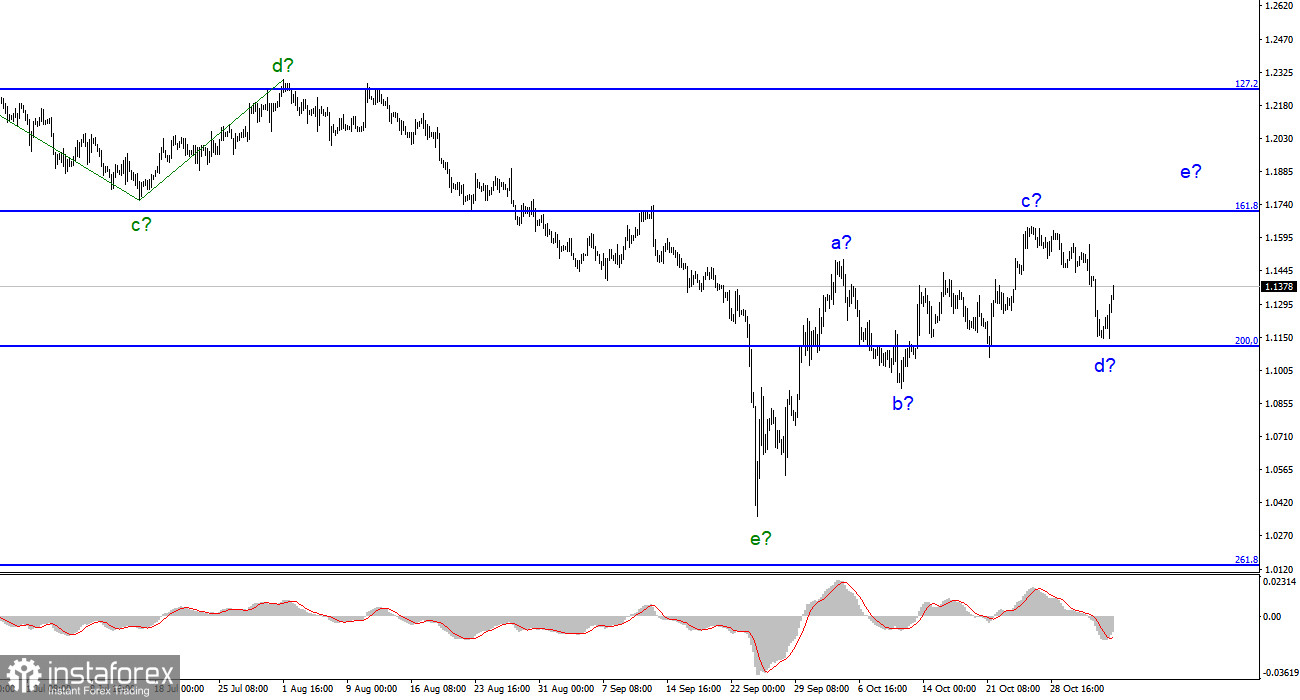

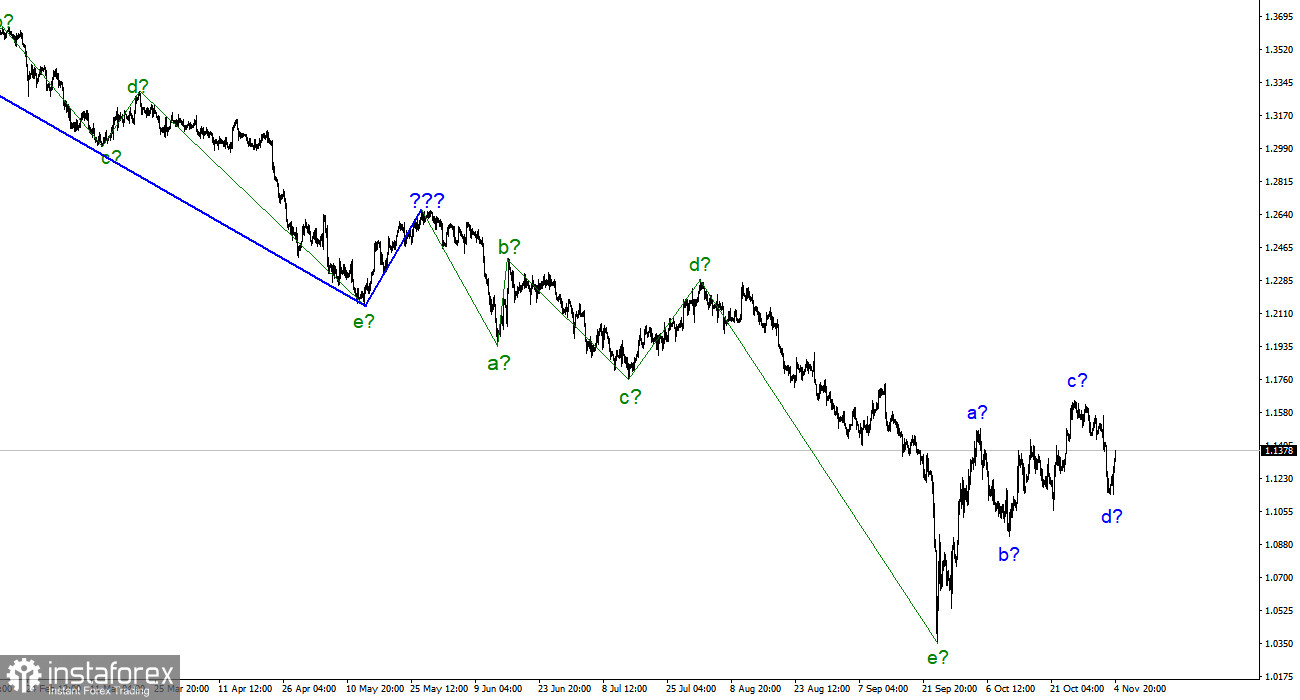

For the pound/dollar instrument, the wave marking looks quite complicated but does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves (a-b-c-d-e). We also have a three-wave upward trend section, which can take a more extended form (a-b-c-d-e). Thus, I expect the increase in the instrument's quote will continue, but it will be a wave of growth. The news background could be interpreted in any direction recently, as both central banks raised their interest rates, and on Friday, we saw the dollar fall against the news background, which could lead to its new growth. All this leads me to believe that the market has decided to complete a full-fledged five-wave structure, after which it will decide on building a new downward trend section. Consequently, the British pound may grow to 17-18 figures in the near future. A successful attempt to break through the 161.8% Fibonacci level will indicate that the market is not ready for new purchases and may mark the beginning of the construction of a new descending section.

The unexpected growth of the instrument complicated the situation.

The exchange rate of the pound/dollar instrument increased by 220 basis points on November 4. It lost the same amount a day earlier when the Bank of England raised the interest rate by 75 points. You can talk as much as you like about why the British dollar fell on Thursday and then start talking about why the dollar fell on Friday. Andrew Bailey certainly made a lot of statements that could be interpreted as "dovish" or pessimistic. But since when has the market been paying more attention to Bailey's rhetoric than a concrete step toward changing monetary policy? The rate increase of 75 points is a record for the last 13–14 years. The Bank of England's rate has risen to a record high in recent decades. However, the market preferred to continue selling the pound.

