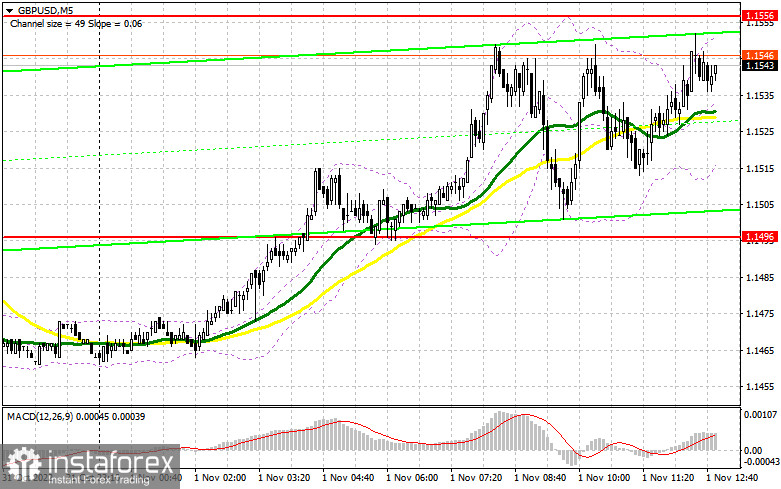

In the morning article, I turned your attention to 1.1496 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. The Manufacturing PMI index turned out to be better than economists' forecasts. So, there was no surge in market volatility. The pair failed to reach the nearest support level of 1.1496. Hence, there were no buy signals. The instrument also did not test the nearest resistance level of 1.1556 in the first half of the day.

When to open long positions on GBP/USD:

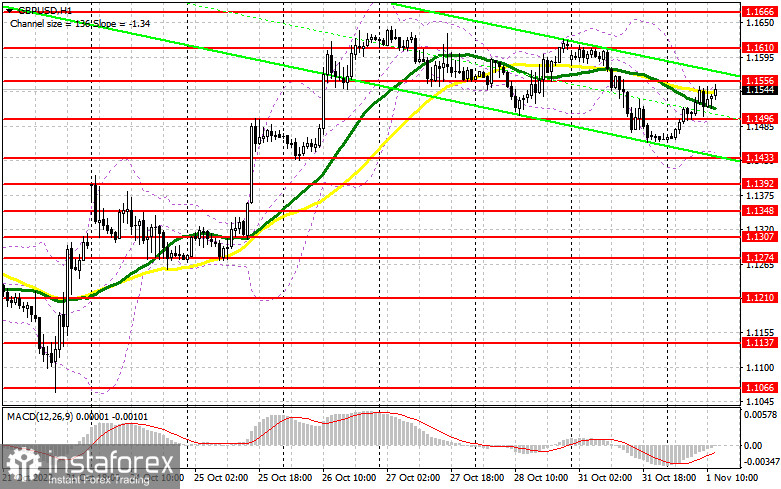

In the afternoon, the ISM Manufacturing PMI Index is on tap. This report is likely to significantly impact the intraday trajectory of the pair. If the indicator falls below 50, the pressure on the US dollar will increase. The pound sterling is sure to take advantage of it. It may try to break above the resistance level of 1.1556. However, given the trading strategy for the second half of the day has not been revised, it is better to focus on 1.1496. Only a false breakout of this level will give a buy signal with the prospect of a return to the resistance level of 1.1556. As I have already mentioned, without reaching this level, further upward movement to the monthly highs looks unlikely. A breakout of 1.1556 and a downward test will open the path to a high of 1.1610. If so, the pair could touch the resistance level of 1.1666. In this case, it will be more difficult for buyers to control the market. A more distant target will be the 1.1722 area where I recommend locking in profits there. If the price approaches this level, it will significantly undermine the bearish bias. If GBP/USD falls and bulls show no activity at 1.1496, the price may reach a new low of 1.1433. However, it is better not to rush to enter the market. Only a false breakout of 1.1433 will indicate that large traders are increasing the volume of long positions. You can buy GBP/USD immediately at a bounce from 1.1392 or 1.1348, keeping in mind the upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

