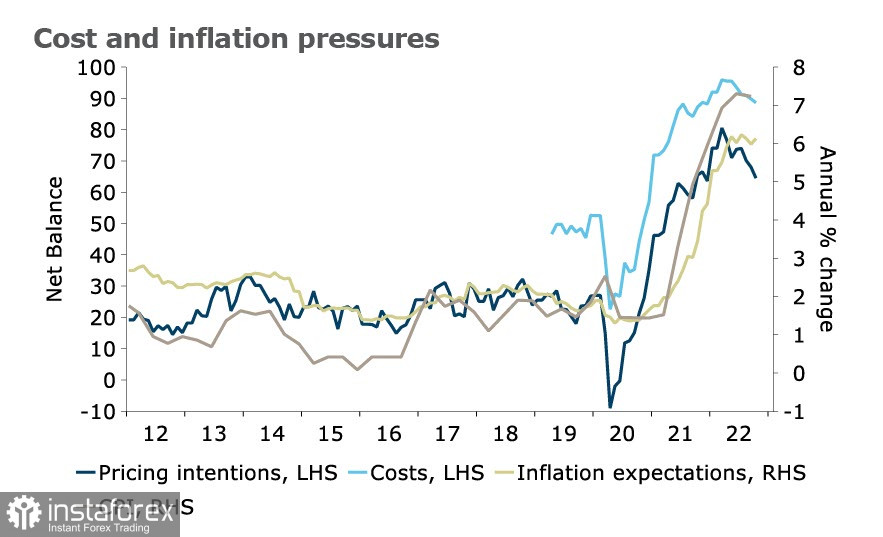

Inflationary pressure on the global economy remains strong. Thus, the central banks' decisive actions to tighten monetary policy have not yet borne fruit. Euro area annual inflation rose to 10.7%, far exceeding the 10.3% median estimate. This can be attributed not only to higher energy and food prices but also to core inflation. This means that the ECB will most likely decide to raise interest rates by 75 basis points at its December meeting. In the third quarter of 2022, seasonally adjusted GDP increased by 0.2% in the euro area. This signals that Europe is rapidly sliding into a recession.

At the same time, US statistics are not encouraging. The Chicago PMI stood at 45.2 compared to 45.7 in the prior month, while economists predicted 47.3. The Dallas Fed Manufacturing Index decreased to -19.4 in October from -17.2 in September, while the forecast was -17.4. Both indicators suggest that today's ISM manufacturing index is likely to fall.

Although general fundamental factors background spurs optimism about the US economic state, the key trends are negative. The ratio of the manufacturing sector to total GDP has been steadily declining since 2001. Moreover, this reading is now noticeably worse than prior to the 2008 crisis. There are no signs of a recovery, and the pace of US deindustrialization is not slowing down.

As for the labor market, the ratio of newly created jobs (Total Nonfarm) to the labor force is following much of the same pattern. The ratio is noticeably worse than prior to the 2008 crisis and has not even recovered to pre-pandemic levels.

The Fed needs to curb inflation amid a deterioration in the US economic structure and the threat of a recession. Markets are awaiting Wednesday to receive signals from the Fed regarding its immediate plans. Until the situation becomes clearer, market volatility on Tuesday and Wednesday is likely to remain low.

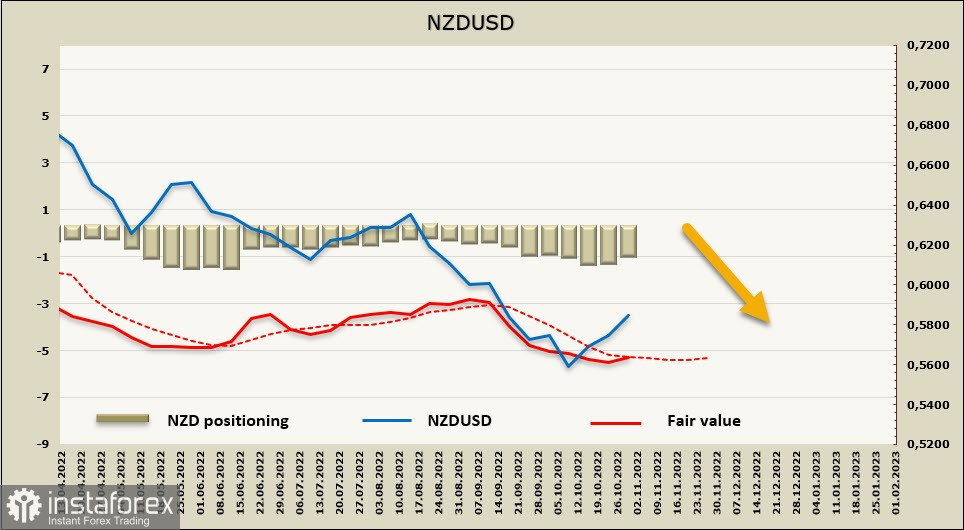

NZD/USD

Despite rumors about the Fed's decision to ease monetary policy, the forecast for the RBNZ rate remains stable. The regulator is expected to raise its key rate by 0.75% in November. Analysts at ANZ forecast that the rate may reach 5% in February. Inflationary pressure remains strong, although indicators point to weaker growth in prices.