On Friday, we saw the opposite picture. Since when is the unemployment rate more important than payrolls? Of course, both reports are important, but unemployment in the US is still very low, and stable job creation in the economy is an important indicator of the state of the economy. But the market decided on Friday that strong payrolls are no longer a reason to buy the dollar. As a result of these movements, the wave pattern takes on a more complex form. What prospects are opening up for the British pound now? I think they are neutral. The Bank of England has raised its rate eight times already, but each time we see that the market does not pay too much attention to this. The corrective structure is the maximum the British pound can count on now. I am afraid that after reaching 17–18 figures, the instrument will turn around, and we will see a new extended downward trend section. An unsuccessful attempt to break 1.1711, which corresponds to 161.8% Fibonacci, may indicate that the market is ready for this scenario.

General conclusions.

The pound/dollar instrument wave pattern assumes the construction of a new downward trend segment, but it will probably start later. Now I advise buying the instrument on MACD reversals "up" with targets near the estimated mark of 1.1711, which equates to 161.8% Fibonacci. There is a possibility that the upward section has been completed, and now we are observing the construction of a corrective upward wave as part of a new downward section. Therefore, you need to be careful with your purchases.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale, which is good since both instruments should move similarly. At this time, the upward correction section of the trend is nearing completion. If this is the case, we will soon be building a new downward trend.