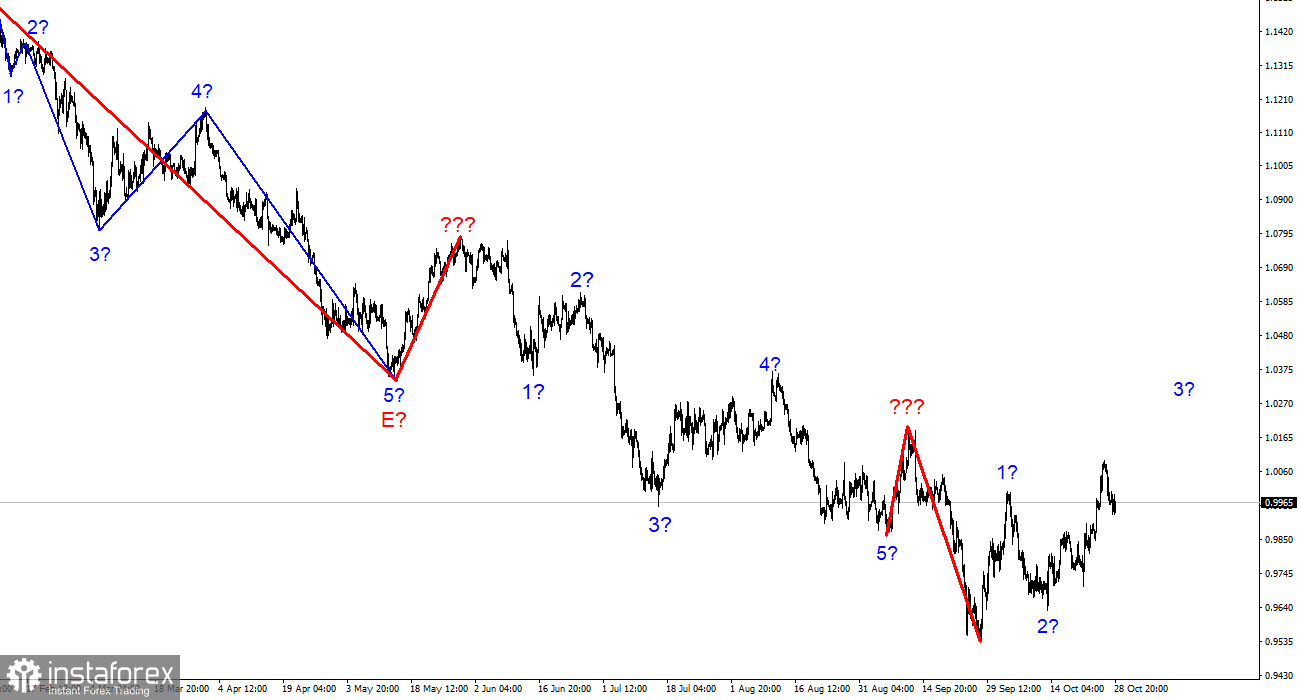

The wave marking of the 4-hour chart for the euro/dollar instrument has finally undergone certain changes. The demand for European currency has been growing in recent days. Quotes have been rising, and this has led to the fact that they have gone beyond the peak of the last rising wave. Thus, now we have at least a three-wave ascending structure, which can become a new upward section of the trend for five or more waves, or it can remain a three-wave corrective. In the first case, the European currency has a good chance of growth over the next few months. In the second case, the decline in quotes may resume at any moment. The most important thing is that now the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but in practice, it happens extremely rarely. Now both instruments assume the construction of at least one more upward wave, and the low of September 28 can be considered a new starting point. The downward section of the trend has become so complicated that even its internal waves are very difficult to identify correctly. But now we have a clear starting point.

The demand for the euro currency is declining.

