Now, a lot depends on the decision that the Fed will take on Wednesday. Notably, markets have already predicted the meeting outcome. They suppose that the regulator will raise the key interest rate by 75 basis points. Most analysts also expected the 75-basis-point rise on Wednesday. Then, the Fed may raise the benchmark rate by 50 basis points and, later, by 25 basis points. After that, the regulator is likely to take a pause to analyze the inflation's reaction to the 4.75% interest rate. Some FOMC members believe that this should be enough to push inflation to the 2% target in the next year or two. If the Fed sees a confident decline in inflation, it may start cutting the benchmark rate closer to the end of 2023.

However, every action has its aftermath. In the recent six months, economists have been discussing the possibility of the US economic recession in the next two years. I suppose that a recession itself is not a catastrophe as the economy cannot grow forever. It is a wavy process. However, experts polled by Bloomberg think that a recession will hit not only the US and the EU but the whole world. It is predictable since the US and the EU are one of the leading economies in the world and a lot depends on them. It is obvious that a decline in the GDP of the EU and the US will lead to a slowdown in the Chinese economy and economies of developing countries. What will be the magnitude of this drop? In fact, analysts expect a decrease of just 1-2%. Although it is a considerable downturn, it is not a catastrophe. If there was a depression on the horizon, then the panic could be reasonable. The world has faced numerous recessions. Every 5-10 years, economies of various countries overcome economic crises and ordinary people do not even pay attention to them. Consumer prices always rise independently of a crisis.

If we extrapolate a possible recession from the euro or dollar exchange rates, we will hardly say when it began. For the market only money flows are important. If the Fed's key interest rate is higher than in Europe, then investments go to the US. And vice versa. Why has the dollar grown so much in the last 9 months? The fact is that the Fed's interest rate began to rise much earlier and increased significantly more as of November. Geopolitical stability is also important for the market. In case of tensions, traders invest in the safest assets and currencies. Thus, the US dollar is the best variant as it is the global reserve currency. I suppose that demand for the greenback will remain high for a long time. Traders have no reasons to sell the US dollar now.

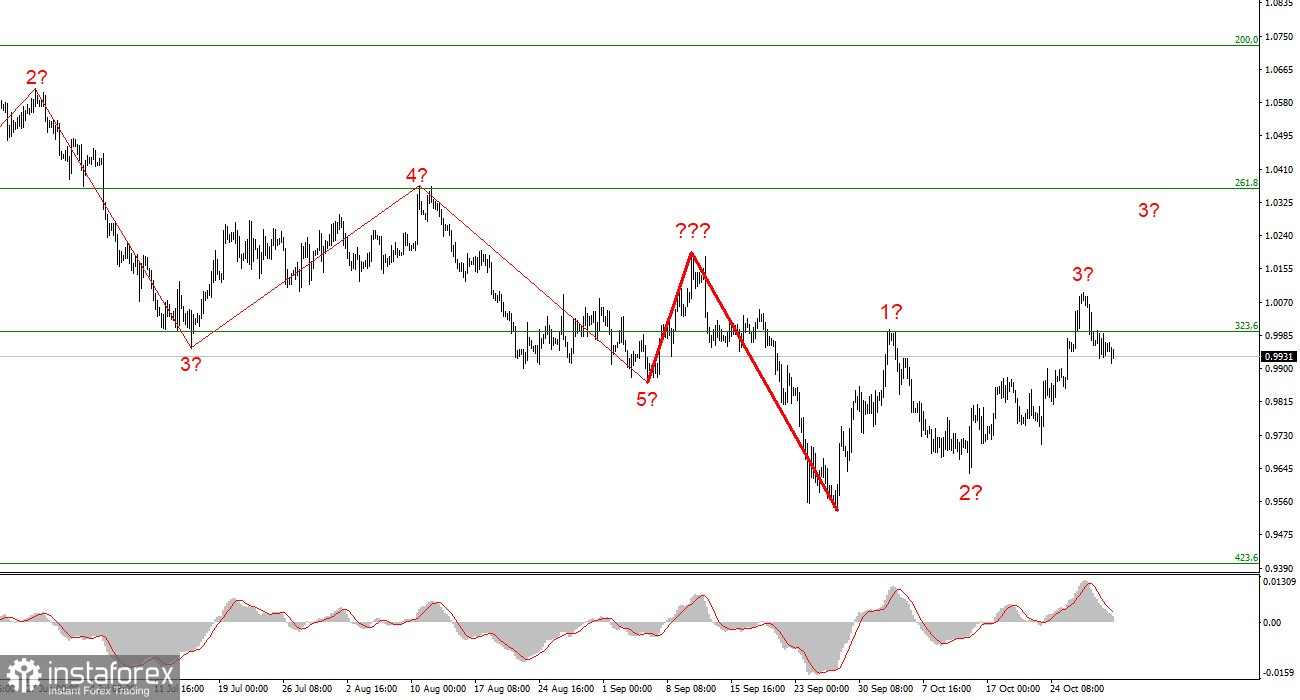

Judging by the analysis, the asset has already started forming an upward section of the trend. However, it will hardly last long. At the moment, the instrument can form a new impulsive wave. That is why traders may go long with the target located near 1.0361, the 261.8% Fibonacci level. The MACD indicator should be headed upwards. However, traders should be ready that the asset will end the formation of this section.