Today, the Reserve Bank of New Zealand is due to publish its financial stability report that could provide some answers as to whether the New Zealand economy is ready for further rate hikes or not. In any case, the situation in New Zealand is not worse than in the United States. The inflation and GDP growth rates are comparable, as well as the debt burden on households is relatively low. This will allow them to calmly go through high mortgage and consumer loan rates. Employment is high, and wages are growing at the fastest pace in years. Thus, the RBNZ can focus on dampening inflationary pressures without regard to the economic state. All this makes the kiwi as resilient as the US dollar.

The net short bets on NZD decreased by 0.3 billion to -0.74 billion in the reporting week. The price is trying to turn up, but it has not yet entered positive territory.

A week earlier, we assumed that the kiwi would hardly continue to lose value if the labor market report turned out to be better than expected. And the RBNZ did revise up its rate forecast. Both of these conditions are met, so the NZD/USD has a chance of extending gains. The pair is likely to rise above its recent high of 0.5866. The area of 0.5910/30 can be seen as a target. However, its rally strength will depend on the stance the Fed is set to announce at its meeting on Wednesday. That is, a sell-off in the New Zealand dollar is unlikely.

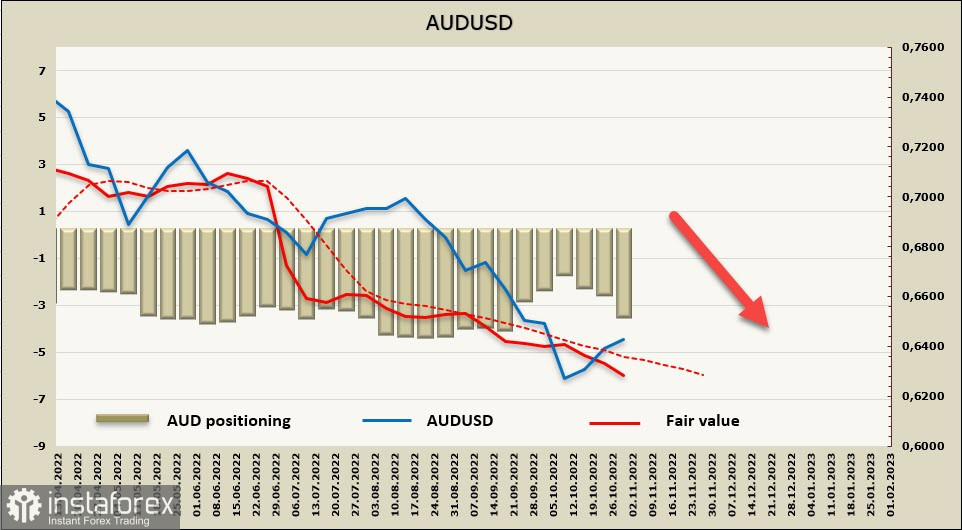

AUD/USD

As expected, the RBA raised its key rate by 0.25% to 2.85% at today's meeting. This rate change is clearly not in favor of the aussie. In addition, the RBA signals that it intends to slow down the pace of rate increases. The yield spread also does not support the Australian dollar, thus adding to bearish sentiment, as inflationary pressures in Australia and the US are roughly at the same level.

The Chinese PMI turned out to be downbeat, standing at 49.0 against the estimate of 50.9. Notably, the purchasing managers' index for China's non-manufacturing sector came in at 48.7 in October 2022, down from 50.6 in September. The index for the manufacturing sector fell to 49.2 from 50.1. China's zero-tolerance COVID-19 policy has a strong inhibitory effect on its economy as well as global supply chain, which in turn affects Australia's trade balance.

Net short positions on AUD increased by 1.1 billion in the reporting week. Thus, market sentiment is clearly bearish. The price is trading downwards and is unlikely to gain value.

The Australian dollar seems to be weaker than the kiwi. The AUD/NZD pair is declining, and its downside momentum remains. The AUD/USD pair recovered above 0.6414 amid weakening expectations regarding the Fed's policy rather than due to the internal strength of the aussie. Weak data on China's economy will continue to put pressure on the aussie. The rate differential is also not in its favor, so the price is likely to hit a new local high. Then it will be possible to go short with a view to reaching the long-term target of 0.5513.