The bears tried to regain the upper hand but failed. They were unable to push the pair below 1.1496. Large buyers are now protecting this level. Besides, the pair climbed markedly in the Asian session. The US economic report may tip the balance of power, helping bears to regain control. This scenario comes true if data turns out to be strong, significantly exceeding economists' forecasts. Sellers need to defend the resistance level of 1.1556. If they fail, the downward correction will hardly take place. If GBP/USD climbs amid weak US macro stats, only a false breakout of this level will give a sell signal. The pressure on the pound sterling will escalate. So, a correction to the nearest support level of 1.1496 looks possible. A breakout and an upward test of this level will provide a sell signal. The pair is likely to drop to a low of 1.1433. A more distant target will be the 1.1392 level where I recommend locking in profits. If GBP/USD grows and bears show no energy at 1.1556 in the afternoon, there will be no surge in volatility. In this case, the pair may approach a high of 1.1610. Only a false breakout of this level will give a sell signal with the prospect of the resumption of the downward movement. If bears do not try to take control at that level, the pair may rise to a high of 1.1666. You can sell GBP/USD at this level immediately after a bounce, keeping in mind a downward intraday correction of 30-35 pips.

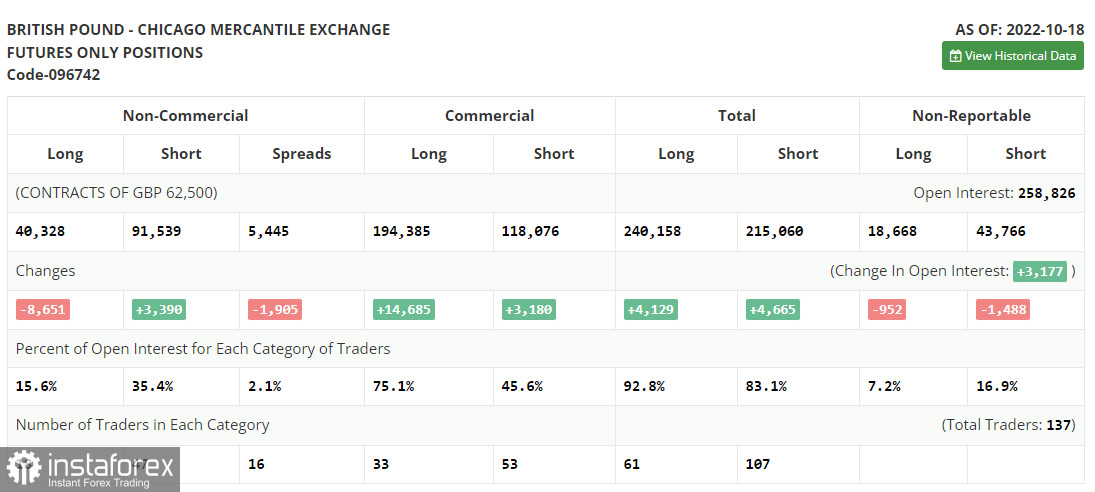

COT report

The COT report (Commitment of Traders) for October 18 logged a sharp drop in long positions and an increase in short ones. The resignation of British Prime Minister Liz Truss and the appointment of Rishi Sunak have had a positive impact on the pound sterling. However, investors remain concerned about the prospects of the UK economy due to soaring inflation. They believe that it will hardly be able to recover because of the headwinds such as the cost of living crisis, the worsening energy crisis, and high interest rates. Apart from that, retail sales, the main engine of economic growth, dropped sharply. It once again confirms the fact that households are not ready to spend extra money due to high prices. The pressure on the pound sterling will persist until the UK authorities find a way to solve economic issues. The latest COT report revealed that the number of long non-commercial positions decreased by 8,651 to 40,328, while the number of short non-commercial positions climbed by 3,390 to 91,539, which led to a slight increase in the negative delta of the non-commercial net position to -51,211 versus -39,170. The weekly closing price rose to 1.1332 against 1.1036.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which signals market uncertainty.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD moves up, the indicator's upper border at 1.1556 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.