In addition to the meetings of the Federal Reserve and the Bank of England, this week market participants will focus on the monthly report of the US Department of Labor with data for October (to be released on Friday). Meanwhile, at the same time, Statistics Canada will also publish a monthly report on the national labor market. As for the Fed, data on GDP, inflation and the labor market are decisive for the Bank of Canada when planning the parameters of monetary policy.

As you know, following the results of last week's meeting, the Bank of Canada unexpectedly raised its base interest rate by 50 basis points (to 3.75%), although a 75 bps increase was widely expected. Bank of Canada Governor Tiff Macklem said that leaders are nearing the end of the tightening cycle, although they have not yet reached the end.

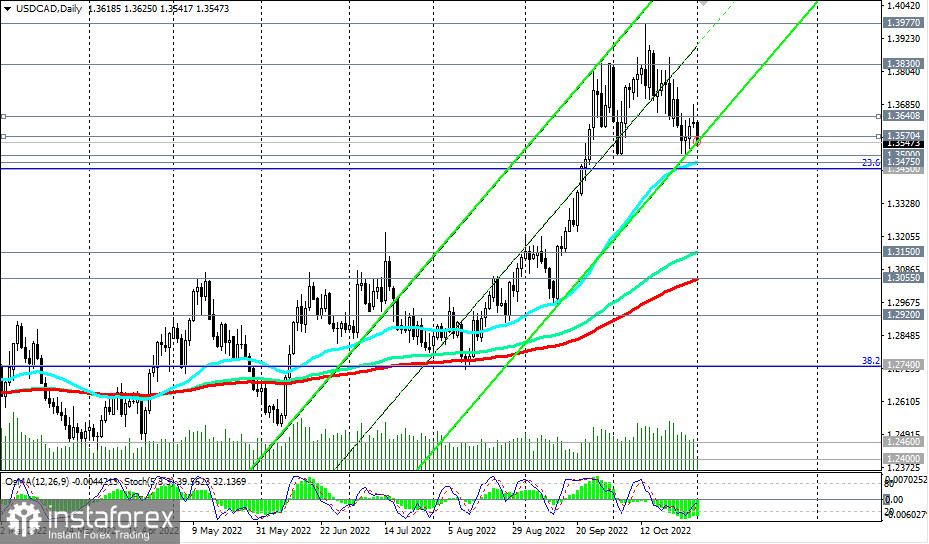

The Bank of Canada, like many other major world central banks that have embarked on the path of tightening monetary policy, is in a difficult situation - to contain inflation without harming the national economy. Clearly, this decision comes amid growing fears of a deepening global economic downturn. It disappointed market participants, and immediately after this decision was announced, the USD/CAD pair jumped almost 100 pips from an intra-hour low of 1.3558, but then turned back down, opening this week also on a negative wave. Although an upward trend prevails in general, a breakthrough into the zone below the support levels of 1.3475, 1.3450 will increase the risks of breaking the bullish trend of the pair.

The general weakening of the US dollar also contributes to today's decline in the USD/CAD pair. The DXY dollar index was near 110.87, in the lower part of the range formed between the local support and resistance levels of 114.74 and 109.37. The general upward dynamics of the dollar remains, and the breakdown of the local "round" resistance levels of 114.00, 115.00 will be a signal that the DXY index will return to growth.

Otherwise, and if tomorrow's Fed decision on rates disappoints market participants, then the dollar will fall under a wave of short positions, causing the DXY index to fall as well (with short targets at support levels 109.50, 109.00, 108.00. Recall that it will be published at 18:00 (GMT) At a press conference that will begin half an hour later, Fed Chairman Powell will explain the central bank's decision and possibly hint at the agency's future plans.

Among the news for today, which will cause an increase in volatility in the USD/CAD pair, it is worth paying attention to important macro statistics for the United States

The index of business activity (PMI) in the manufacturing sector in Canada will be released, which is an important indicator of the state of the sector and the Canadian economy as a whole. A result above 50 is seen as positive and strengthens the CAD, below 50 is negative for the Canadian dollar. The data above the value of 50 indicate an acceleration of activity, which has a positive effect on the quotes of the national currency. If the indicator falls below the forecast and, especially, below the value of 50, the Canadian dollar may weaken sharply in the short term. A relative decline is also expected, to 49.2 in October from 49.8 a month earlier. This is not a positive factor for CAD.

Macklem is also expected to speak. Due to the late time, it is unlikely to cause a strong increase in volatility in CAD quotes. Although, if he says something important, then the Canadian dollar will "work it out" the very next day.