Analysis and tips on how to trade EUR/USD

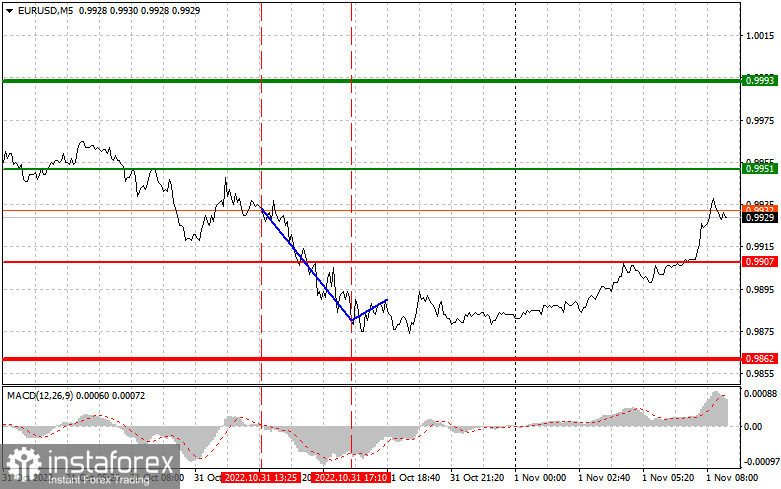

The price tested the mark of 0.9932 at the moment the MACD started to move down from the zero level, becoming the confirmation of the entry point and generating a nice signal to sell the euro. It resulted in a fall of 40 pips. Long positions at 0.9882 on a bounce brought no result although the price had not gone below the mark.

Preliminary data show that annual inflation in the eurozone came in at 10.7% in the previous month, the worst result in the eurozone's history. Meanwhile, its GDP saw an uptick of 0.2% in October, following a 0.8% rise in the second quarter. Today's macroeconomic calendar contains no important releases in the eurozone, which may trigger a bullish correction. The United States will deliver the ISM Manufacturing PMI report. A decrease in figures below 50 could cause a sell-off in the dollar and boost risk assets, including the euro.

Buy signal

Scenario 1: long positions could be opened today at around 0.9951 (green line of the chart) with the target at 1.0000 where it would be wiser to close trades and sell the euro, allowing a correction of 30-35 pips. The pair could show growth only if the ISM Manufacturing PMI comes worse than expected. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: it will become possible to go long when the price reaches 0.9907 with the MACD being in the oversold zone. This would limit the pair's downside potential and lead to a bullish reversal in the market. The quote may go either to 0.9951 or 0.9993.

Sell signal

Scenario 1: today, short positions could be considered when the price hits 0.9907 (red line on the chart), with the target at 0.9862 where it would be wiser to close trades and go long, allowing a correction of 20-25 pips in the opposite direction from the level. The euro would feel stronger pressure if US macro data comes upbeat and expectations of a hawkish Fed increase. Important! Before selling the instrument, make sure the MACD is below zero and just starts moving down from this level.

Scenario 2: the euro could be sold today when the price touches 0.9993 and the MACD is in the overbought zone at the same time. This could limit the pair's upside potential and lead to a bearish reversal in the market. The quote may go either to 0.9907 or 0.9862.

Indicators on charts:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure always to place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.