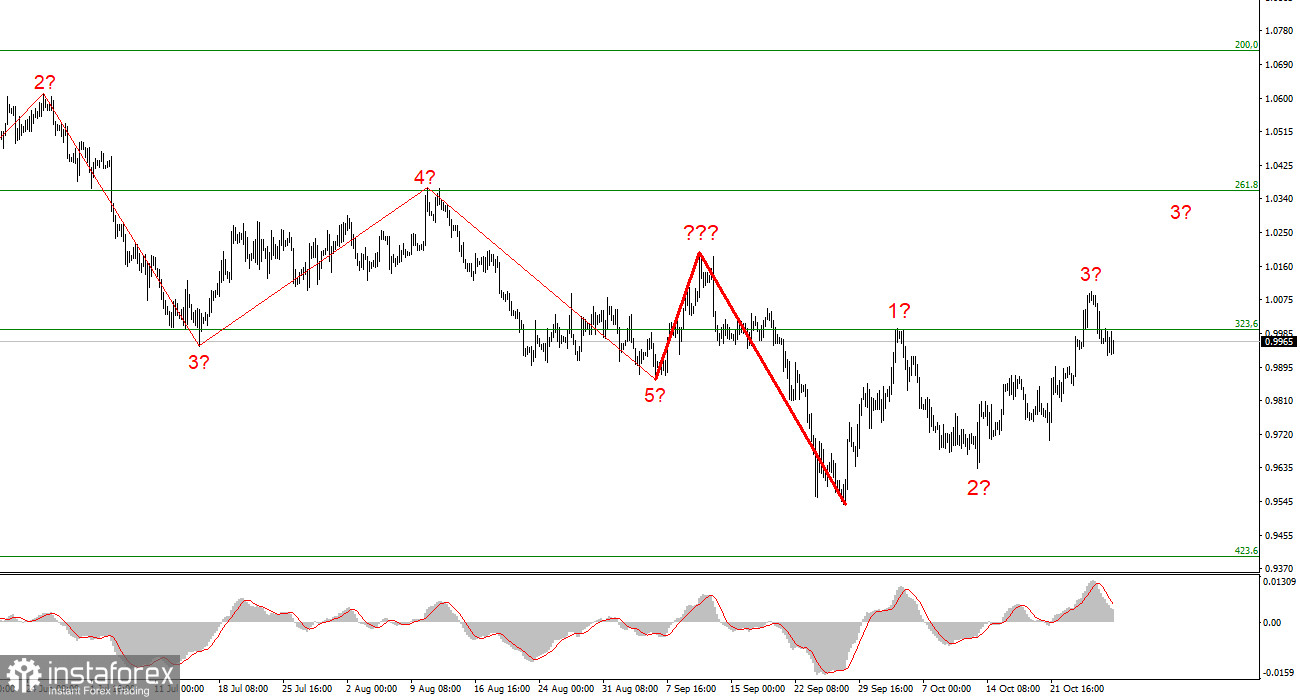

The euro/dollar instrument did not decrease or increase by 1 point on Friday. Nevertheless, earlier a successful attempt was made to break through the 323.6% Fibonacci level, which indicates the readiness of the market to sell the instrument. On Thursday and Friday, the demand for the European currency was declining, and it was clear that the market had won back the ECB interest rate increase, and now it intends to prepare for the Fed meeting to be held next week. In my opinion, the wave pattern may undergo serious changes after the market learns the results of this meeting.

What can we expect from the Fed? In the last few weeks, rumors have been actively circulating that the rate will continue to rise but at a slower pace than before. I think it's just a rumor. The head of the San Francisco Fed, Mary Daly, said that "it's time to start discussing the slowdown in the rate hike." Thus, at the November meeting, the FOMC members will only begin to pronounce this scenario. Therefore, I do not expect the rate to rise by less than 75 basis points. If this assumption is correct, then the demand for the US currency may grow significantly, just as the demand for the euro grew this week before the ECB meeting. What does this mean for wave marking? If wave 3 of the upward section is being built now, then the instrument should resume raising quotes as soon as possible so that the wave takes a five-wave form. In this case, it will be possible to expect the construction of the fifth wave of the ascending section. If this wave is c, then the decline may continue next week, but then the entire downward section of the trend may take an even longer form or start building a new downward section.

General conclusions.

Based on the analysis, I conclude that the construction of an upward trend section has begun, but it may not last very long. At this time, the instrument can build a new impulse wave, so I advise buying with targets located near the estimated mark of 1.0361, which equates to 261.8% by Fibonacci, by MACD reversals "up." However, by the end of this section of the trend, you also need to be ready now.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any kind of length, so I think it's best now to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be just completed, and a new one has begun its construction.