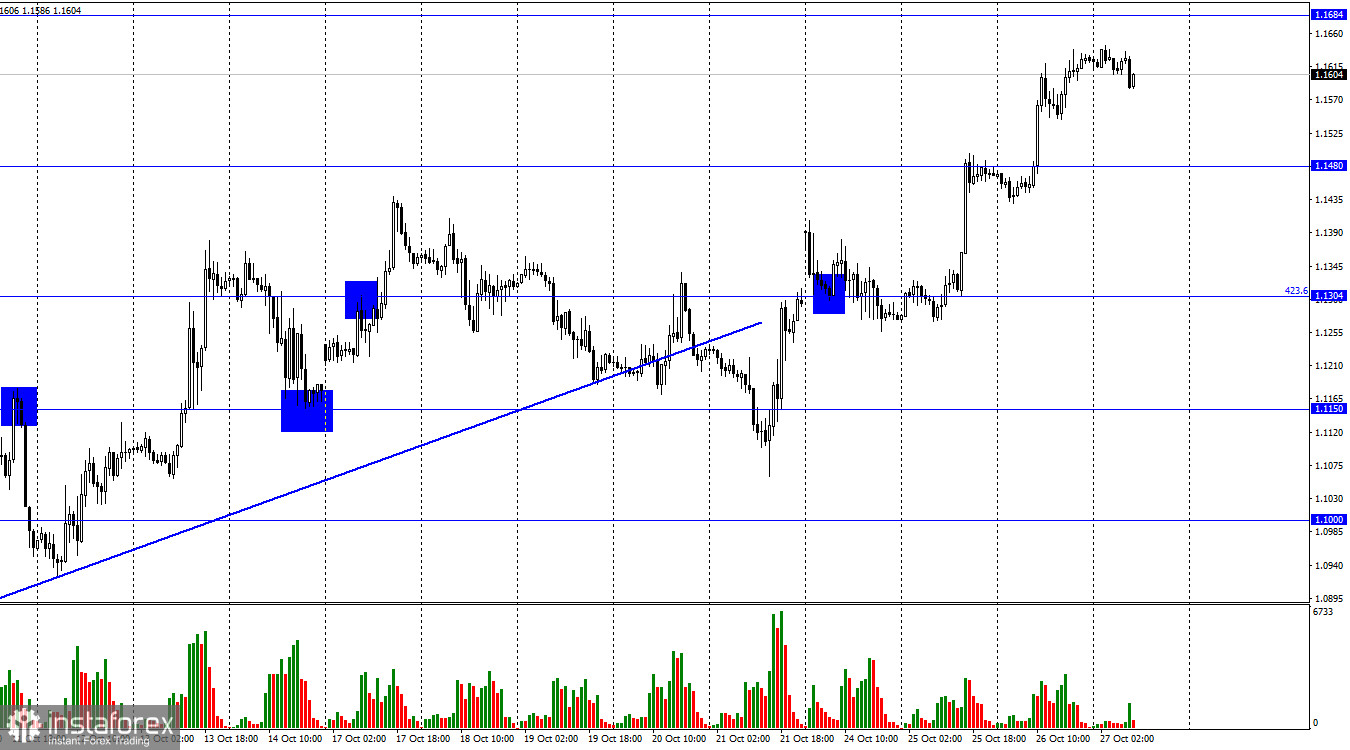

According to the hourly chart, the GBP/USD pair continued the growth process on Wednesday after closing above the level of 1.1480 in the direction of the next level of 1.1684. There was no information background yesterday, so I think that the growth of the euro and the pound occurred due to the refusal of traders to buy the dollar on the eve of the Bank of England and ECB rate hikes. Everyone has already gotten used to the Fed's rate hike and could even have already taken into account all future tightening of US monetary policy. Moreover, we already know the value to which the Fed can raise its rate – 4.5-4.75%. In the cases of the Bank of England and the ECB, everything is more complicated and traders cannot fully take into account the final size of the rates in advance.

The closer the meeting of the Bank of England is, the higher the rates rise. In the figurative sense of the word. After the latest report on British inflation was released, it became clear that prices in the UK continue to rise very quickly. The Bank of England needs to tighten its approach to rates, even more, otherwise, we may soon see 15% inflation in annual terms. Thus, traders have no doubt that the rate of the British regulator will rise by 0.75% in November, but the probability of an increase of 1.00% is also growing and is already 40-50%. All three central banks are preparing for a large-scale increase, so I am not sure that the British will continue to show growth. It looks very much like traders are now buying up the pound and the euro, working out future rate hikes by central banks. However, ignoring the Fed rate hike completely will not work either.

