The EUR/USD currency pair started the new week quite calmly. On Monday, no important information was published in the States, but there were important reports in the European Union that market participants cheerfully ignored. It is not the first time we have noticed that the market does not pay attention to important events or reports from the EU. Of course, the ECB meeting is an exception, but most other events are ignored. Moreover, more volatile trades are observed in the American trading session, and in the European one - the pair often moves sideways. There is a feeling that everything in the foreign exchange market now depends on the US dollar.

The pair spent most of the week's first trading day near the moving average. We believe overcoming or rebounding from this line should be unambiguous. Therefore, fixing above or below 20 points cannot be considered a clear signal. This week, given the strength of the fundamental background, almost any movement can occur. So far, the US dollar has been gradually growing for the third day, as if playing off the Fed's rate hike in advance, which no one doubts. And the more the fed rate rises, in the end, the more likely the US currency will grow again during this period. After all, what has happened in recent weeks? The European currency rose from its 20-year lows by 550 points. Yes, this is quite a lot and can be considered the beginning of a new upward trend, but the fundamental and geopolitical backgrounds remain very difficult for all risky assets. Pay attention to the same bitcoin, for example. Well, it grew to $ 2,000, and then at the expense of what to grow? The same is now true for the euro currency. Yes, it showed an increase of 5.5 cents against the dollar, but before that, it had fallen for two years and lost 25 cents. 5.5 cents is a correction of 21%. And with the continuing negative background that has brought the euro so low, who can say that the US dollar is no longer of interest to traders and investors?

The European economy continues to slow down.

On Mondays, we rarely witness important events or publications. However, yesterday was an exception. Two important reports have been published in the European Union, and we believe that they determine the future fate of the euro. First, look at the GDP report for the third quarter as a preliminary value. The growth was only 0.2% q/q, which means that the EU economy has already come close to the moment when there will be no growth. Recall that the ECB raised the rate to only 2%, and economic growth has already fallen to almost 0.

Consequently, any further tightening of monetary policy will not lead to a slowdown but a fall. And the more the European economy falls, the more painful it will be for its most problematic countries, like Greece. We believe that the ECB will not be able to thoughtlessly raise the rate as much as it wants or as much as it sees fit. It should be remembered that the Fed "manages" the economy of one country and the ECB – a whole conglomerate of countries. Consequently, the ECB should consider the interests of the weakest members of the alliance financially so that countries like Germany or Austria do not cover their debts at their own expense. Therefore, the ECB rate has an upper limit of growth.

At the same time, inflation in the European Union rose to 10.7% and did not even notice three rate increases by the regulator. In principle, we observed the same thing during the initial period of the Fed rate hike, when the rate was rising, but inflation did not notice it. However, the maximum value of inflation in the States was 9.1%, which has already shocked all economists. Inflation in the EU has quietly crossed the double-digit threshold and continues to grow. This suggests that the ECB will have to raise the rate more than the Fed, and the Fed, recall, aimed at the level of 4.75%, which, according to many experts, will plunge the economy into recession. If there is a recession in the United States, then the European Union will not avoid it. And, most likely, it will be stronger in the EU. The ECB will try to minimize the risks and not raise the rate too much. From our point of view, this means that the dollar may be in high demand for a long time.

