Although the rise in gold is to be commended, it is entirely based on the weakness of the dollar. In addition, market participants are reducing prices for the precious metal.

According to Reuters, gold rose to a two-week high on Wednesday as dollar and U.S. bond yields tumbled on expectations that the Federal Reserve will soften its aggressive rate hike stance starting in December.

As of 16:05 EST, the dollar index was down 1.16% to hit 109.59:

Spot gold at that time was fixed at $1,665 with a net profit of $11.90. However, as we have seen many times recently, it was the weakness of the dollar that led to an increase in spot gold prices by $ 17.20, and pressure from sellers led to a decrease in the price of gold by $5.30.

This clearly shows that market participants continue to focus on the pace and scale with which the Federal Reserve continues to raise interest rates. It is widely accepted that the Fed will raise rates by 75 basis points in November, and for the most part this has already been factored into current market prices. It is also widely believed that the Fed will continue to raise rates at the December FOMC meeting.

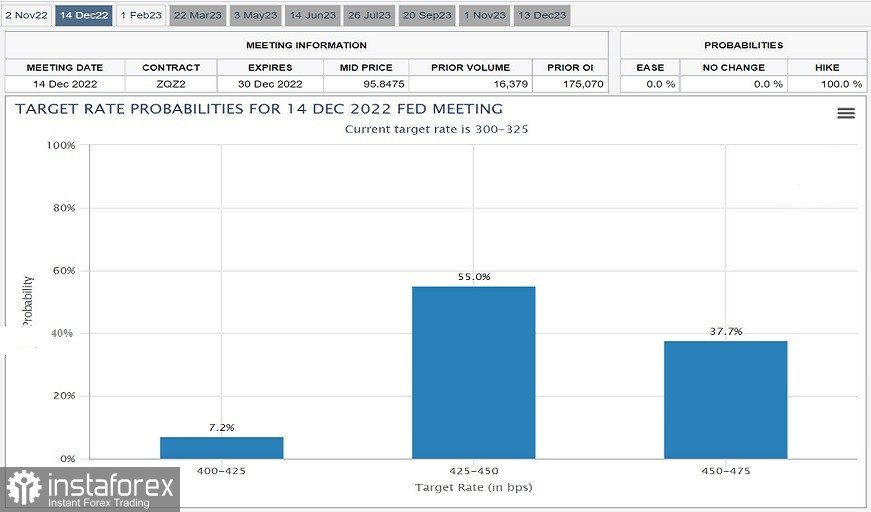

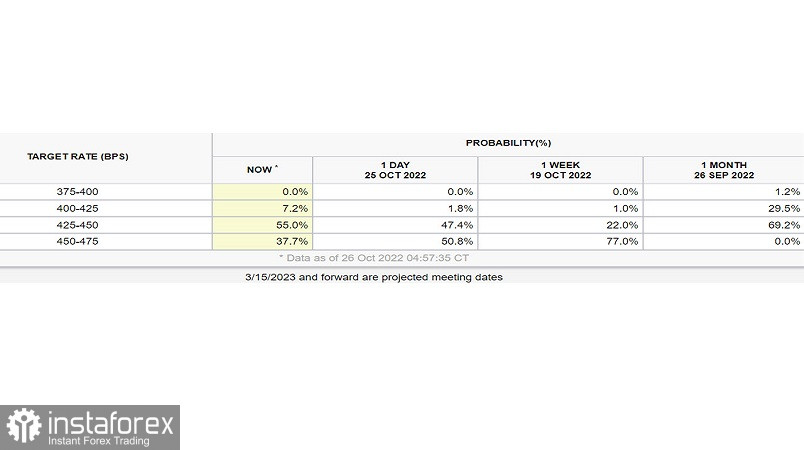

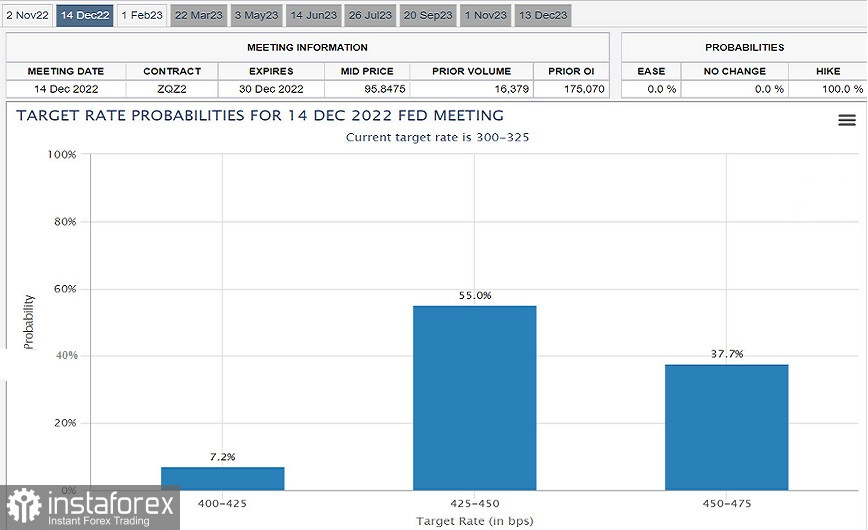

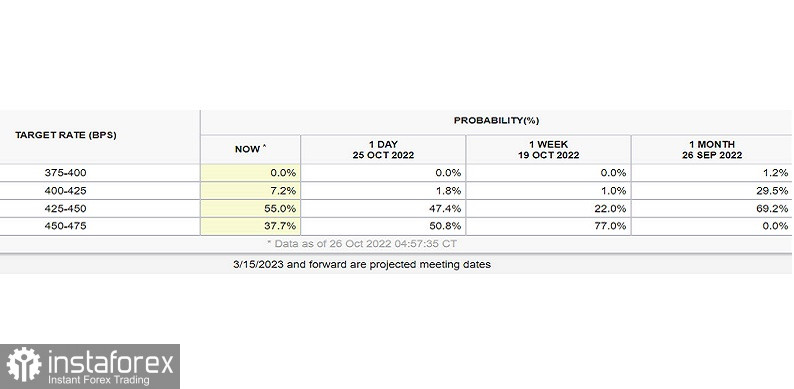

According to the FedWatch tool, there is a 55% chance that the Federal Reserve will raise rates to 425–450 basis points and a 37.7% chance that they will raise rates to 450–475 basis points in December.

For February 2023, there is no final consensus on the size of the rate hike. According to the CME FedWatch tool, there is a 26.8% chance that the Federal Reserve's base rate will be in the range of 450 to 475 basis points.

There is a 42.4% chance that Fed rates will be in the range of 475–500 basis points, and by the end of the year the base rate will be in the range of 500–525 basis points.

Uncertainty about the scale of the upcoming rate hike is directly related to expectations that the Fed will change its mind with the arrival of new data. Important reports are coming out this week that will help shape the Fed's decision to raise rates in both November and December.

Today, the US government is to release third-quarter GDP data, as well as an update on US government debt. On Friday, the government will publish its report on core inflation or PCE. This can provide key and important data that will determine what the Federal Reserve's next steps might be.

The most important question is whether analysts expect an economic slowdown due to the rapid rate hikes that began in March. However, what will be the inflationary pressure? What if we don't see inflation drop after five consecutive Fed rate hikes this year?

The fear remains that after all the rate hikes by the Federal Reserve, we will see only the nominal effect of reducing inflation in Friday's report.