Also, the British pound may feel a surge of optimism due to the coming to power of Rishi Sunak, who served as finance minister for two years and knows best how to manage the economy. The hopes for Sunak are very high and the risks are also very high since he won the election almost without any struggle. He was the only candidate who crossed the threshold of 100 votes of support from the Tory Conservatives.

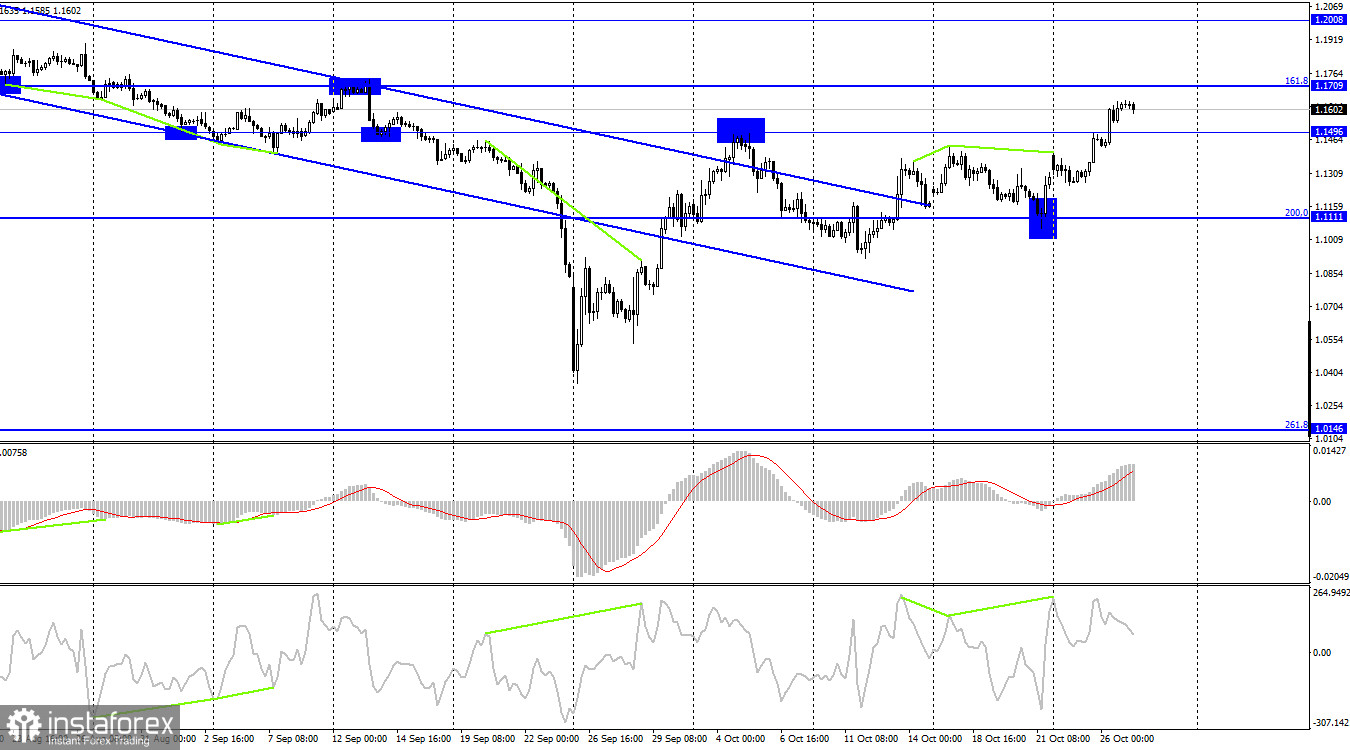

On the 4-hour chart, the pair performed a new reversal in favor of the British, canceled the "bearish" divergence, and secured above the level of 1.1496. Thus, the growth process can be continued in the direction of the Fibo level of 161.8% (1.1709). A rebound from this level will work in favor of the US currency and some fall. But the key growth factors of the pair are now the rebound from the level of 1.1111 and consolidation above the downward trend corridor.

