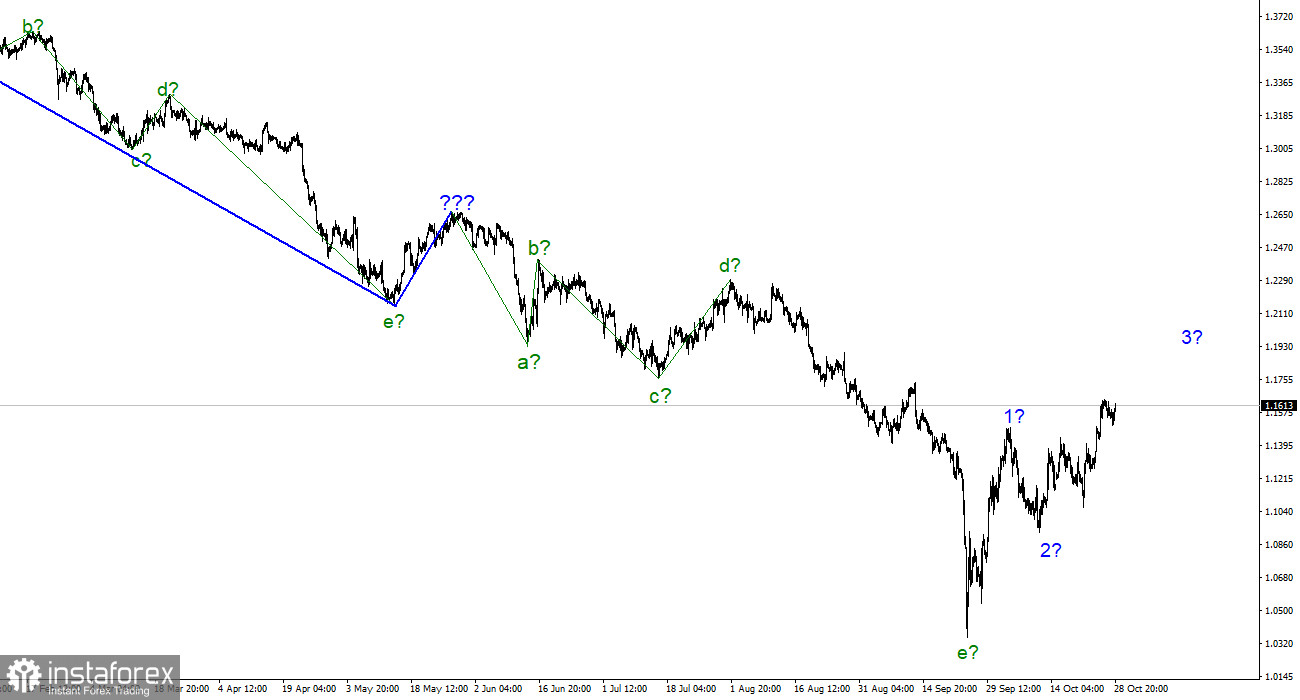

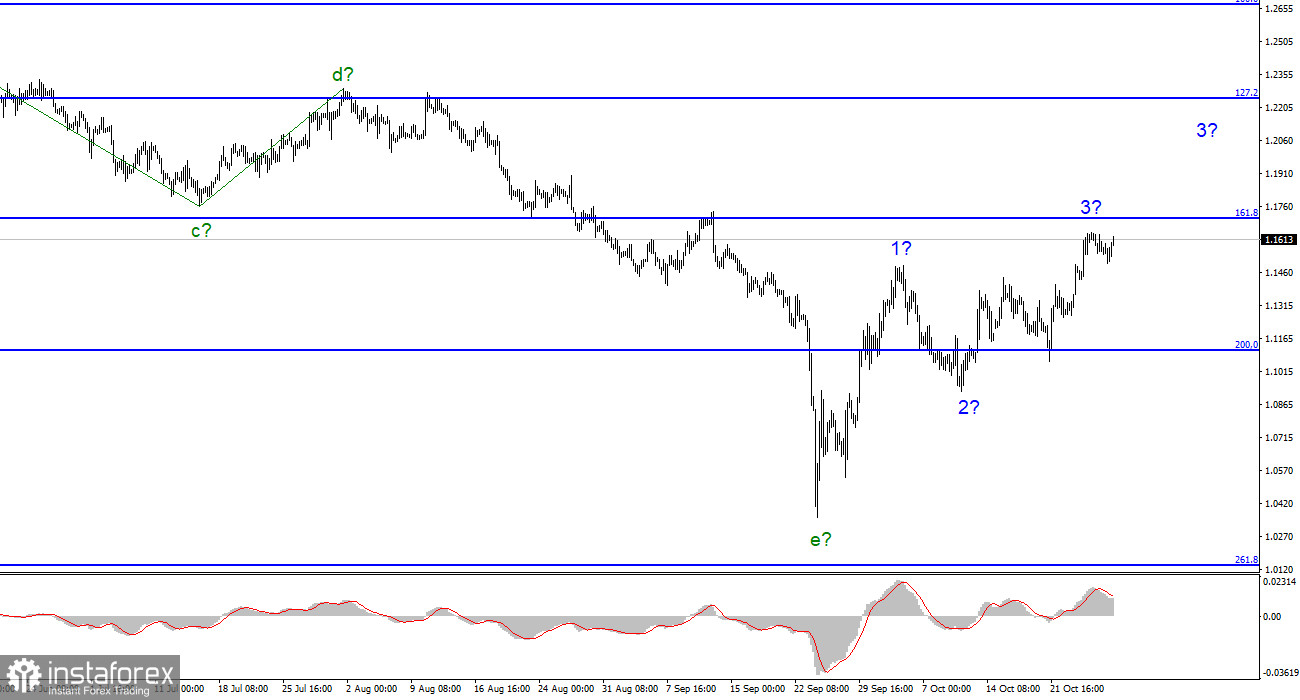

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. If this is indeed the case, then the construction of a new upward trend section has begun. Its first and second waves are presumably completed, and the third wave is being built, which can be both 3 and C. Since the European wave marking has changed, both wave markings now coincide. As I have already said, the upward structure can be limited to only three waves. In this case, the completion of the third wave may occur at any time, after which the construction of a new downward trend section may begin since the peak of this wave is already above the peak of the first wave. And if this wave is c, and not 3, then it should not be extended; just a small approach above the last peak is enough. Thus, we finally managed to sort out the wave markings, which have recently left many unanswered questions, but there are still huge doubts that the demand for the British will grow for a long time now. The instrument retains the possibility of resuming a downward trend segment.

The market is approaching the meeting of the Bank of England on a positive note.

The exchange rate of the pound/dollar instrument increased by 55 basis points on October 28. Thus, the construction of the current wave continues, unlike the upward wave for the euro/dollar instrument, where it may already be completed. The British pound approaches the meeting of the Bank of England in a good mood, and the fact that it continues to increase and the euro does not lead me to think that the market is waiting for the most "hawkish" decision from the Bank of England. In my opinion, this may increase the interest rate by at least 75 basis points. At the last meeting, several members of the PEPP committee supported the option with an increase of 75 points, but the number of those who voted for a 50-point increase turned out to be more.

Then came the report on inflation in the UK, which again witnessed an increase. Therefore, the Bank of England has no other option but to increase the pace of tightening the PREP. Until Wednesday, the demand for the British dollar may increase, and then it may suffer the fate of the euro, which began to lose demand on the day of the ECB meeting as the market played out the rate increase in advance. But the very next day, the Fed will hold a meeting, at which we should also expect a rate increase of 75 points. We are waiting for a very busy week, and the wave marking may undergo significant changes based on its results. I believe that other actions of both central banks, besides raising rates by 75 points, as everyone expects, are also not excluded. In this case, the instrument's dynamics will depend on which bank and in which direction it will deviate from the value that is now generally accepted.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a new upward trend segment. Thus, I advise buying the instrument on the MACD reversals "up" with targets near the estimated mark of 1.1705, equating to 161.8% Fibonacci. You should buy cautiously, as the trend's downward section may resume construction.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it may already be completed.