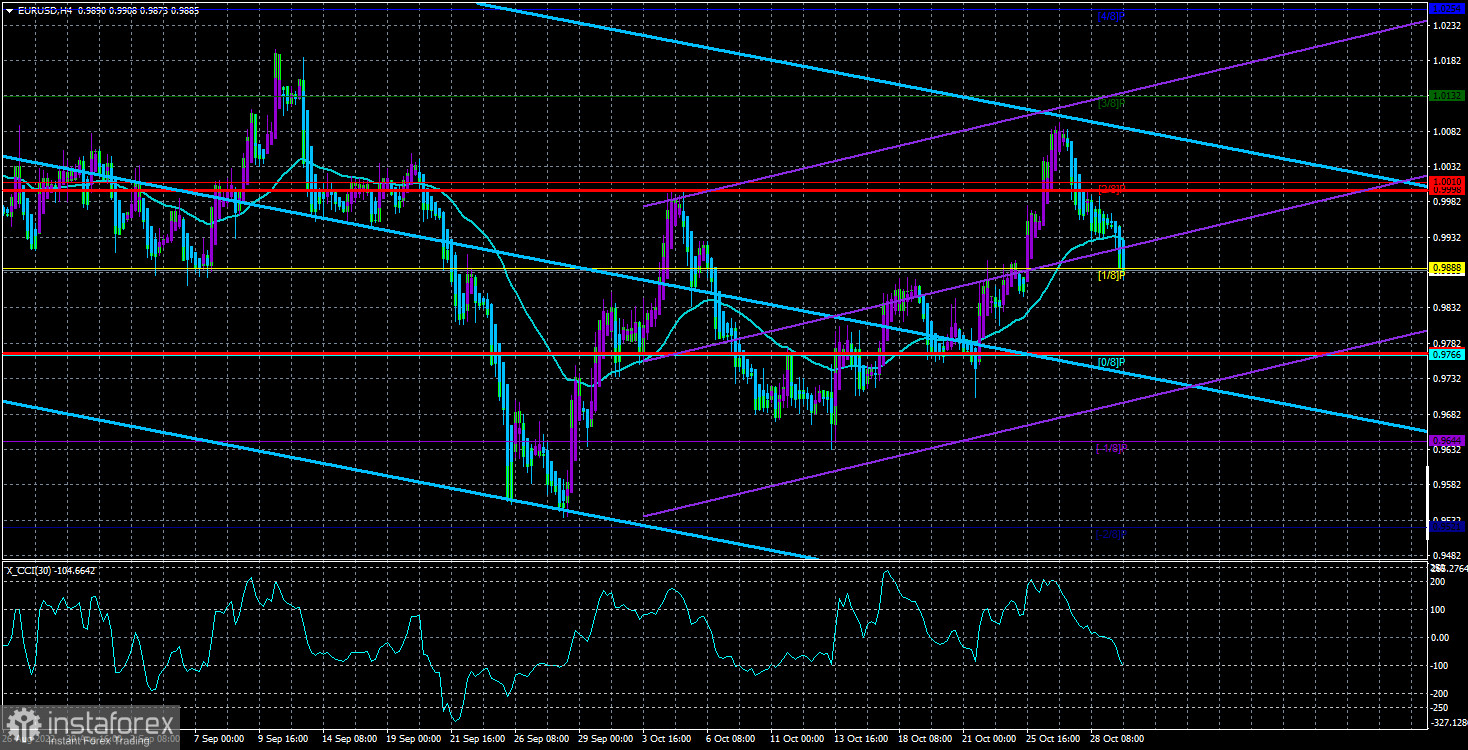

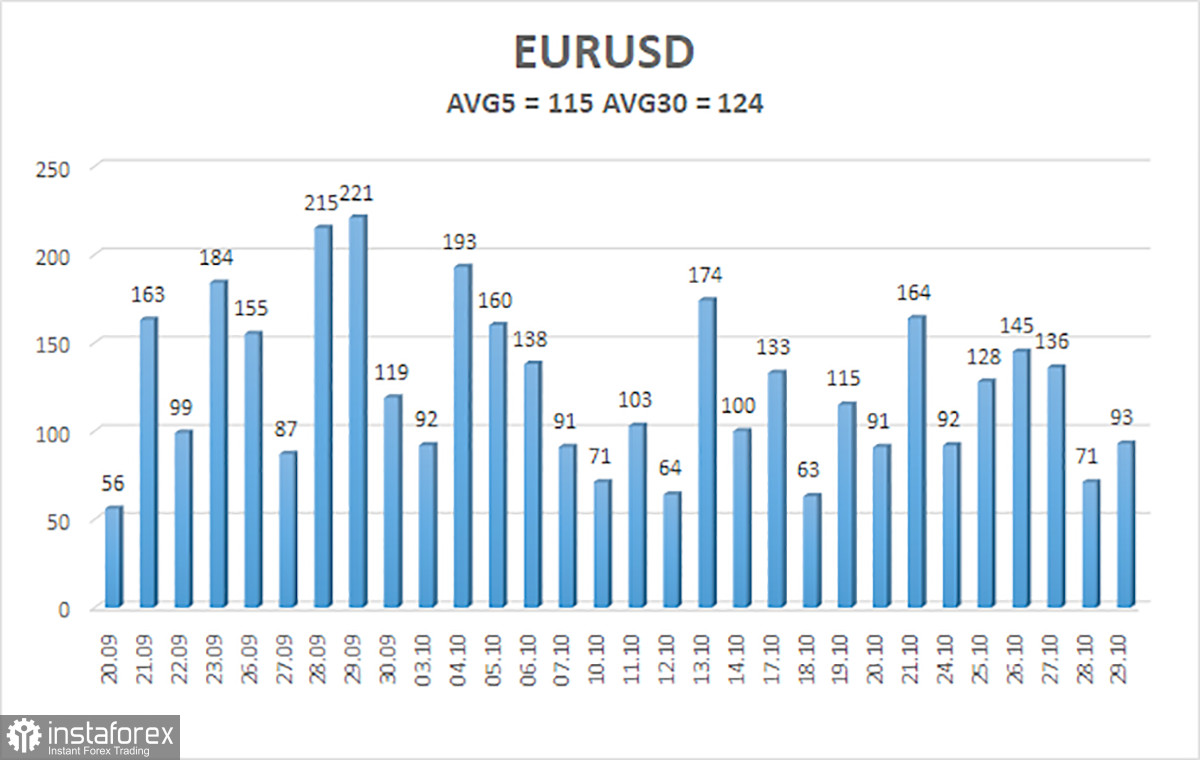

The average volatility of the euro/dollar currency pair over the last five trading days as of November 1 is 115 points and is characterized as "high." Thus, on Tuesday, we expect the pair to move between 0.9768 and 0.9998 levels. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9766

S3 – 0.9644

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0132

R3 – 1.0254

Trading Recommendations:

The EUR/USD pair has consolidated slightly below the moving average. Thus, it would be best if you stayed in short positions with a target of 0.9766 until the Heiken Ashi indicator turns up. Purchases will become relevant again no earlier than fixing the price above the moving average with goals of 0.9998 and 1.0010.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.