophe. Therefore, it is quite reasonable not to consider those movements that happened by chance. If so, the pound remains "at the bottom," and there was no sharp upward movement.

We can also pay attention to the euro/dollar pair, where there was no collapse and no rise in quotes. According to the euro currency, can we now say the global downward trend is over? Unlikely. Since the euro and the pound like to move identically, we tend to believe that those two segments of a strong fall and growth in the pound only confused the technical picture. Now many are waiting for the growth of the British pound, and on what basis can it happen if neither the fundamental nor the geopolitical backgrounds have changed? All those factors that brought the pound so low remain in effect.

Penny Mordaunt withdrew her candidacy from the election.

In yesterday's article, we already said that there are only two candidates for the prime minister post. However, yesterday morning, it became known that Penny Mordaunt voluntarily withdrew her candidacy, stating that she fully supports Rishi Sunak. Thus, the British millionaire of Indian origin automatically became the country's prime minister, the youngest in the last 200 years. King Charles III officially approved his candidacy, and earlier, Boris Johnson, who had a good chance of winning, refused to participate in the elections. On the second attempt, Sunak still became prime minister, and now Britain is waiting for him to take the first steps as the head of state after the disastrous start of Liz Truss, which shocked the whole of Britain.

We believe that the change of power in the UK may slightly support the British currency, but we do not expect strong growth due to this fact alone. The British economy has been going through hard times since it decided to leave the European Union. By the way, at this time, according to YouGov polls, most Britons regret leaving the EU and want to return to it. There are more than 60% of them. Recall (and we repeatedly wrote about this five years ago) that the referendum ended with a score of 48% - 52% in favor of those who support Brexit. That is, even at the time of 2016-2017, about half of the British were against the exit. When the UK economy is frankly stalling, inflation is rising, and living standards are falling, many who voted for Brexit have already changed their minds. As recently as last weekend, several thousands of rallies were held to support the country's return to the European Union. Of course, in the near future, it is difficult to imagine that Britain will be asking for it back, but at the same time, the mood of the British population is beginning to change from satisfied to dissatisfied.

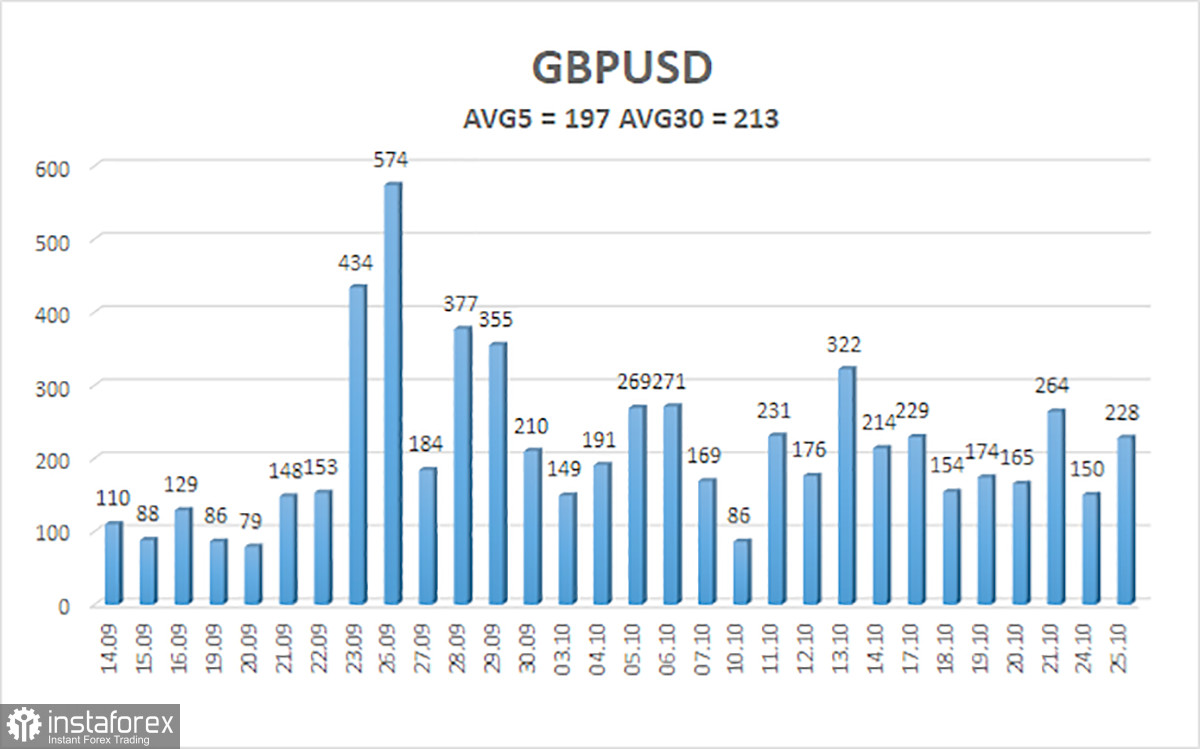

The average volatility of the GBP/USD pair over the last five trading days is 197 points. For the pound/dollar pair, this value is "very high." On Wednesday, October 26, thus, we expect movement inside the channel, limited by the levels of 1.1290 and 1.1683. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading Recommendations:

The GBP/USD pair has started a new upward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.1592 and 1.1683 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1169 and 1.1108. At this time, the probability of a "swing" is high.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.