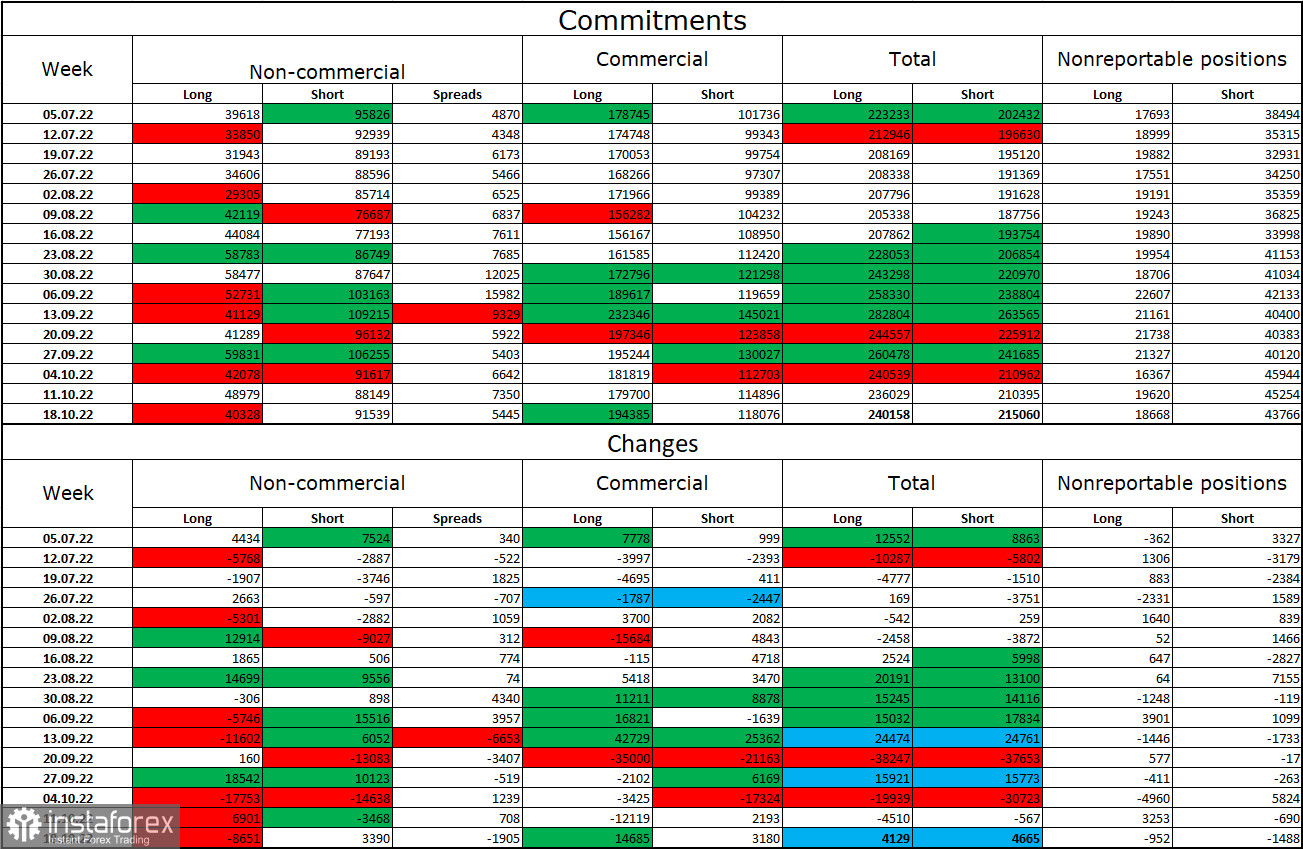

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders over the past week has become more "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 8,651 units, and the number of short contracts increased by 3,390. But the general mood of the major players remains the same – "bearish," and the number of short contracts is still very much higher than the number of long contracts. Thus, in general, large traders continue to mostly remain in the sales of the pound and their mood is gradually changing towards the "bullish" in recent months, but this process is too slow and long. The pound can continue to grow only if there is a strong (for itself) information background, with which obvious problems have been observed in recent months. I draw attention to the fact that the mood of speculators on the euro has long been "bullish", but the European currency is still not popular among traders. And for the pound, even COT reports do not give grounds to buy it.

News calendar for the USA and the UK:

USA - Basic orders for durable goods (12-30 UTC).

USA – GDP for the third quarter (12-30 UTC).

USA - The number of initial applications for unemployment benefits (12-30 UTC).

On Thursday, the calendar of economic events in the UK does not contain anything interesting, but there will be at least two reports in the US that are important. The influence of the information background on the mood of traders today will be average in strength.

GBP/USD forecast and recommendations to traders:

I recommend selling the British in the event of a rebound from the level of 1.1709 on the 4-hour chart with a target of 1.1496. It was possible to buy the British dollar with a target of 1,1709, now these transactions should be kept open until the outcome of the ECB meeting and American statistics.