Analysis and tips on how to trade GBP/USD

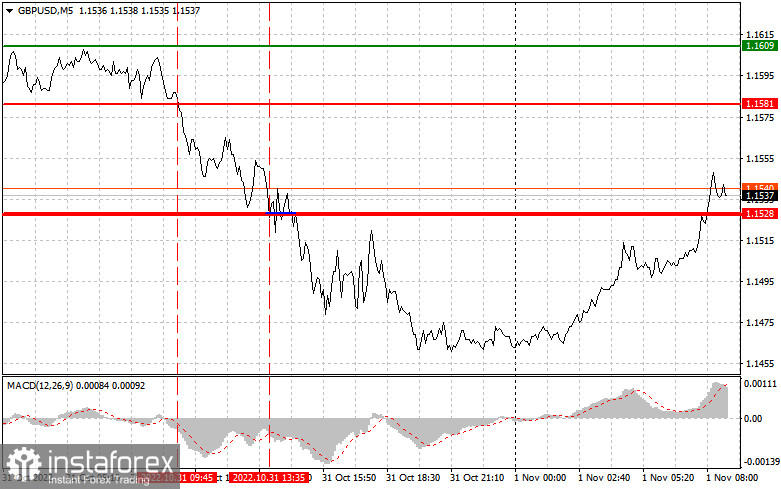

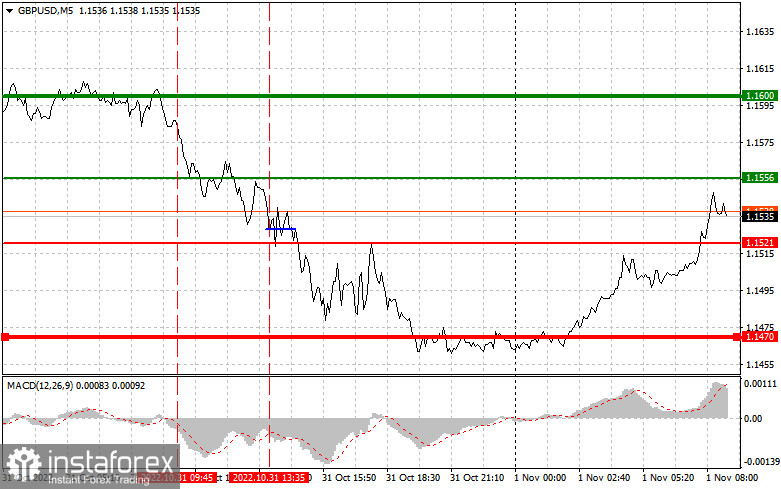

The price tested the mark of 1.1581 at the moment the MACD was well below zero, which limited the pair's downside potential. Therefore, it would be unwise to sell the pound. A buy signal never came. In the second half of the day, I opened a buy trade on a bounce after a test at 1.1528, which brought no result although the price did not surge.

A sell-off in the pound took place despite the release of strong data in the United Kingdom yesterday. The UK's data on Nationwide housing prices and the Manufacturing PMI are due. Pressure on the pound would increase should the PMI figures keep falling. The United States will see the release of the ISM Manufacturing PMI report. A decrease in figures below 50 could cause a sell-off in the dollar and boost risk assets, including the sterling.

Buy signal

Scenario 1: long positions could be opened today when the quote touches the mark of 1.1556 (green line of the chart) with the target at 1.1600 (thick green line) where it would be wiser to close buy trades and sell the pound, allowing a correction of 30-35 pips. The pair could extend growth if a bearish correction is over. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: it will become possible to go long when the price reaches 1.1521 with the MACD being in the oversold zone. This would limit the pair's downside potential and lead to a bullish reversal in the market. The quote may go either to 1.1556 or 1.1600.

Sell signal

Scenario 1: today, short positions could be considered when the price tests the mark of 1.1521 (red line on the chart), with the target at 1.1470 where it would be wiser to close sell trades and go long, allowing a correction of 20-25 pips in the opposite direction from the level. The sterling could feel stronger pressure if UK macro data comes disappointing. Important! Before selling the instrument, make sure the MACD is below zero and just starts moving down from this level.

Scenario 2: the pound could be sold today when the price approaches 1.1556 and the MACD is in the overbought zone at the same time. This could limit the pair's upside potential and lead to a bearish reversal in the market. The quote may go either to 1.1521 or 1.1470.

Indicators on charts:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure always to place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.